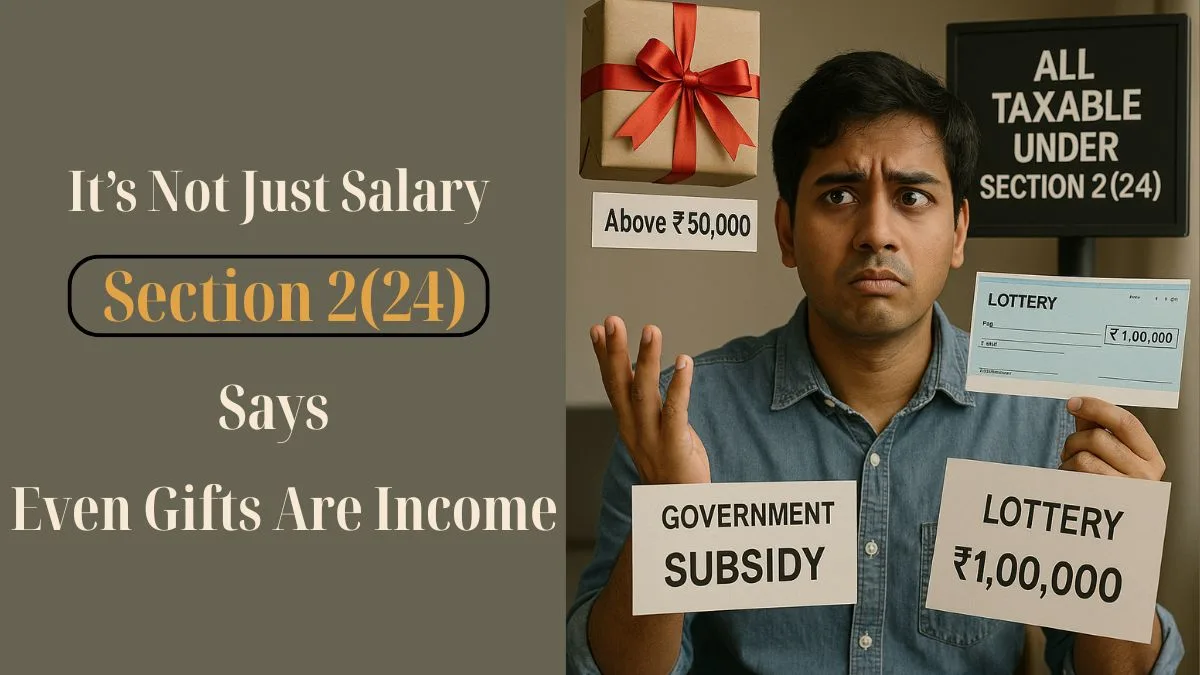

In the Indian taxation system, Section 2(24) of the Income Tax Act plays a foundational role. It defines what is considered “income” under Indian tax laws. This section provides an inclusive definition of income, meaning it not only lists what income includes but also leaves room to include other receipts or gains, depending on their nature.

Let’s break it down in a simplified way, so even non-finance folks can get a clear idea.

What Is Section 2(24) of the Income Tax Act?

Section 2(24) of the Income Tax Act, 1961, is essentially the gatekeeper of income. If your receipt or gain falls under this section, then it’s considered taxable (unless an exemption applies elsewhere). So, yes, understanding this section helps you understand the very definition of income as per Section 2(24) of the Income Tax Act 1961.

Definition of Income as per Section 2(24)

This section defines the term “income” for taxation, & here are some of the inclusions:

- Profits & gains.

- Dividends.

- Voluntary contributions received by a trust or institution.

- Income from business or profession.

- Capital gains.

- Income from all sources & in any form – even winnings from lotteries or games.

- Special provisions relating to voluntary contributions received by the electoral trust.

What does that mean for you? Even if a certain gain doesn’t seem like traditional income, if it's covered under any clause of this section, it becomes taxable income.

Why Section 2(24) Is So Crucial

Understanding Section 2(24) is like understanding the DNA of the Income Tax Act. Whether you're salaried, running a business, managing a charitable trust, or an investor, this section touches everyone.

And it's evolving. Over time, the legislature keeps adding more categories under this section to widen the tax base. That's why section 2(24) of the Income Tax Act notes are always updated in tax publications.

A Word on Voluntary Contributions

One highlight under this section is the special provisions relating to voluntary contributions received by the electoral trust. These contributions, which are otherwise exempt from tax under certain conditions, are still considered income for disclosure and accounting purposes. This ensures transparency & regulatory control in political funding. "

Practical Implications

Let’s say you receive an insurance payout, a gift, or capital gains from selling shares. Are these taxable? That depends on the nature of the income & how it's treated under Section 2(24) & its sub-clauses.

Here's an example:

If a charitable trust receives a donation (voluntary contribution), it is considered income under this section. However, it may later be exempt under Section 11 if conditions are met."

Final Thoughts

In conclusion, Section 2(24) of the Income Tax Act, 1961, is not just a statutory definition—it’s the starting point of every tax computation. So, whether you are filing taxes, managing a trust, or running a company, it’s worth knowing how this section may impact your income & liability.

Want clarity on whether your income falls under Section 2(24)? Head over to Callmyca.com & connect with trusted tax experts who’ll simplify the law for you—no jargon, just solutions.