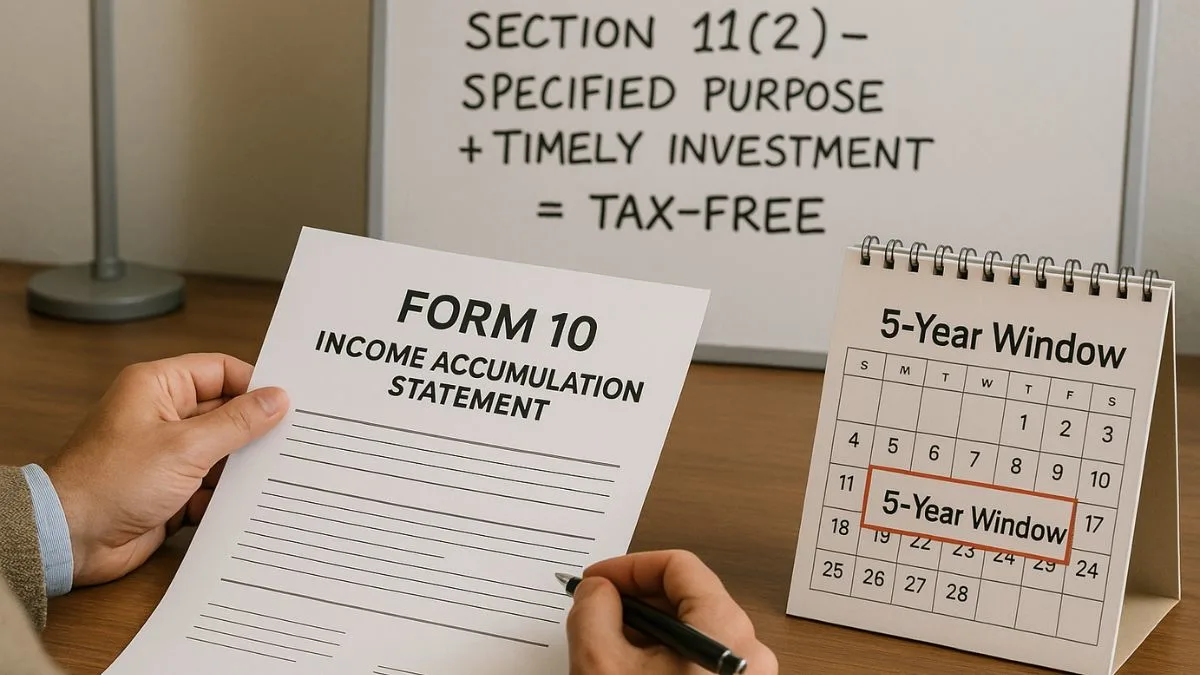

When it comes to income tax benefits for charitable & religious institutions, Section 11(2) of the Income Tax Act plays a vital role. This section addresses a special provision that permits the accumulation or setting aside of the income of a charitable institution beyond the standard limit of 15% under specific conditions. In simple terms, this section allows these institutions to save a portion of their income for future use without losing their tax-exempt status, provided they follow specific rules.

What Is Section 11(2) of the Income Tax Act?

Section 11(2) of the Income Tax Act 1961 is a continuation of the benefits allowed under Section 11(1). While the latter provides tax exemption on income from property held for charitable or religious purposes up to 15%, Section 11(2) allows for the accumulation of income by trusts & charity institutions exceeding this 15%, subject to meeting certain conditions.

The primary intention behind this provision is to allow charitable trusts to build up reserves for large-scale future projects, like building hospitals, schools, or shelters.

Income from Property Held for Charitable or Religious Purposes

The tax law clearly defines that any income from property held for charitable or religious purposes is eligible for tax exemption. Property here doesn't only refer to immovable assets like land or buildings, but includes all types of assets—movable or immovable—owned & used by the trust.

However, if the income exceeds the allowed 15%, it may be taxable unless the provisions of Section 11(2) are invoked.

Section 11(2): Accumulation Beyond 15% of Income

Now, let’s say a trust earns ₹10 lakhs in a year. It can claim tax exemption on ₹1.5 lakhs (15%) without doing anything special. But if the trust wants to accumulate more than 15% of its income, for say, constructing a hospital in the future, it needs to follow the rules under Section 11(2) of the Income Tax Act.

Under this section, the trust or institution must:

- Inform the Assessing Officer about the purpose for which the income is being accumulated.

- Submit Form 10 electronically before the due date.

- Invest the accumulated amount in the modes specified under Section 11(5).

- Spend the accumulated amount within 5 years for the specified purpose.

Failing to meet any of these requirements can lead to the accumulated income becoming taxable.

Why Is This Important?

This provision offers a structured approach to long-term planning for non-profit organisations. Instead of forcing them to spend all their income within the same financial year, it encourages strategic savings for bigger & better-impact projects.

Many trusts and charitable institutions rely on Section 11(2) to create a financial buffer that supports sustainability, infrastructure development, & continuity of operations. This is particularly helpful for organisations dependent on donations & unpredictable funding cycles.

Real-Life Use Cases

Imagine a trust that wants to open a free cancer treatment centre but needs ₹5 crores to do so. With annual donations & revenue of only ₹50 lakhs, it would take several years to gather the needed funds. Thanks to Section 11(2), the trust can accumulate income beyond 15%, invest it securely, & then channel it into the project once the funds are sufficient.

Similarly, another trust planning a multi-year literacy program can start saving for the entire duration instead of exhausting resources annually. "

Compliance and Audit

To enjoy the benefit of accumulation, transparency & compliance are crucial. The trust must maintain proper books of accounts, submit audit reports in Form 10B, & ensure that the accumulated income is spent only for the intended purpose.

Non-compliance or diversion of funds can result in withdrawal of exemption, leading to penalties & tax liabilities. "

Final Thoughts

Section 11(2) of the Income Tax Act, 1961 is not just a tax-saving tool but a visionary clause that enables charitable institutions to dream big & work systematically. By offering room for accumulation beyond 15% of income, the law empowers NGOs, trusts, & religious bodies to undertake significant projects with confidence.

However, with great benefit comes greater responsibility. Trusts must ensure that all rules are strictly followed to remain eligible for the exemption. As more organisations become aware of this provision, Section 11(2) of the Income Tax Act continues to play a transformative role in the non-profit sector of India.