What Is the Earliest Date to File a Tax Return in India?

Updated Guide for FY 2024–25 | AY 2025–26

If you're a proactive taxpayer, you might be wondering:

"When is the earliest date I can file my Income Tax Return (ITR)?"

Filing early has many advantages, like faster refunds, stress-free processing, and avoiding last-minute errors.

Let’s understand when exactly you can start filing your tax return in India for the current financial year.

✅ Financial Year vs Assessment Year

Before we dive into dates, it’s important to understand two terms:

- Financial Year (FY): The year in which you earn income.

➔ Example: FY 2024–25 (1st April 2024 to 31st March 2025) - Assessment Year (AY): The year in which you assess and file your return for the income earned in the financial year.

➔ Example: AY 2025–26 (1st April 2025 onwards for FY 2024–25)

You always file your ITR in the assessment year for the income earned in the financial year.

✅ Earliest Date to File Income Tax Return

Generally, you can start filing your ITR after:

- Income Tax Department Notifies the ITR Forms:

- Forms for the new assessment year (like ITR-1, ITR-2) must be officially notified.

- E-filing Portal Opens Filing Window:

- The income tax website updates its system to start accepting returns.

- TDS Details Are Updated:

- Form 26AS and AIS (Annual Information Statement) are updated with TDS, TCS, and other details.

✅ Based on recent trends, the earliest date usually falls in the first week of April or May each year.

📅 Typical Filing Timeline

|

Activity |

Usual Timeline |

|

Notification of ITR Forms |

February–March |

|

Start of ITR Filing (Without Audit) |

April–May |

|

Last Date for Filing (Without Audit) |

31st July |

|

Last Date for Filing (With Audit) |

31st October |

For FY 2024–25 (AY 2025–26), taxpayers can expect to start filing from April 2025 onward.

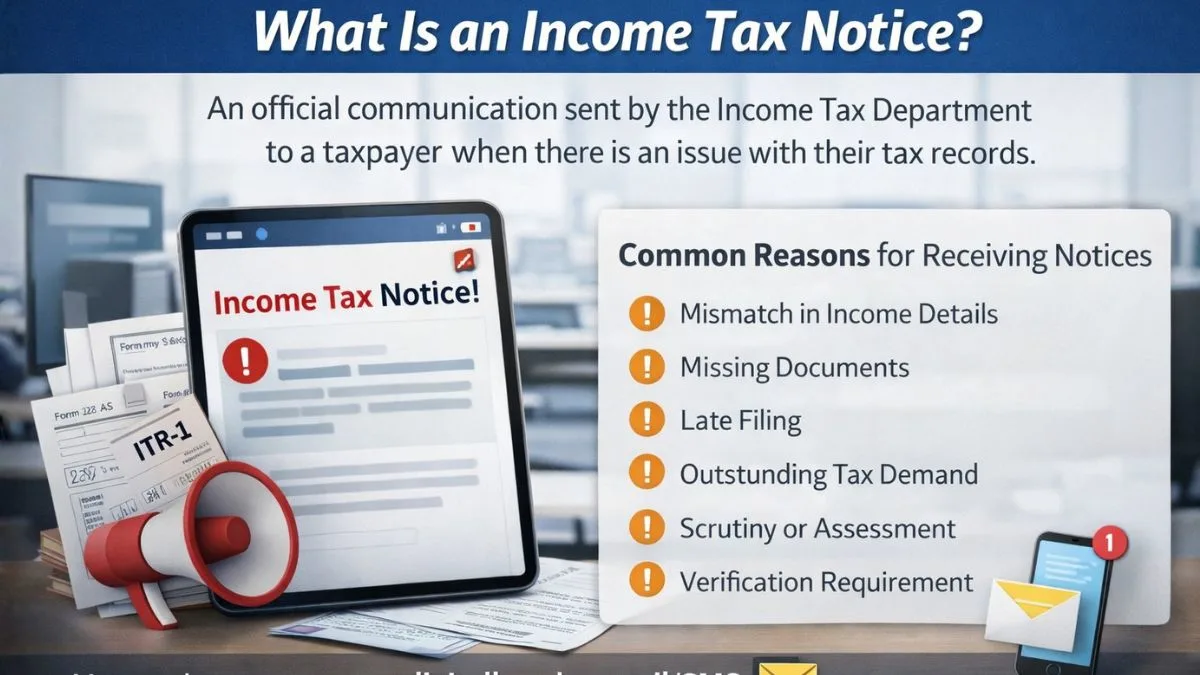

❗ Important Points Before Filing Early

- Ensure your Form 16 from your employer is issued (usually by 15th June).

