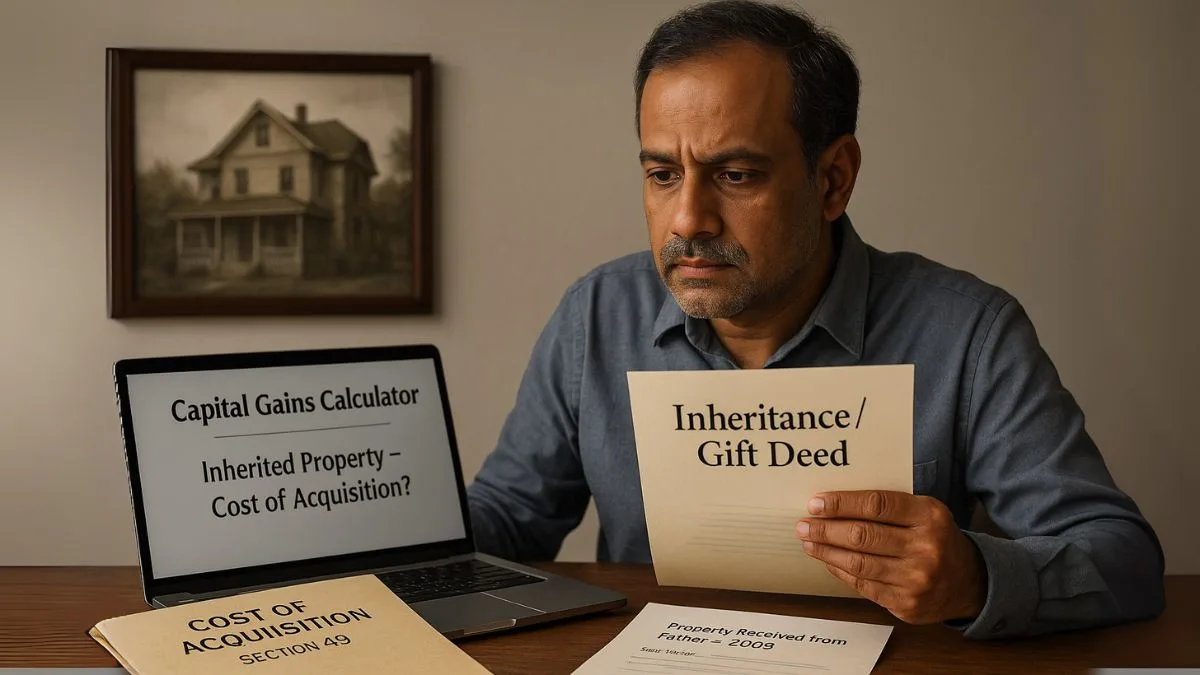

If you have acquired a property through inheritance, as a gift, or under a will, you may be familiar with Section 49 of the Income Tax Act. Though often overlooked, this provision holds significant relevance when calculating capital gains on the subsequent sale of such assets.

Understanding its implications is essential, as it directly impacts how the cost of acquisition is determined in these specific scenarios. An incorrect computation can lead to an inflated tax liability, making it all the more important to apply the provisions of Section 49 accurately & diligently.

Let’s break it all down in simple terms.

What is Section 49 of the Income Tax Act?

Section 49 deals with how to determine the cost of acquisition for capital assets that are not acquired through direct purchase, but through special circumstances such as:

- Gift

- Will

- Inheritance

- Succession

- Partition of HUF

- Amalgamation

- Demerger

- Transfer to a revocable or irrevocable trust

When you receive such assets, you’re not spending money to acquire them. So, when you sell them, how does the Income Tax Department calculate the tax?

That’s exactly what Section 49 clarifies."

Why Section 49 Matters in Capital Gains Calculation

When you sell an asset, you are taxed on capital gains, which is the difference between the sale value & the cost of acquisition.

For normal purchases, it’s straightforward: cost means the price you paid. But under Section 49, the cost is deemed to be the cost paid by the previous owner.

This is critical in cases of:

- Inherited property

- Gifts of shares or mutual funds

- Assets received under family arrangements

So, instead of zero, the cost of the previous owner becomes your base for capital gains calculation.

Indexed Cost of Acquisition

One major advantage of Section 49 is the benefit of indexation.

You can apply the indexed cost of acquisition based on the year when the previous owner first held the asset, not when you received it.

This significantly reduces your capital gains tax liability & is especially useful for long-term capital assets like property, gold, or unlisted shares.

For example, if your father bought a plot of land in 1995 and gifted it to you in 2020, the cost of acquisition and indexation will start from 1995, not 2020."

Holding Period and Capital Gain Type

Thanks to Section 49, the holding period also includes the time for which the asset was held by the previous owner.

This is important because:

- Assets held for more than 24 months (for immovable property) qualify as long-term capital assets.

- Long-term capital gains (LTCG) are taxed at 20% with indexation benefits.

So, if your mother held an apartment for 10 years before gifting it to you, & you sell it one year later, it’s still considered long-term, not short-term."

Special Cases Covered under Section 49

Here are some typical scenarios where Section 49 applies:

- Gift or Inheritance

When you receive an asset without paying anything, your cost of acquisition is the same as that of the person who gave it to you.

- Trust Transfers

If an asset is transferred to or from a trust, Section 49 ensures that the tax treatment remains fair by considering the original cost.

- Amalgamation or Demerger

If shares are received as a result of a corporate restructuring, the original investment’s cost & date are considered for capital gain purposes.

- Succession or Partition of HUF

In the case of family partition or succession after death, you inherit not just the asset but also its tax history.

Documents to Keep Handy

To ensure smooth tax filing, make sure you collect:

- Purchase deed of the original owner

- Gift or inheritance deed

- Proof of relationship (if applicable)

- Evidence of the date of acquisition by the previous owner

- Valuation reports, if required

These will be essential to claim the correct cost of acquisition under Section 49.

Mistakes to Avoid

- Using market value as cost instead of the previous owner's actual purchase price

- Ignoring the indexation benefit

- Calculating short-term capital gains despite a long holding period

- Not keeping proper documentation

Even a small miscalculation can inflate your tax liability or trigger scrutiny from tax authorities.

Real-Life Scenario

Imagine you inherited a flat from your grandfather, who bought it in 1980 for ₹2 lakhs. You sell it today for ₹1 crore. Without Section 49, you’d pay tax on the entire ₹1 crore. But thanks to this section, the original purchase price & indexed cost of acquisition (adjusted for inflation) can significantly reduce your taxable capital gain.

Final Thoughts

Section 49 of the Income Tax Act is a powerful yet often overlooked provision that can save taxpayers substantial amounts of money. Whether you’re dealing with gifted property, inherited assets, or family business partitions, knowing how to use the cost of the previous owner, apply indexation, & calculate the correct holding period can make a world of difference in your tax planning.

So, before you rush to sell that old plot of land or inherited apartment, make sure you’ve fully understood how Section 49 can help you minimise your capital gains tax.

Confused about how to calculate capital gains on inherited or gifted assets? Let the tax experts at Callmyca.com do the math — legally, accurately, & with maximum savings. Book a consultation today and stay tax smart!