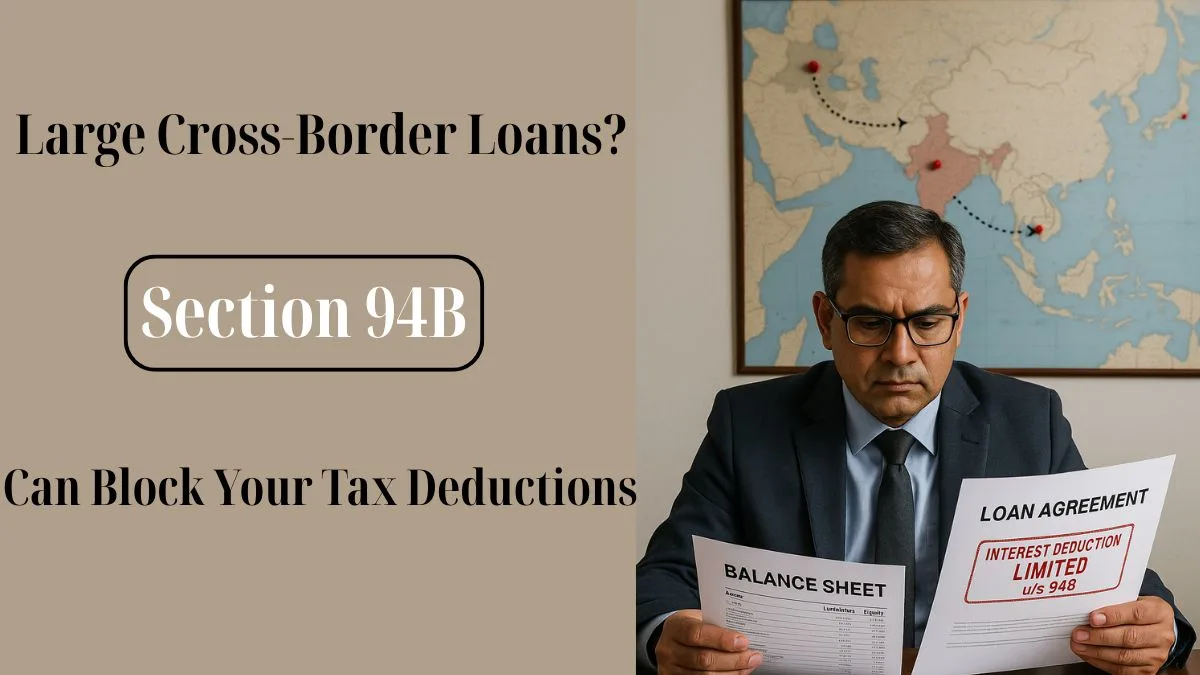

Section 94B of the Income Tax Act, introduced through the Finance Act, 2017, aims to curb base erosion & profit shifting (BEPS) by restricting excessive interest deductions claimed by companies. It essentially limits the deductibility of interest expenses paid by Indian companies or the permanent establishment (PE) of a foreign company in India to their associated enterprises.

This provision was adopted in line with the OECD's recommendations under Action Plan 4 of BEPS, ensuring that interest payments made by companies are not artificially inflated to shift profits outside India.

Applicability of Section 94B of the Income Tax Act

The applicability of Section 94B arises in situations where:

- An Indian company, or a PE of a foreign company in India, incurs interest expenses on any form of debt.

- The debt is issued by a non-resident associated enterprise.

- The total interest deduction claimed exceeds ₹1 crore in a given financial year.

The provision ensures that excessive interest payments to foreign-associated entities do not result in undue tax advantages for the Indian entity. "

Interest Expenses Claimed by a Company to Its Associated Enterprises

A common tactic used by multinational companies is routing funds to Indian subsidiaries via debt instruments. This results in substantial interest expenses claimed by a company to its associated enterprises, which reduces taxable income in India.

To prevent this, Section 94B(1) of the Income Tax Act places a cap on the amount of interest that can be deducted. As per this provision, only 30% of the company’s earnings before interest, tax, depreciation, & amortisation (EBITDA) can be claimed as a deductible interest expense.

For example, if an Indian company has an EBITDA of ₹10 crore & has paid ₹5 crore in interest to its foreign AE, it can only claim ₹3 crore as a deduction. The remaining ₹2 crore is disallowed under Section 94B.

Key Provisions for the Restriction of Interest Payments

The section provides the provisions for the restriction of interest payments, but it also includes some exceptions. These are:

- It does not apply to banks & insurance companies.

- The disallowed interest can be carried forward for up to eight assessment years & claimed as a deduction in future years, provided it falls within the 30% EBITDA limit.

This ensures fairness while still protecting the revenue base."

Limitation on Interest Deduction in Certain Cases

The limitation on interest deduction in certain cases under Section 94B is crucial for preventing aggressive tax planning strategies. It aligns Indian tax laws with global anti-abuse measures & provides a level playing field for all businesses.

If an Indian company, or a PE of a foreign company in India, pays interest to a non-resident associated enterprise, the deduction shall be limited to 30% of EBITDA. This rule discourages shifting profits out of India via thin capitalisation.

Practical Implications for Indian Businesses

Indian businesses that rely heavily on foreign loans from related entities need to re-evaluate their financing structure. Section 94b of the Income Tax Act mandates strategic tax planning. Instead of focusing solely on interest-based funding from associated enterprises, companies must now consider equity financing or external commercial borrowings from unrelated lenders.

Documentation and Compliance

Companies must maintain documentation proving the nature of the relationship with the lender & the terms of the debt. This includes:

- Loan agreements

- Board resolutions

- Proof of payment

- Applicability of Section 94b of the Income Tax Act to the transaction

Non-compliance may attract penalties & disallowance of interest deductions.

Conclusion

In summary, Section 94B of the Income Tax Act introduces an essential control mechanism against the abuse of interest payments for tax avoidance. It holds special relevance in international transactions where companies may attempt to shift profits by inflating interest expenses. Businesses must assess their funding strategies to ensure they do not fall afoul of the limitation on interest deduction in certain cases & remain compliant with Indian tax regulations.

If you're still unsure about the applicability of Section 94B of the Income Tax Act to your company’s transactions or need assistance with documentation, Callmyca.com can help you simplify your compliance journey with expert guidance tailored to your business—click here to explore our tax planning services.