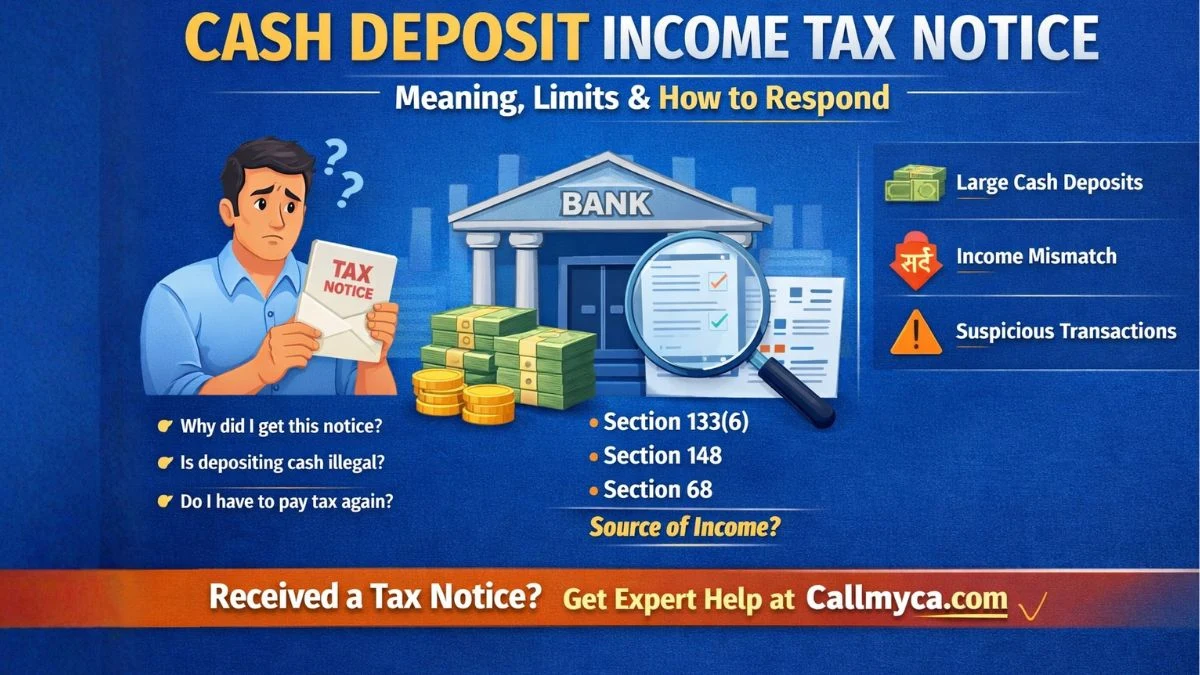

- Check Form 26AS and AIS/TIS reports for correct TDS credits.

- Verify that you have received interest certificates from banks, capital gain statements from brokers, and any investment proofs.

- If there are mismatches, wait till corrections are made.

