When it comes to managing retirement savings, the Employees' Provident Fund (EPF) plays a critical role for salaried individuals. However, situations may arise where one needs to withdraw funds before the stipulated maturity period. This is where Section 192A of the Income Tax Act comes into play.

Introduced with effect from June 1, 2015, Section 192A was enacted to bring clarity & uniformity to the taxation of early EPF withdrawals. It mainly deals with TDS on premature withdrawal from EPF, aiming to curb tax evasion & ensure tax compliance on such payments.

What Is Section 192A of the Income Tax Act?

Section 192A of the Income Tax Act 1961 governs the payment of the accumulated balance due to an employee under the EPF scheme, particularly in cases where the withdrawal happens before completion of 5 years of continuous service.

Under this provision, TDS will be deducted under Section 192A of the Income Tax Act if the total withdrawal exceeds ₹50,000 & certain other conditions are met.

In simpler terms, if you're planning to tap into your EPF corpus early, you're likely to face a tax deduction—10% TDS, to be exact.

When Does TDS Apply Under Section 192A?

According to this section, TDS on premature withdrawal from EPF will be applicable in the following scenarios:

- The employee withdraws more than ₹50,000 from the EPF account.

- The withdrawal occurs before 5 years of continuous employment.

- Form 15G/15H is not submitted at the time of withdrawal.

In such cases, an employee must pay a 10% TDS on the accumulated lump sum payment. The tax is deducted by the EPFO or the concerned Trust at the time of credit or payment, whichever is earlier.

Key Points to Know

Here are some crucial facts that every taxpayer should be aware of regarding Section 192A of the Income Tax Act:

- No PAN? If the employee fails to furnish PAN at the time of withdrawal, TDS at 30% may be deducted instead of 10%.

- If Form 15G or 15H is submitted & the total income is below the taxable limit, no TDS will be deducted.

- Exemptions apply if the termination of service was due to ill health, business closure, or other causes beyond the employee’s control. "

Taxation vs TDS: Don’t Get Confused

It’s important to distinguish between TDS (Tax Deducted at Source) & actual tax liability. While Section 192A of the Income Tax Act mandates TDS on premature EPF withdrawal, the final tax is calculated based on the individual's total income & slab.

So even if 10% TDS is deducted, you might still owe more tax, or you may be eligible for a refund upon filing your income tax return.

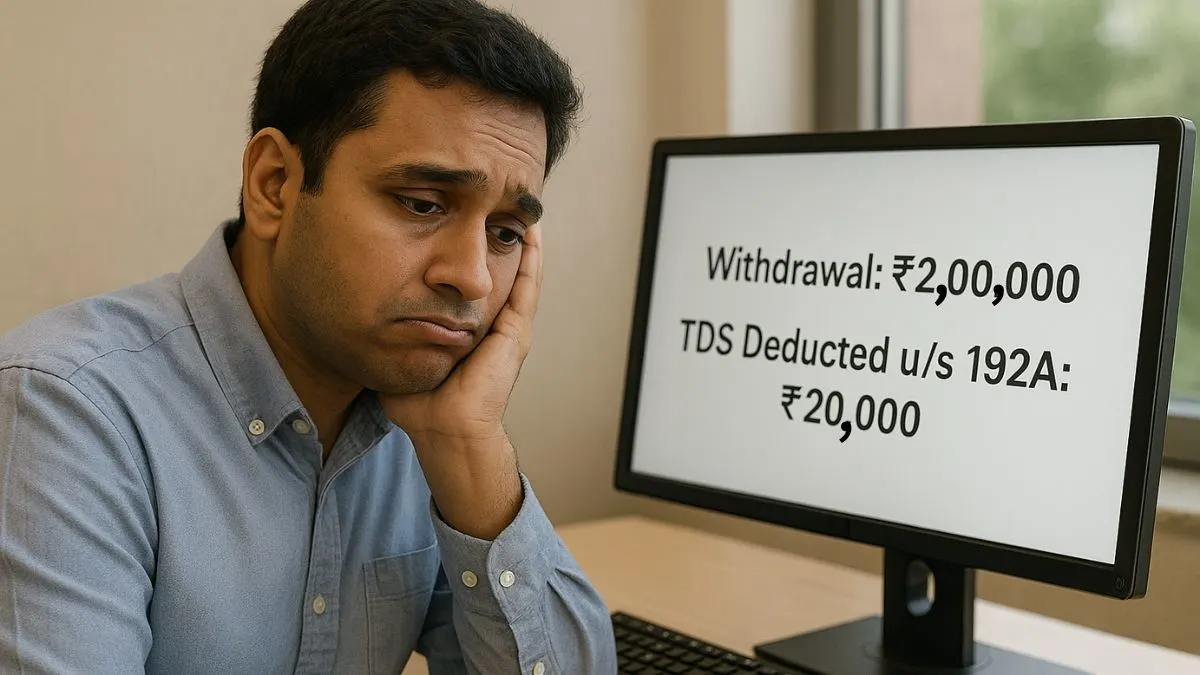

Example for Better Understanding

Let’s say Ramesh, an employee, decides to withdraw ₹80,000 from his EPF account after 3 years of service. He doesn’t submit Form 15G & has a valid PAN. According to Section 192A, TDS will be deducted at 10%, so ₹8,000 will be withheld by EPFO.

At the end of the financial year, Ramesh must declare this withdrawal as "income from other sources" while filing ITR. Based on his total income & applicable slab rate, he may either pay additional tax or claim a refund. "

Compliance for Employers and EPFO

Employers & EPF Trusts must ensure compliance with Section 192A of the Income Tax Act 1961 by deducting TDS on eligible withdrawals & filing the correct TDS returns. Mismatches can result in notices or penalties from the Income Tax Department.

For employees, it’s wise to verify your TDS deduction via Form 26AS & maintain a record of the EPF withdrawal.

Conclusion

To summarise, Section 192A of the Income Tax Act makes it mandatory to deduct TDS on premature withdrawal from EPF if the conditions of withdrawal are not met. The payment of accumulated balance due to an employee may be tempting during financial emergencies, but it's crucial to understand the tax implications before making a decision.

If the amount exceeds ₹50,000 & is withdrawn within five years, an employee must pay a 10% TDS unless appropriate forms are submitted. Moreover, this tax is deductible from the accumulated lump sum payment by the EPF authorities.

Informed decision-making will help you stay compliant & avoid surprises during tax filing.

Need help managing EPF taxes or understanding your TDS deductions? Visit Callmyca.com to connect with expert tax professionals today.