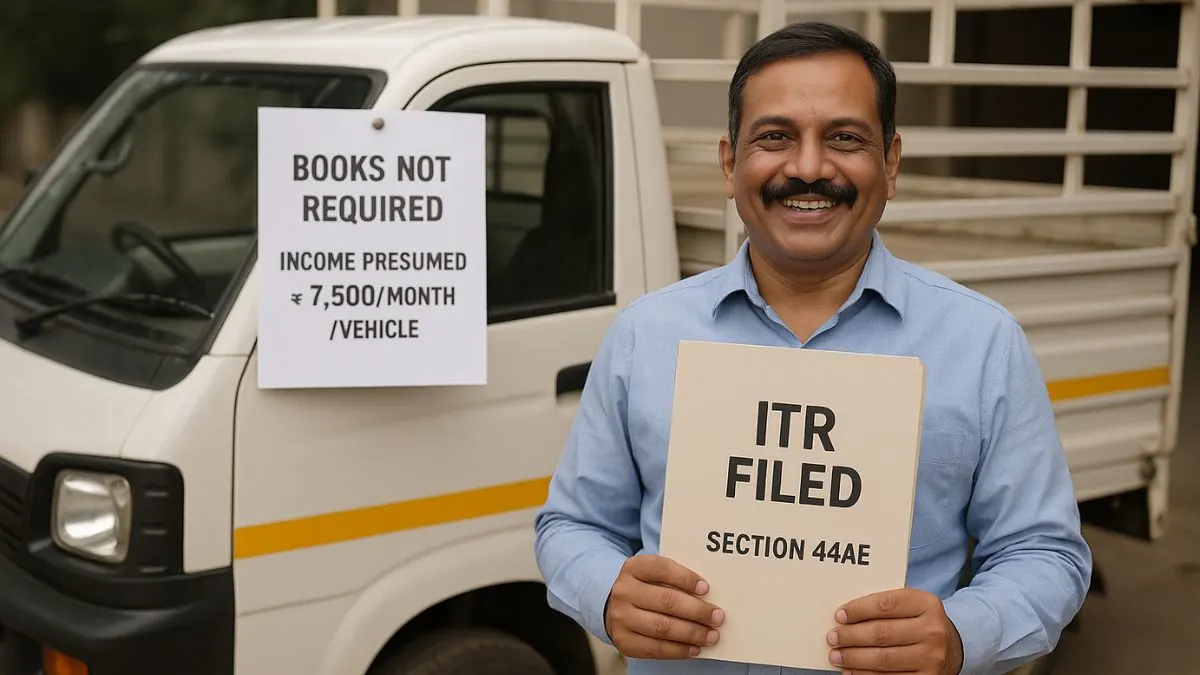

In India, small business owners often face challenges when it comes to maintaining books of accounts & complying with complex tax filing requirements. Among them, transporters — especially those who operate on a small scale — find it particularly hard to comply with intricate taxation norms. Thankfully, Section 44AE of the Income Tax Act provides relief to such businesses through the Presumptive Taxation Scheme for transporters.

This section is specially designed for individuals or entities engaged in the business of plying, hiring or leasing of goods carriages. It offers a simple, straightforward way to compute taxable income, saving time, effort, & paperwork.

What is Section 44AE of the Income Tax Act?

Section 44AE is a provision under the Presumptive Taxation Scheme introduced by the Income Tax Act, 1961. It specifically offers a Presumptive Taxation Scheme for small transport businesses, including individual truck owners & small fleet operators.

Rather than maintaining detailed records of income & expenses, assesses under this section can declare income on a presumptive basis — that is, based on a fixed amount per vehicle per month. This system for estimating the income of an assessee reduces the compliance burden while ensuring tax transparency.

Who Can Opt for Section 44AE?

This scheme is only applicable to:

- Individuals,

- Hindu Undivided Families (HUFs),

- Partnerships (not LLPs),

- And other entities

…engaged in the business of plying, hiring or leasing goods carriages.

The key condition is that the assessee should not own more than 10 goods vehicles at any time during the year, including those taken on hire purchase or lease.

Computation of Income on Estimated Basis

Under this section, income is calculated on a presumptive basis rather than actual profits or gains. Here's how:

- For heavy goods vehicles (gross weight exceeding 12,000 kg): ₹1,000 per ton per month or part of a month.

- For other goods vehicles: ₹7,500 per month or part of a month.

This computation of income on an estimated basis allows small transporters to focus more on operations and less on account-keeping.

Let’s say you own five light commercial vehicles & use them throughout the financial year. Your presumptive income would be:

₹7,500 × 12 months × 5 vehicles = ₹4,50,000.

You must pay tax on this income, & you won't be allowed to claim further deductions under Sections 30 to 38 (e.g., depreciation, fuel, repairs, etc.) except in the case of remuneration or interest to partners (if applicable). "

Benefits of Section 44AE

- Simplified Tax Filing: You’re not required to maintain books of accounts.

- Reduces Audit Requirement: If you declare income as per Section 44AE, you’re not subject to tax audit.

- Clear Compliance Rules: Tax is paid on predefined rates, leaving no room for confusion or over-calculation.

- Encourages Voluntary Compliance: Makes it easier for small transporters to join the formal economy.

This section is designed to simplify the taxation for small businesses without compromising on revenue collection.

Important Conditions to Keep in Mind

- You must not own more than 10 vehicles at any point during the year.

- If you do not want to opt for the scheme in a particular year, you will need to maintain regular books & get audited as per normal provisions. "

- Once you opt out, you can’t re-enter the scheme for five years.

Drawbacks of Section 44AE

While this scheme has many upsides, it also has a few limitations:

- If your actual income is lower than presumptive income, you still have to pay taxes on the presumptive value.

- You cannot claim deductions like fuel expenses or toll taxes, which can be substantial for some transport businesses.

However, for many small operators, the Presumptive Taxation Scheme under Section 44AE still turns out to be more beneficial than the regular route.

Final Thoughts

Section 44AE of the Income Tax Act is a much-needed relief for small-scale transporters across India. It not only helps avoid cumbersome paperwork but also ensures ease of doing business. If you’re someone struggling with calculating your transport income every year, opting for the presumptive taxation under this section could be a game-changer.

Want expert help in choosing the right presumptive scheme or filing your business ITR under Section 44AE? Visit Callmyca.com — your partner for smart tax savings & effortless compliance!