Planning for retirement while reducing your tax liability? That’s exactly where the NPS Income Tax Sections come in. The National Pension System (NPS) is not just a retirement savings scheme—it’s a powerful tool to claim extra tax benefits over & above the usual ₹1.5 lakh limit of Section 80C. Let’s dive into how NPS works in your favour and which income tax sections help you save more every year.

📌 Which Income Tax Sections Apply to NPS?

NPS contributions are eligible for deductions under three major sections of the Income Tax Act:

- Section 80CCD(1)

This section covers your contribution to the NPS. You can claim a tax deduction of:

- Up to 10% of salary (Basic DA) for salaried individuals

- Up to 20% of gross total income for self-employed individuals

This deduction is within the overall ₹1.5 lakh cap under Section 80C.

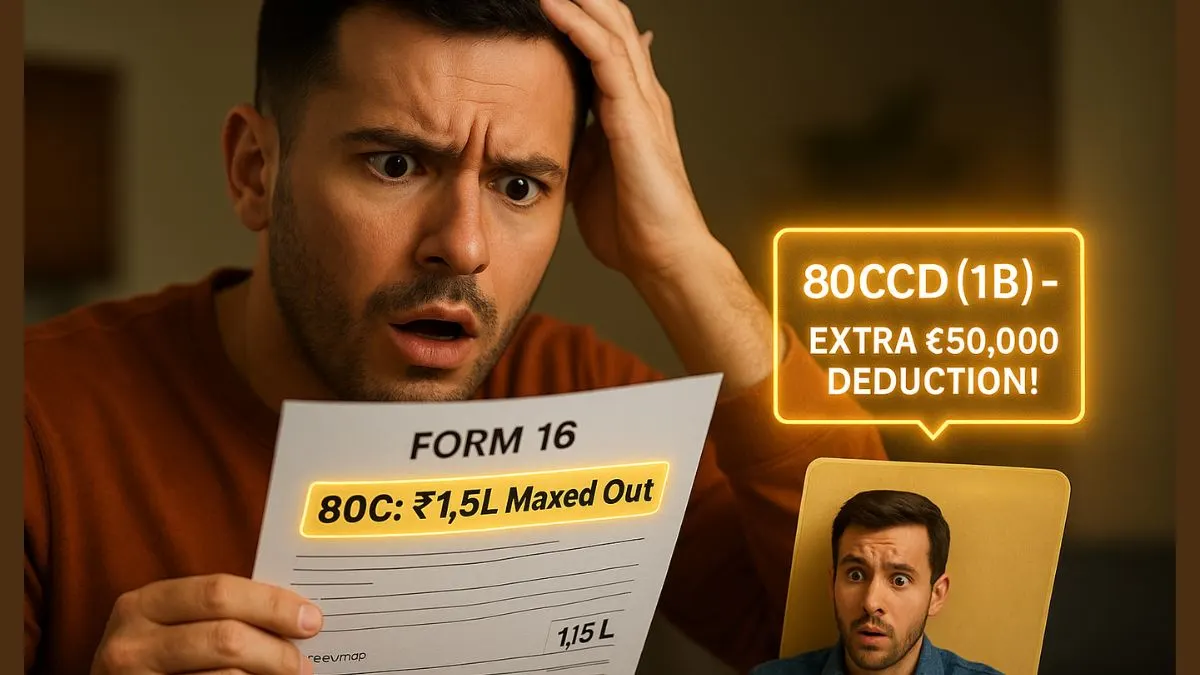

- Section 80CCD(1B)

This is the game-changer. Introduced in 2015, it gives you an additional ₹50,000 deduction over & above Section 80C’s ₹1.5 lakh limit. "

This is exclusively for contributions to NPS made by an individual.

- Section 80CCD(2)

This applies to employer contributions to your NPS account. The tax deduction limit here is:

- 10% of salary (Basic DA) for private sector employees

- 14% of the salary for Central Government employees

There is no monetary cap under this section. It’s over & above 80C and 80CCD(1B). "

🧮 Example for Better Clarity

Let’s say you’re a salaried employee with ₹10 lakh salary (Basic DA):

- Your own NPS contribution: ₹1 lakh → Section 80CCD(1)

- Additional voluntary contribution: ₹50,000 → Section 80CCD(1B)

- Employer contribution: ₹1 lakh → Section 80CCD(2)

Your total tax-saving = ₹2.5 lakh (₹1L ₹50K ₹1L)

This is how the NPS income tax section benefits beat regular investment options.

🆕 What About NPS in New Tax Regime?

Under the new regime, Section 80CCD(2) continues to be valid for employer contributions. However, Section 80CCD(1) and 80CCD(1B) are not available if you opt for the new tax regime.

So if you're looking to claim the maximum tax benefits under NPS, the old tax regime is your best friend.

👥 Corporate NPS – Employer’s Gift That Saves You Tax

Corporate NPS is a win-win for both the employer & employee. When your company contributes to NPS:

- It is deductible from their business income, &

- You get the benefit under Section 80CCD(2).

If you’re in a high tax slab, this is a smart tax-saving hack that you should ask your HR to activate!

📝 Summary of NPS Tax Deductions

|

Section |

Who Can Claim? |

Deduction Limit |

Included in 80C? |

|

80CCD(1) |

Individual (Salaried/Self) |

10% of Salary / 20% of Gross Income |

Yes (within ₹1.5 lakh) |

|

80CCD(1B) |

Individual |

₹50,000 |

No (over & above 80C) |

|

80CCD(2) |

Employer |

10%-14% of Salary |

No (separate benefit) |

📌 Additional Tax Perks with NPS

- Maturity: Up to 60% of the total corpus withdrawn at retirement is tax-free.

- Annuity purchase (40%) is taxable as per the income slab.

- Tier II account has no tax benefits, but it works as a flexible savings option.

📌 Who Should Use NPS for Tax Saving?

NPS is perfect for:

- Salaried individuals in the 20% or 30% tax slab

- Self-employed professionals looking to invest long term

- Employees whose employers offer corporate NPS contributions

- People are already maxing out 80C & still looking to save more

Final Note (Natural & Clickbait CTA):

💡Want to make the most of your NPS deductions & file your ITR stress-free? Let Callmyca’s experts handle it for you. Explore our tax-saving services now at Callmyca.com—you might be just one step away from your biggest refund yet!