In a move to tighten compliance and widen the tax base, the Indian government introduced Section 194Q of the Income Tax Act, a provision that has significantly impacted the way businesses handle large purchases. Whether you’re a trader, manufacturer, or service provider, understanding the applicability of Section 194Q is essential to stay on the right side of the tax authorities.

What Is Section 194Q of the Income Tax Act?

Section 194Q is a new section of the Income Tax Act, introduced in the Finance Act, 2021 and effective from July 1, 2021. It deals with Tax Deducted at Source (TDS) on the purchase of goods. The provision aims to bring transparency in high-value transactions & prevent tax evasion by ensuring that tax is deducted right at the point of purchase.

This section mandates that the buyer of goods deduct TDS from the payment made to a resident seller, provided certain conditions are met. "

Applicability of Section 194Q

The provision applies when:

- The buyer’s turnover or gross receipts exceeds ₹10 crore during the preceding financial year.

- The purchase value from a resident seller exceeds ₹50 lakh in a financial year.

This means if your business has more than ₹10 crore turnover in FY 2023–24 and you buy goods worth more than ₹50 lakh from a single seller in FY 2024–25, you’re liable to deduct TDS under Section 194Q.

TDS Rate Under Section 194Q

One of the most asked questions is: What is the TDS rate under Section 194Q?

✅ TDS under Section 194Q is deducted at the rate of 0.1% of the purchase value exceeding ₹50 lakh.

However, if the seller does not furnish a PAN, the TDS rate jumps to 5% as per Section 206AA.

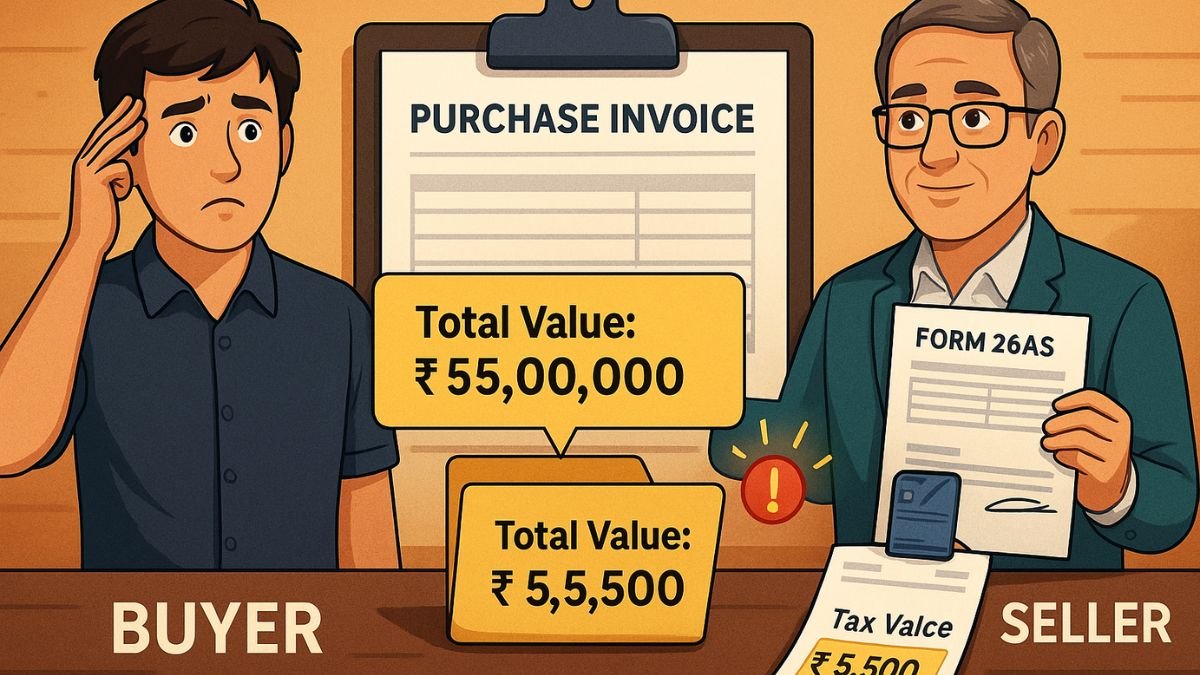

Threshold and Example to Understand Section 194Q

Let’s understand this with a simple example:

Suppose your company had a turnover of ₹12 crore in FY 2023–24. In FY 2024–25, you purchase goods worth ₹80 lakh from a supplier. Since the purchase exceeds the threshold of ₹50 lakh, you are required to deduct TDS at 0.1% on ₹30 lakh (₹80 lakh – ₹50 lakh), i.e., ₹3,000.

Thus, ₹3,000 will be deducted before making the payment and deposited with the government under the buyer’s TAN.

Clarification by CBDT: Guidelines Under Section 194Q

To remove ambiguities, CBDT releases Guidelines under Section 194Q of the Income Tax Act regularly. These include clarifications such as:

- TDS under Section 194Q is not applicable if tax is already deducted under other sections like 194C or 194J.

- No TDS under 194Q if TCS under Section 206C(1H) is already applicable, except when the buyer is also required to deduct TDS—then 194Q prevails.

Hence, for overlapping transactions (especially those above ₹50 lakh), 194Q usually overrides 206C(1H) unless TDS is already applicable under other sections.

CBDT Circulars and Practical Turnover Limits

The CBDT has clarified via FAQs and notifications that the TDS applicability turnover limit refers to the buyer's last year's gross receipts or sales crossing ₹10 crore. This is a crucial test for determining whether your business must deduct tax under this section.

Additionally, Section 194Q applies only to purchases of goods, not services. This removes confusion between various TDS provisions. "

Exemptions and Exceptions

Section 194Q does not apply in the following cases:

- If the seller is a non-resident.

- If tax is deductible under any other provision of the Income Tax Act.

- Transactions involving securities or commodities traded through recognised exchanges.

This helps avoid double taxation and ensures clarity on the taxation of digital or market-based trades.

Final Thoughts

In essence, Section 194Q of the Income Tax Act is a major shift in how high-value B2B transactions are taxed in India. By requiring buyers to deduct TDS on purchases above ₹50 lakh, the government ensures greater transparency and accountability in the trading ecosystem. With TDS under Section 194Q being as low as 0.1%, compliance is manageable, but ignorance could result in disallowance of expenses under Section 40(a)(ia) and potential interest or penalty.

So if you’re running a business, it’s crucial to keep track of your turnover, vendor-wise purchase value, and ensure timely TDS deduction and payment under this section. Stay compliant, stay informed.