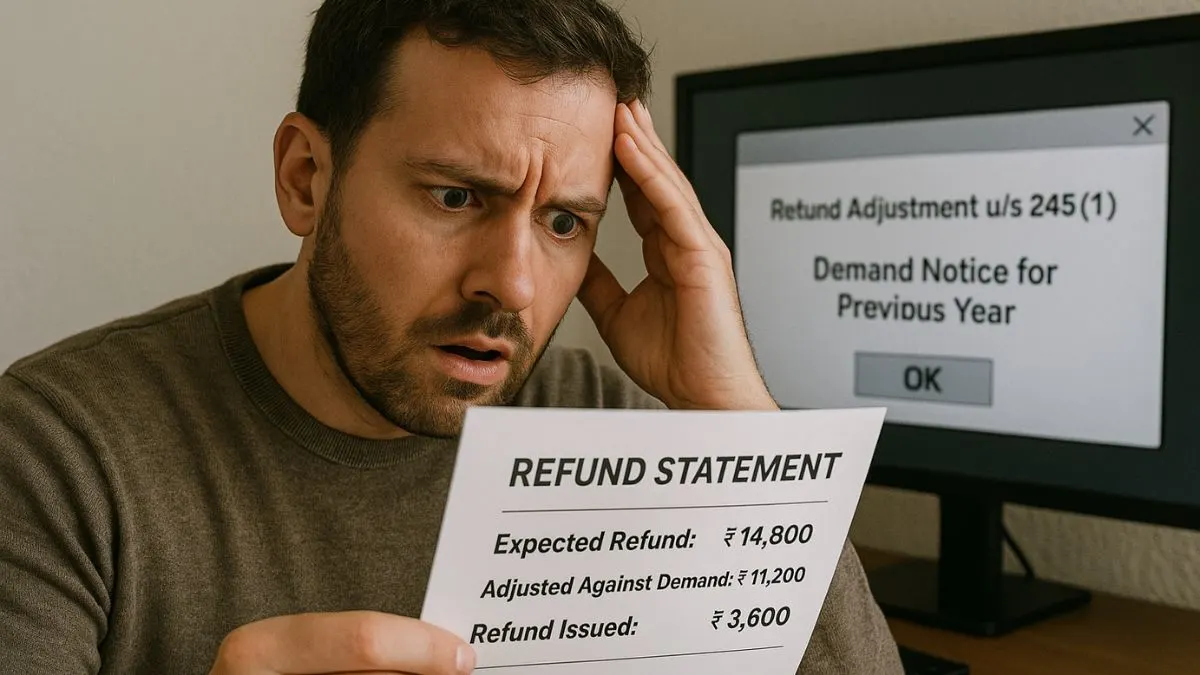

Taxpayers often look forward to receiving income tax refunds as a financial breather. However, what happens when you have unpaid dues from a previous assessment year? Section 245(1) of the Income Tax Act addresses this very situation. It allows the Assessing Officer (AO) to offset your refund against any outstanding tax liability. This legal provision provides the Income Tax Department the authority to adjust any refund due with pending dues, ensuring proper revenue collection for the government.

Understanding Section 245(1): The Core Concept

Section 245(1) of the Income Tax Act deals with the set off of refunds against tax remaining payable. In simple terms, if you are eligible for a refund but also have some pending tax dues from previous years, the income tax authorities can adjust your refund accordingly.

But here's the catch: the process is not arbitrary. The AO must send an intimation to the taxpayer before making any adjustment. This intimation is issued to you notifying you that you have dues pending for a previous year & that the refund will be used to clear those dues. This communication is mandatory under the law, allowing the taxpayer a fair opportunity to respond or raise objections.

When Does Section 245(1) Apply?

This section generally comes into play when:

- A taxpayer is eligible for a refund in the current assessment year.

- The taxpayer has tax liabilities pending from any previous assessment year.

- The department identifies the pending dues & prepares to adjust the refund against such dues.

For instance, if you’re supposed to receive a refund of ₹15,000 for AY 2024-25 but you owe ₹8,000 from AY 2022-23, the department will set off ₹8,000 from your refund & disburse only ₹7,000, after sending you the appropriate notice. "

Legal Requirements Before Adjusting Refunds

The Income Tax Department must send a notice under Section 245(1) before proceeding with the adjustment. The purpose is to allow the taxpayer to respond if they have a disagreement with the pending demand.

This notice is typically sent through email or can be accessed via the income tax e-filing portal. Once the notice is served, the taxpayer has 30 days to respond. If the taxpayer fails to respond within the time limit, the department assumes consent & proceeds with the refund adjustment.

Role of the Assessing Officer (AO)

The Assessing Officer (AO) plays a pivotal role under Section 245(1). It is the AO who identifies the refund & pending dues, issues the intimation, & then proceeds to offset your refund with the due tax amount if necessary. This step ensures both transparency & proper communication.

The AO also has the discretion to decide whether or not to initiate the adjustment based on the nature of the dues & the refund amount available.

Real-Life Scenario: How It Works

Let’s say Priya filed her income tax return & claimed a refund of ₹25,000. Meanwhile, she had a pending demand of ₹12,000 from AY 2021-22. The Income Tax Department, under Section 245(1), sent her a notice stating the pending demand. Priya had 30 days to respond, but she didn’t take any action. Consequently, the AO adjusted ₹12,000 from the refund & issued the remaining ₹13,000 to her account.

This is a classic example of how Section 245(1) allows the Income Tax Department to adjust refunds with pending dues after proper communication.

What Happens If You Disagree?

If you believe the demand raised by the department is incorrect, you can respond to the notice on the income tax portal. If the AO finds your explanation valid, they may not proceed with the adjustment. In such cases, you may still receive the full refund.

However, if your response is not accepted or you fail to respond, the department will go ahead & set off the refund against the tax dues. "

Key Takeaways

- Section 245(1) of the Income Tax Act provides legal backing for adjusting refunds against tax dues.

- The Assessing Officer (AO) plays a critical role in identifying the dues & issuing notices.

- Setting off refunds against tax remaining payable cannot be done without notifying the taxpayer.

- The taxpayer must respond within 30 days of receiving the notice.

- Failure to respond results in automatic adjustment by the department.

Confused about refund adjustments or received a Section 245(1) notice? Let our tax experts at Callmyca.com help you decode it & protect your refund—click here to get expert guidance now!