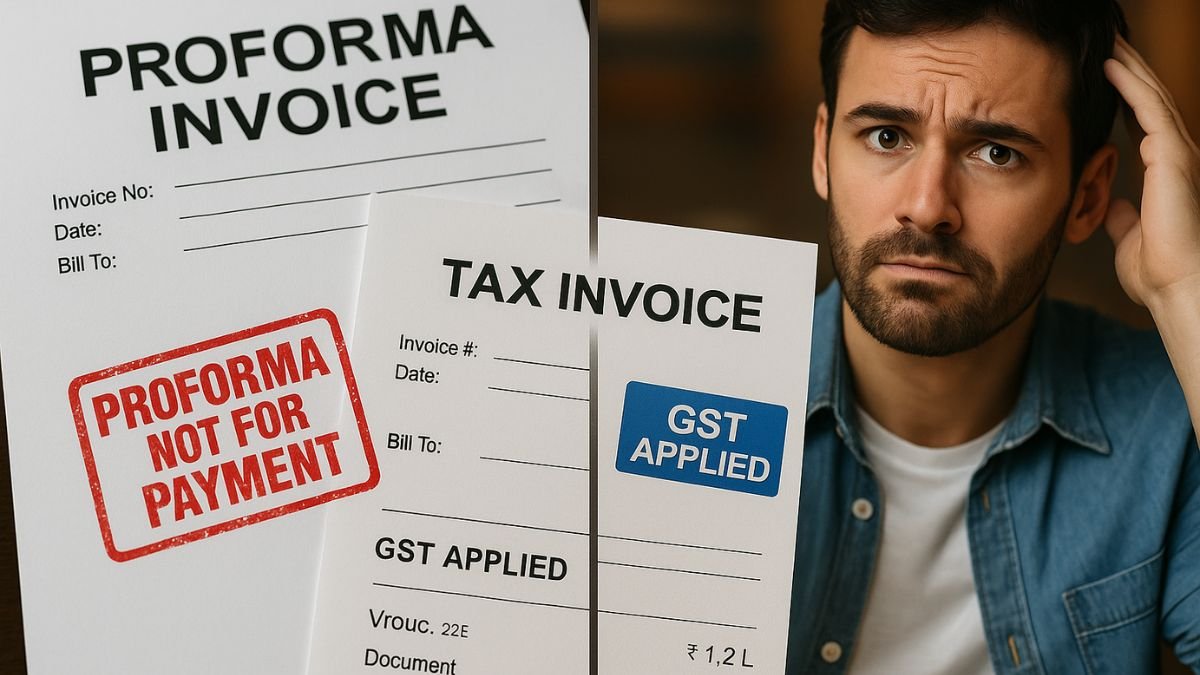

In the world of business transactions, documentation is everything. But not all invoices are created equal. Two of the most commonly misunderstood documents are the Pro Forma Invoice and the Tax Invoice.

If you’re wondering about the difference between a proforma invoice and a tax invoice, you’re not alone. Many businesses confuse the two, especially when dealing with international or B2B clients. This article will help you understand each document clearly, its purposes, legal value, and when to use them. "

What Is a Proforma Invoice?

A Proforma Invoice is an initial invoice generated by the seller to provide the buyer with the details of goods or services to be delivered. Think of it as a pre-invoice. It is not a legal document, and no accounting entry is recorded against it.

More simply put, the proforma invoice is an advanced document that serves as a means of projecting the terms of the upcoming transaction.

Here’s what you should know: "

- A proforma invoice is a non-legal document for a prospective buyer

- It is negotiable and subject to change

- It provides an estimate and outlines terms such as quantity, price, delivery timeline, and payment terms

This document is often used for:

- Internal approvals

- Pre-shipment procedures

- Customs clearance (especially in exports)

- Client review before issuing a final invoice

So, when your client asks for a quote that looks official but is still flexible, you send a Proforma Invoice.

What Is a Tax Invoice?

A Tax Invoice, on the other hand, is the real deal. It is a legal document used to record a taxable sale. Once issued, it becomes part of your books and is used for:

- Accounting and bookkeeping

- Tax calculation and input tax credit (especially under VAT or GST)

- Legal record for revenue recognition

Tax Invoice must include:

- Invoice number and date

- Seller and buyer’s GST/VAT numbers

- Description of goods/services

- Applicable taxes (GST, VAT, etc.)

- Total payable amount including tax

Unlike a proforma, a Tax Invoice is binding and final. It reflects an actual financial transaction. "

Key Differences Between a Proforma Invoice and a Tax Invoice

Let’s break down the difference between a proforma invoice and a tax invoice in India (also applicable to most jurisdictions):

|

Feature |

Proforma Invoice |

Tax Invoice |

|

Purpose |

To provide an estimate |

To confirm a sale and claim tax |

|

Legal Status |

Not legally binding |

Legally recognized |

|

Tax Applicability |

No tax included or claimable |

Includes applicable taxes |

|

Editable |

Yes, it's negotiable |

No, once issued, it’s final |

|

Used For |

Quotation, approval, export |

Tax reporting, accounting |

So remember: Proforma invoice is negotiable and subject to change, but once you issue a Tax Invoice, it locks in the deal.

Proforma Invoice Format

A basic proforma invoice format includes:

- “Proforma Invoice” as the title

- Invoice number and date

- Buyer and seller information

- List of products/services

- Estimated prices and delivery timelines

- Terms and conditions

Since it's non-binding, you don’t include tax breakdowns or payment obligations.

Proforma Invoice vs Quotation

Many people confuse a proforma invoice with a quotation, but here’s a simple way to differentiate:

- A quotation is an informal offer, often just a list with prices

- A proforma invoice is more formal, structured like an invoice, and is often used in international trade

While both offer pricing information, a proforma invoice is an advanced document that serves as a means of projecting the actual commercial invoice.

Proforma Invoice vs Commercial Invoice

The difference between a proforma invoice and a commercial invoice becomes crucial in shipping:

- Proforma Invoice is used before the sale and for customs valuation

- Commercial Invoice is issued after the sale and is legally binding

In exports, customs often require a proforma for estimation and a commercial invoice for final clearance.

Proforma Invoice vs Invoice (General)

When we say invoice, it generally refers to a tax invoice or a final invoice. So, the difference between a proforma invoice and an invoice is similar to our earlier points: proforma is an intention, invoice is an execution.

Final Words

Here’s what we’ve learned:

- A Proforma Invoice is a non-legal document for the prospective buyer that provides an estimate and outlines terms

- A Tax Invoice is legally binding and used for accounting and taxation

- A proforma invoice is negotiable and subject to change, while a tax invoice is final

- Understand your business scenario to issue the correct document

Using the wrong document can lead to confusion, non-compliance, or even legal issues.

👉 Still confused between proforma and tax invoices?

Visit www.callmyca.com to get expert help on documentation, invoicing compliance, and taxation support tailored to your business.