When businesses or organisations make payments to professionals, it is not just about settling invoices—it involves a legal obligation to deduct tax at source (TDS). This is where Section 194JB of the Income Tax Act becomes crucial. Introduced to bring clarity and compliance, this section specifically governs tax deducted at source (TDS) on payments made to professionals for their services.

Let’s understand what Section 194JB of the Income Tax Act is all about, who it applies to, and how it affects your professional transactions.

What is Section 194JB of the Income Tax Act?

Section 194JB states that any person, except individuals and Hindu Undivided Families (HUFs) not under tax audit, must deduct TDS when making payments to professionals for various services. These services could include legal, medical, architectural, engineering, or any technical consultancy.

In simple words, if your business hires a chartered accountant, software developer, doctor, or architect and the fees exceed the prescribed limit, you are required to deduct TDS before making the payment.

Applicability of Section 194JB

This section is applicable when:

- The payment is for professional or technical services.

- The payment amount exceeds ₹30,000 in a financial year.

- The payer is not an individual or HUF, or if they are, they must be subject to tax audit in the previous year.

So, if you are a company, LLP, or even a trust or AOP making such payments, this rule applies to you.

What Type of Payments Are Covered?

According to the Income Tax Act, Section 194JB covers the following types of payments:

- Fees for professional services

- Technical consultancy charges

- Royalty payments

- Non-compete fees

- Payments made to mutual funds and AOPs (Association of Persons) for dividends and similar distributions

Hence, whether you're paying a lawyer for legal advice or hiring a consultant for a marketing strategy, TDS under Section 194JB needs to be deducted if the amount crosses the specified threshold.

TDS Rate Under Section 194JB

The TDS rate under Section 194JB is 10% of the payment amount.

For example:

If you’re paying a consultant ₹50,000 for a service, you must deduct ₹5,000 as TDS and pay ₹45,000 to the consultant.

However, if the recipient doesn’t provide their PAN (Permanent Account Number), the TDS rate can shoot up to 20%, as per Section 206AA of the Act.

Exclusions and Exceptions

As mentioned earlier, individuals and HUFs who are not subject to tax audit in the previous financial year are not required to deduct TDS under this section.

Also, if the total amount paid to the professional in a year does not exceed ₹30,000, there is no requirement to deduct TDS.

Another key point—if mutual funds or AOPs are distributing income in the form of dividends, they are also required to deduct tax at source under Section 194JB.

TDS Payment and Filing Responsibilities

If you are deducting TDS under this section, it must be:

- Deposited to the government by the 7th of the following month.

- Reported in the quarterly TDS return (Form 26Q).

- TDS certificate (Form 16A) should be issued to the payee within the due date.

Failing to comply with any of these requirements can lead to penalties, interest, and disallowance of expenses under the Income Tax Act.

Common Mistakes to Avoid

- Not deducting TDS on time – Even a single day’s delay can invite interest.

- Paying the full amount without deduction – This can lead to the disallowance of expenses.

- Incorrect PAN or missing TDS returns – This affects both the payer and payee during ITR filing.

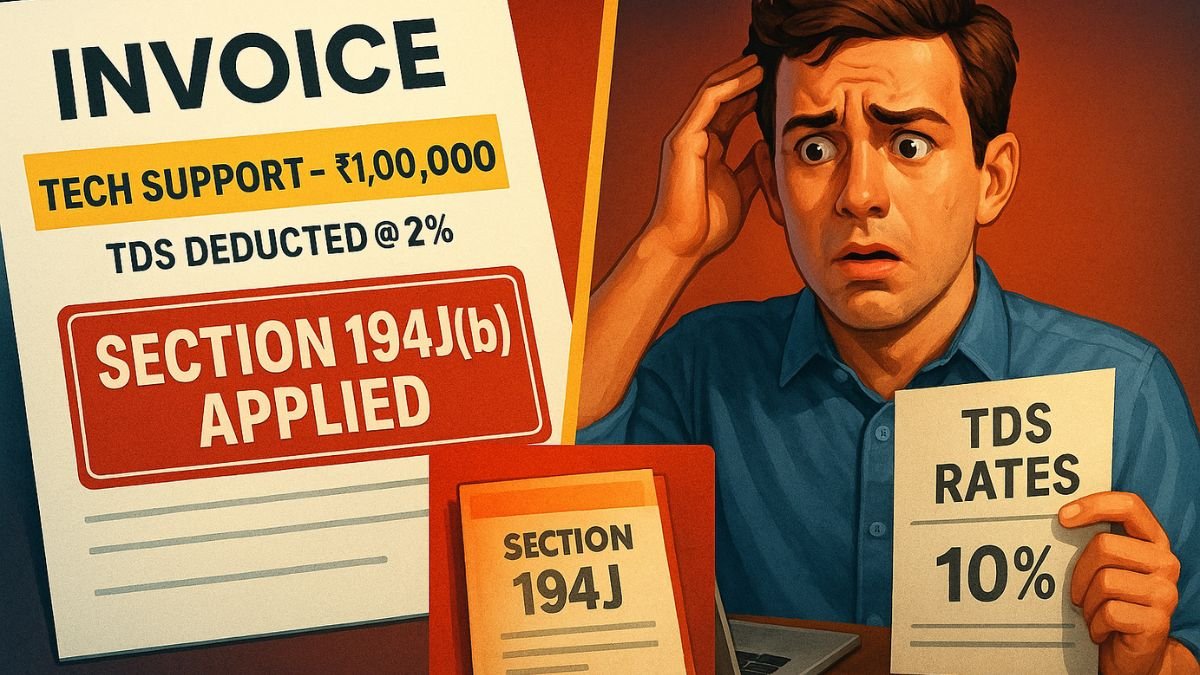

Section 194JB vs 194J

While Section 194J also deals with TDS on professional services, Section 194JB is a new extension with additional compliance guidelines specific to dividends and AOPs, making it broader in scope.

Real-Life Example

Let’s say ABC Pvt. Ltd. hires a tech consultant and pays ₹1.2 lakhs in professional fees in FY 2024–25. ABC must deduct ₹12,000 (10%) as TDS under Section 194JB, deposit it with the government, file a return, and issue a TDS certificate.

If ABC fails to do so, the entire ₹1.2 lakh may be disallowed as a business expense, and the company could be liable for interest and penalty.