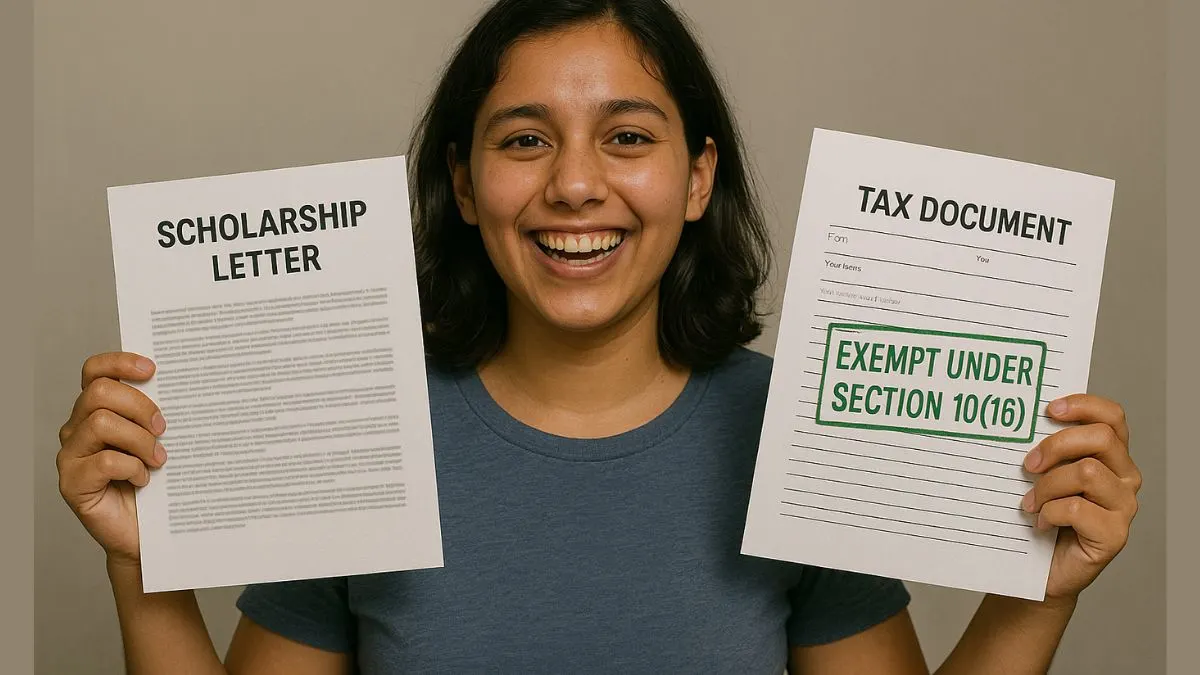

When navigating India’s tax system, Section 10 of the Income Tax Act, 1961 offers a set of powerful exemptions—& one of its most beneficial sub-sections is Section 10(16). This clause exists to provide relief to students, scholars, & even salaried individuals under certain conditions. But what exactly does it say, & how does it impact your financial life?

Let’s dive deep into the meaning & relevance of Section 10(16) of the Income Tax Act, especially in the context of scholarships, deductions from salaries, & gratuity exemptions.

What is Section 10(16) of the Income Tax Act?

Section 10(16) reads:

“Scholarships granted to meet the cost of education are not included in total income.”

In simple words, any scholarship received by a student or individual to cover education-related expenses is completely tax-free. Whether you're a school student receiving a government-funded scholarship or a research scholar supported by a private trust, this exemption applies to you.

Who Can Claim Exemption Under Section 10(16)?

This exemption is not restricted to a particular class of students. Whether you’re in school, college, or pursuing higher education abroad, if the scholarship is granted to meet the cost of education, you are eligible.

Some of the common beneficiaries include:

- Students receiving government scholarships.

- Research fellows are supported by universities or academic institutions.

- Beneficiaries of private grants aimed at academic advancement.

What Counts as "Cost of Education"?

One of the most critical aspects is whether the scholarship covers the cost of education directly.

This includes:

- Tuition fees

- Hostel charges

- Academic books & materials

- Research-related expenses

If the money is intended for any of the above, it qualifies for exemption under Section 10(16). However, any additional income or allowance not used for educational purposes may not qualify.

Common Examples Under Section 10(16)

To make it more relatable, here are a few real-life examples:

- A PhD student receives a fellowship of ₹40,000 per month to conduct research at a government university. This is fully exempt under Section 10(16).

- A Class 12 student gets a scholarship of ₹50,000 for outstanding academic performance. Since it's used to cover tuition fees, it's also exempt.

- A scholarship includes a ₹10,000 monthly stipend for food & personal use. This portion may not qualify under Section 10(16) as it isn’t directly linked to educational costs.

What About Salaried Individuals?

Interestingly, Section 10(16) of the Income Tax Act doesn’t just stop at students. In specific cases, it allows for deductions from your salary income, too.

For example:

- If you’re a teacher or researcher who’s receiving a scholarship or grant to pursue higher education, the stipend or allowance for educational costs can be claimed as exempt.

- If you’re working on a deputation with an academic institution & receive scholarships granted to meet the cost of education, such grants are exempt under Section 10(16).

Does Section 10(16) Cover Gratuity or Salary Deductions?

No, Section 10(16) does not provide an exemption for gratuity received by an employee. That exemption is offered under a different sub-section of Section 10 (precisely, Section 10(10)). But since you've mentioned gratuity & salary deductions, it’s important to clarify that while Section 10(16) is focused on scholarships, it complements the broader exemption structure provided under Section 10.

So, if you are researching tax planning tools, look beyond 10(16) & explore other deductions from salaries such as:

- HRA under Section 10(13A)

- Gratuity under Section 10(10)

- Leave encashment under Section 10(10AA)

Important Judicial Clarifications

Case laws have helped clarify grey areas in this section. For example:

- Courts have ruled that scholarships for post-doctoral research abroad are exempt, even if received in foreign currency.

- If an employee receives a fellowship while working in a part-time academic role, it may still be exempt under Section 10(16), provided the conditions are met.

Conclusion: Why Section 10(16) Matters

With rising education costs, Section 10(16) of the Income Tax Act, 1961 is a much-needed relief. It ensures that scholarships granted to meet the cost of education are not taxed, thereby encouraging educational growth & research.

For salaried professionals & students alike, understanding the deductions from salaries, gratuity rules, & exemptions under this clause can lead to significant tax savings.

Still confused about what’s tax-exempt and what’s not?

Let our experts at Callmyca.com handle your ITR filings & tax planning. Get it right the first time and save more, because one mistake can cost you more than just money.