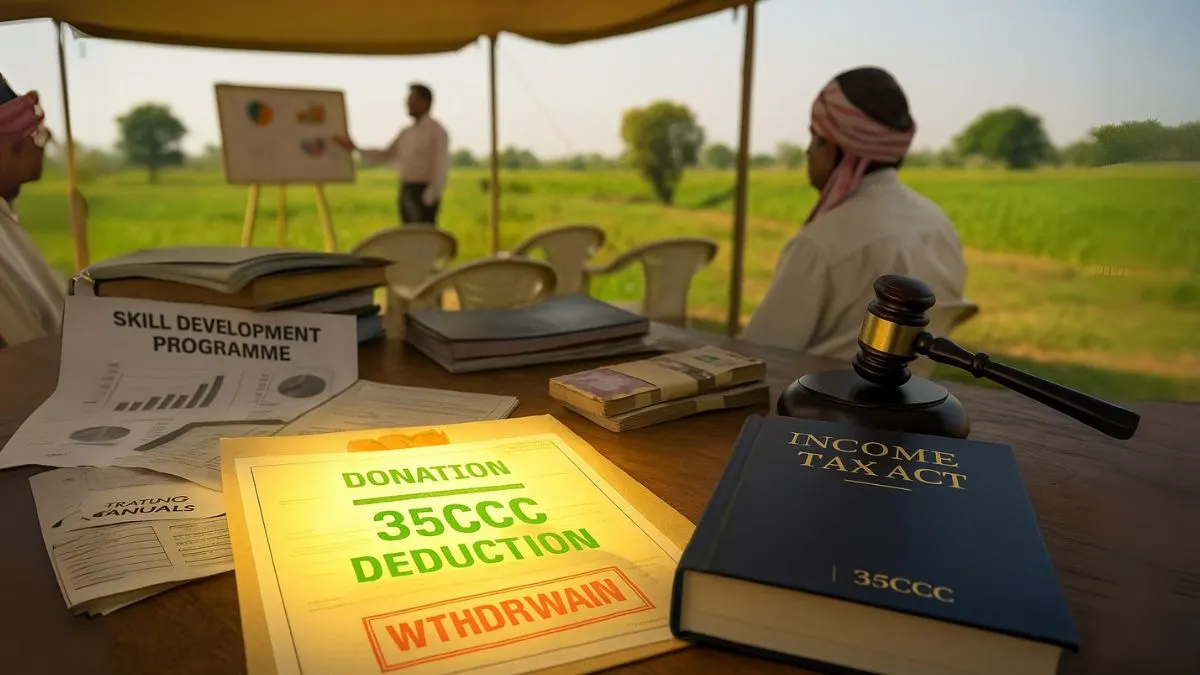

Agriculture is the backbone of India’s economy. Over 50% of the Indian population depends directly or indirectly on agriculture for livelihood. To improve farming practices and enhance productivity, the government has introduced various schemes. One such incentive comes through the Income Tax Act. Section 35CCC of Income Tax Act deals with deductions allowed on expenditure on agricultural extension projects.

This section encourages businesses and institutions to invest in modern agricultural practices and awareness programs by offering tax benefits. Let’s explore the details, scope, and benefits of this provision.

What is Section 35CCC of Income Tax Act?

Section 35CCC was introduced to incentivize expenditure by companies, firms, or individuals towards agricultural extension projects.

- Agricultural extension project means any project for training, education, and guidance to farmers to improve their agricultural operations.

- The government notifies specific projects that qualify for deductions.

- Expenditure made on such projects is eligible for a 100% deduction under Section 35CCC.

In simpler terms, if a company spends money on improving agricultural knowledge & practices through notified projects, the same amount can be claimed as a deduction while computing taxable income."

Objective of Section 35CCC

The key objective behind Expenditure on Agricultural Extension Project - Section 35CCC is to:

- Encourage private sector involvement in agricultural development.

- Support farmers in adopting modern farming methods.

- Ensure tax relief for organizations contributing to rural progress.

This way, both the agriculture sector & the taxpayers benefit.

Also Read: Capital Gain Exemption on Sale of Agricultural Land

Eligible Expenditure under Section 35CCC

Not all agricultural expenses qualify. Only expenditure incurred towards notified agricultural extension projects is allowed.

Examples include:

- Training programs for farmers.

- Awareness camps on advanced irrigation techniques.

- Research-backed extension services on fertilizers, crop rotation, and pest management.

- Collaboration projects approved by the central government.

Thus, expenditure on agricultural extension project becomes deductible only when it is part of a government-notified initiative.

Who Can Claim Deduction under Section 35CCC?

- Companies engaged in agriculture-related businesses.

- Firms & individuals participating in notified agricultural projects.

- Organizations running training programs for farmers under government approval.

Quantum of Deduction

Section 35CCC allows 100% deduction of the expenditure incurred.

- For example, if a company spends ₹10 crore on a notified agricultural extension project, the entire ₹10 crore is deductible from taxable income.

- This reduces the effective tax liability significantly.

Key Conditions for Claiming Deduction

- The project must be notified by the central government.

- Only actual expenditure incurred is eligible; not notional costs."

- Proper documentation & proof of expenditure must be maintained.

- Deduction is allowed only in the year of expenditure, not spread across years.

Also Read: India’s Cleanest Dirty Secret: Agricultural Income & Black Money

Difference Between Section 35CCC and Other Agricultural Deductions

- Section 35CCC: Focuses on expenditure on agricultural extension projects approved by the government.

- Section 35CCC vs 35CCD: Section 35CCD covers skill development projects, while 35CCC is purely agricultural.

- Section 80C/80D: These are general deductions for individuals, not linked to agriculture.

Thus, Section 35CCC is highly specialized & targeted.

Example to Understand Section 35CCC

Let’s assume an agro-based company conducts a government-approved farmer awareness program worth ₹50 lakh.

- Normally, this ₹50 lakh would be treated as business expenditure.

- But under Section 35CCC, the company can claim a 100% deduction, reducing taxable income by ₹50 lakh.

This means a direct tax benefit while contributing to rural upliftment.

Importance for Agricultural Growth

The provision ensures that:

- Farmers gain knowledge about modern agricultural practices.

- Companies are motivated to spend on CSR & extension activities.

- The government achieves policy goals faster with private sector support.

By encouraging expenditure on agricultural extension project, Section 35CCC bridges the gap between technology and farmers.

Limitations of Section 35CCC

- Deduction is limited only to government-notified projects.

- No weighted deduction (like 150% or 200%) is available—only 100% deduction."

- Misuse or false claims can attract penalties.

Compliance and Documentation

To claim deduction under Section 35CCC:

- Maintain bills, receipts, and agreements.

- Keep a copy of the government notification approving the project.

- Submit details during income tax return filing.

Also Read: Exemption on Agricultural Income Explained

Judicial & Policy Insights

Courts have emphasized that deductions under Section 35CCC are conditional upon government approval. Any expenditure outside notified projects does not qualify. Policymakers consider it a tool to attract corporate participation in rural development.

Conclusion

Section 35CCC of Income Tax Act is a forward-looking provision that benefits both taxpayers and the agricultural community. By allowing deductions for expenditure incurred towards notified agricultural extension projects, it motivates organizations to invest in farmer training and awareness.

This provision not only reduces tax liability but also strengthens India’s agriculture sector, making it more modern, efficient, & sustainable.

👉 Want to know how your business can legally claim deductions under Expenditure on Agricultural Extension Project - Section 35CCC? Visit Callmyca.com today and let our experts guide you.