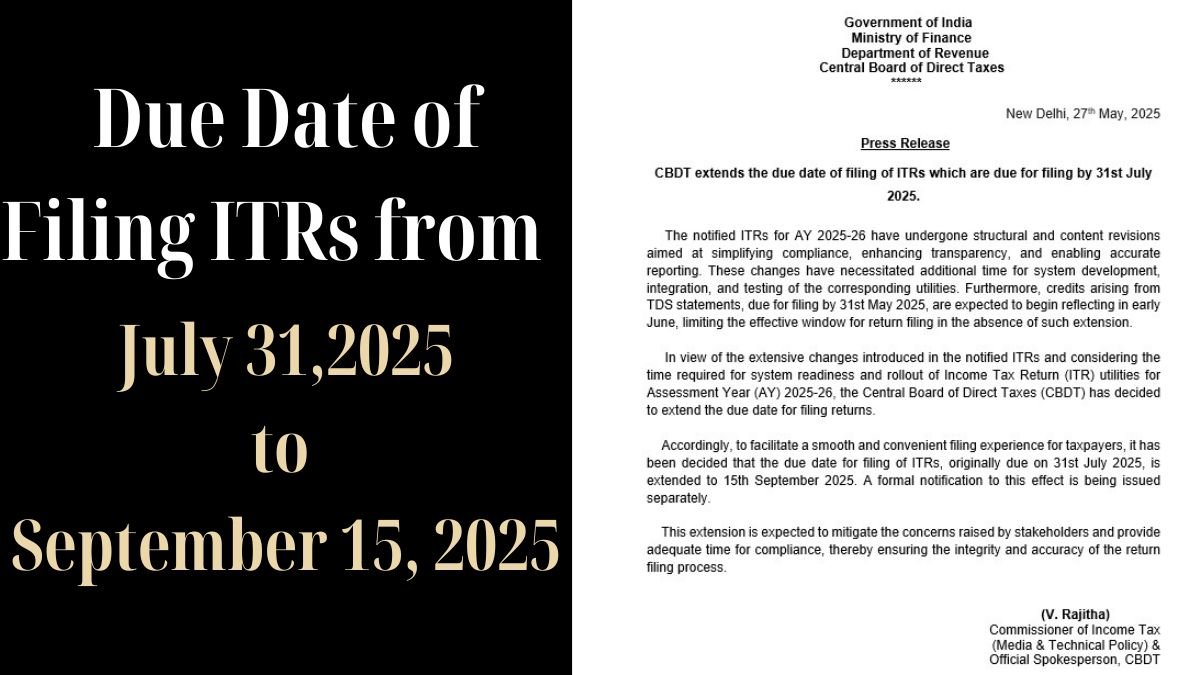

In a significant relief to taxpayers across India, the Central Board of Direct Taxes (CBDT) has officially announced an extension of the due date for filing Income Tax Returns (ITRs) for the Assessment Year (AY) 2025–26. As per the latest press release dated May 27, 2025, CBDT has decided to extend the due date of filing of ITRs, which were originally due for submission by 31st July 2025, to 15th September 2025.

This decision comes as a welcome move amidst multiple changes introduced in the structure and content of the notified ITRs. The update is aimed at easing compliance, enhancing transparency, and enabling more accurate reporting for individual taxpayers and professionals alike.

Why Has the CBDT Extended the Filing Deadline?

The notified ITR forms for AY 2025–26 have seen major changes in layout, system compatibility, and utility functions. These revisions are intended to make return filing simpler, cleaner, and more technology-driven. However, with these upgrades comes the need for extra time, both for the development of tax utilities and for taxpayers to adapt to the new system.

Additionally, the TDS credit statements (Form 26AS), which are due by 31st May 2025, usually reflect in the taxpayer accounts by early June. Without an extension, the time gap between TDS credit visibility and the original filing due date of 31st July would have been too short for many taxpayers to complete accurate filings. "

The Official Notification from CBDT

The CBDT extends the ITR filing deadline for FY25- 26 to Sept 15, 2025, keeping in view the representations made by stakeholders and professionals. A formal notification will be issued separately, but the filing due date extended by the board has already been confirmed via their press note.

The press note emphasises that this decision is meant to offer a smoother and more convenient filing experience while maintaining the integrity of the process. By giving additional time, CBDT aims to reduce filing errors, enable more people to comply on time, and improve the overall quality of returns filed.

Who Benefits from This Extension?

This extension applies specifically to taxpayers whose original filing due date was July 31, 2025. That typically includes:

- Salaried individuals

- Freelancers

- Professionals not under audit

- Small businesses whose accounts are not required to be audited

Taxpayers who were earlier required to file their returns by July 31, 2025, will now have time until September 15, 2025, to complete the process.

This extended window will help in proper TDS reconciliation, error correction, and claim filing for refunds, without rushing through the process at the last minute.

Impact on Tax Professionals and System Preparedness

The extension also gives Chartered Accountants, tax preparers, and software developers the much-needed breathing room to update their platforms, guide clients, and train staff on the new ITR forms and e-filing utilities. This year, the CBDT has released completely revised ITR utilities, which are under integration and testing. With the new system still under roll-out, this proactive decision was widely anticipated.

The filing, from July 31 to September 15 shift, allows all stakeholders—software companies, taxpayers, and consultants—to avoid unnecessary glitches and ensure a compliant, error-free return filing season.

What Should Taxpayers Do Now?

While the due date of filing of ITRs has been extended, taxpayers should not wait until September to begin the process. Instead, use this time to:

- Collect Form 16, TDS certificates, and investment proofs

- Reconcile income from all sources

- Review capital gains and other exemptions

- Use this window for advanced tax computation

- Understand any changes applicable in ITR forms for AY 2025–26

Staying proactive will help you avoid late-night glitches, incorrect entries, and missed refund opportunities.

Summary

Here's a quick summary of this important announcement:

- CBDT has extended the due date of filing of ITRs

- Filing due date extended from July 31, 2025, to September 15, 2025

- Applicable for AY 2025–26

- Extension granted due to major revisions in ITR forms and utility rollouts

- TDS statements due by May 31 will reflect in June, giving more time for reconciliation

- Formal notification to be issued separately

- Taxpayers advised to prepare early despite the extension