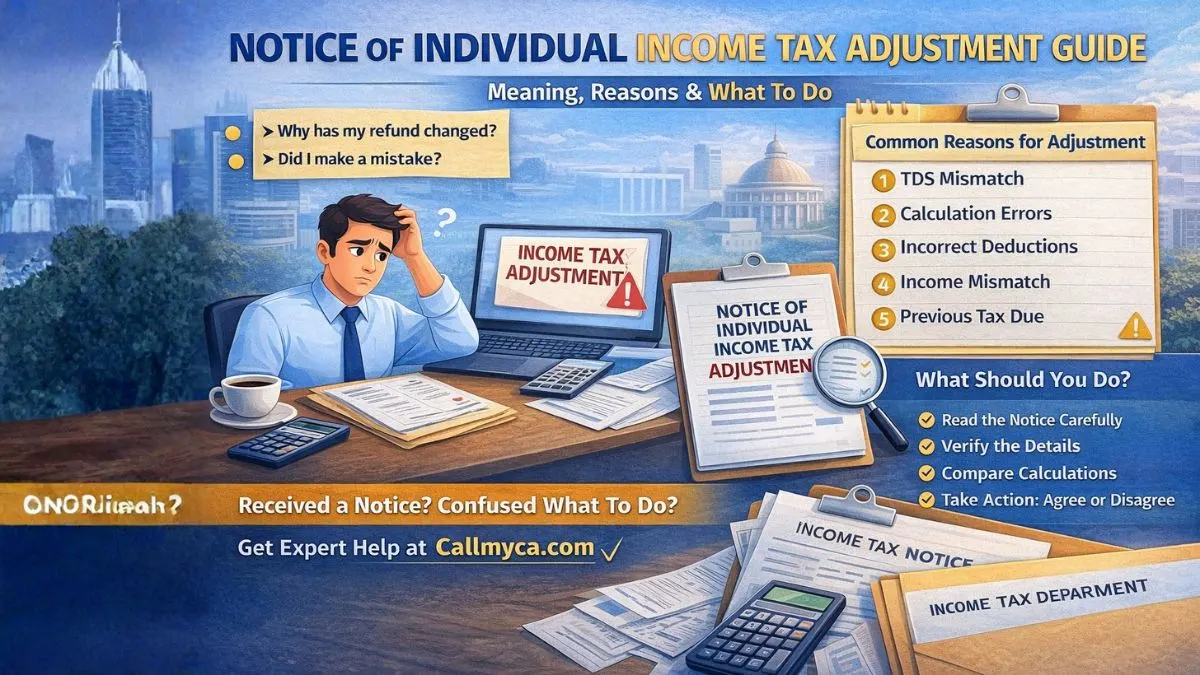

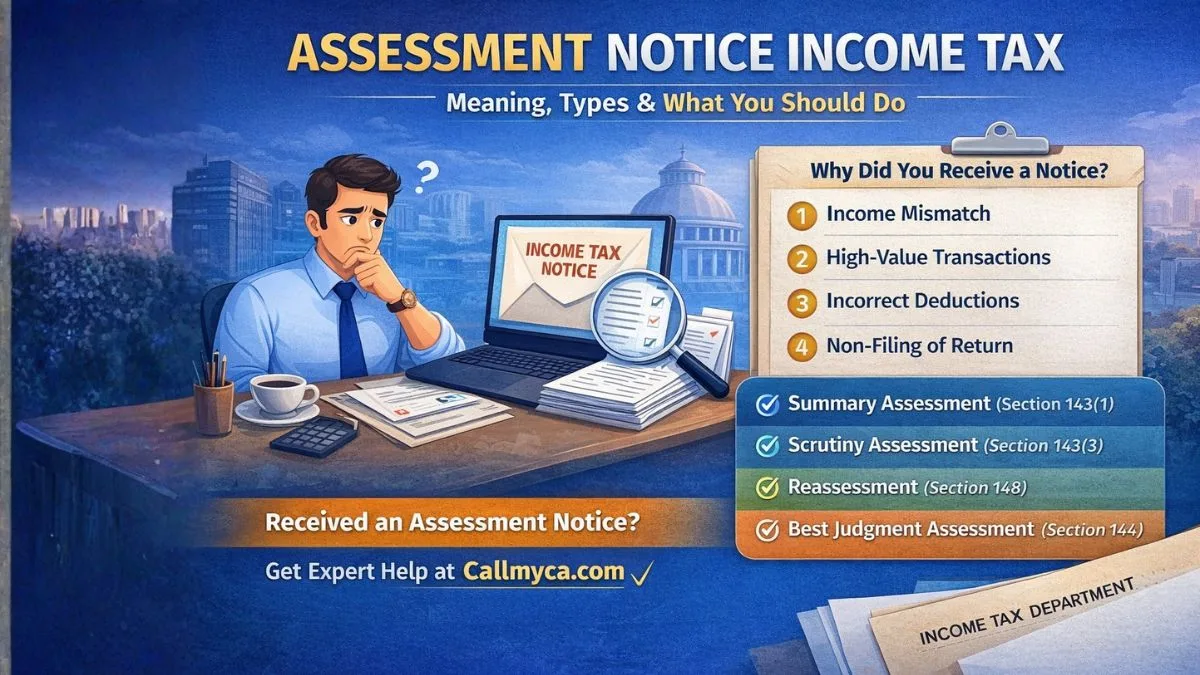

✅ Filing too early without verifying TDS or income data can lead to a notice of mismatch or a delayed refund.

🧠 Example

Suppose you are a salaried employee, and your employer has deposited TDS correctly:

- Form 26AS and AIS get updated by mid-May 2025.

- Form 16 is issued by 15th June 2025.

- Ideally, you can safely file your return by the third or fourth week of June 2025 for AY 2025–26.

However, technically, you can file as early as the income tax portal starts accepting returns, often by April or May if your income details are straightforward.

✅ Advantages of Filing Early

- Faster refund processing

- Peace of mind (no last-minute rush)

- More time to correct errors, if any

- Better financial planning for the next year

✅ Final Words:

The earliest you can file your ITR is usually from April or May onwards, depending on when the portal opens and your income details are updated.

Always ensure your financial documents and TDS credits are in order before submitting, even if early filing is allowed.