Section 73 of the Income Tax Act plays a crucial role in determining how losses from speculation business are treated under Indian tax laws. Often misunderstood, this section specifically deals with the treatment of losses incurred in speculation business and lays down certain conditions and restrictions for set-off and carry forward.

Let’s break it down simply and comprehensively to help you understand how Section 73 of the Income Tax Act 1961 impacts your tax filings.

What Is Section 73 of Income Tax Act?

Section 73 of the Income Tax Act pertains to the treatment of speculation losses. It defines what constitutes a speculative transaction and outlines how losses from such businesses can be adjusted or carried forward.

According to the explanation to Section 73 of the Income Tax Act, a speculation business generally involves buying and selling assets (like shares) without actual delivery. While this sounds like regular trading, the law differentiates speculative transactions from normal business based on delivery, intention, and nature of income.

Speculation Losses – Key Provisions

Under Section 73(1) of the Income Tax Act, any loss in a speculation business can only be set off against income from another speculation business. You cannot use these losses to reduce income from other business or professional activities.

Further, Section 73(2) of the Income Tax Act states that if the entire loss is not adjusted in the current financial year, it can be carried forward for four years. But again, it can only be adjusted against speculative gains during that time.

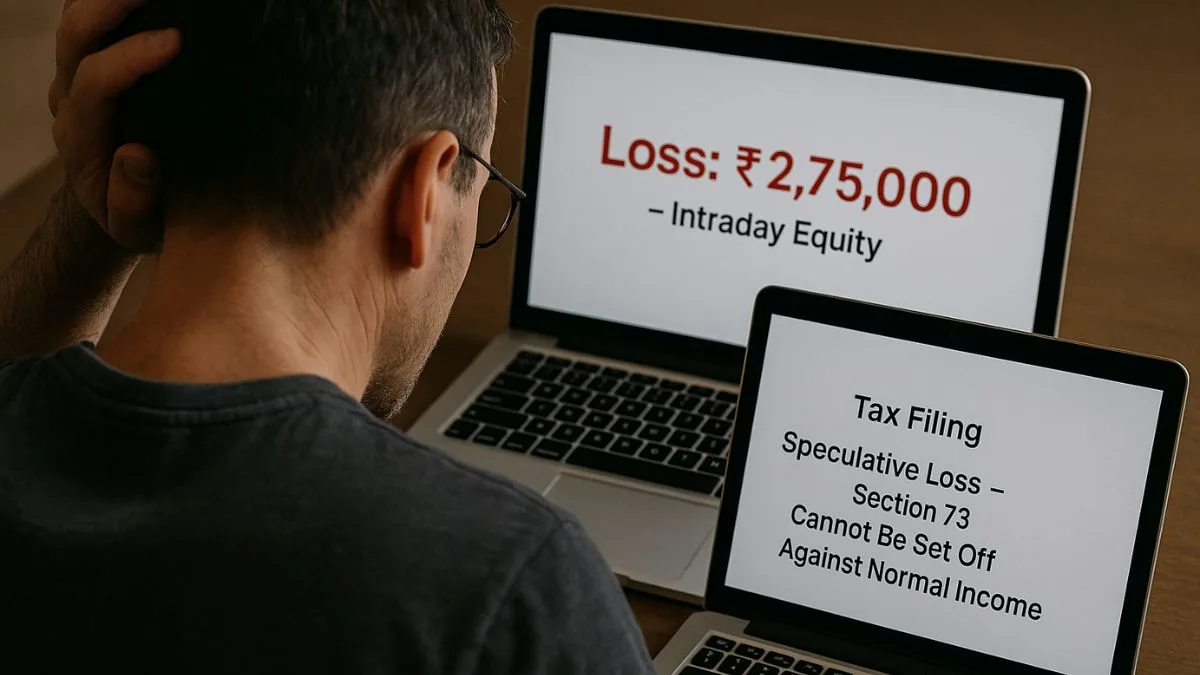

This provision often affects share traders who deal in intraday trading or derivative contracts that fall under speculative transactions.

Applicability and Exceptions

While Section 73 of the Income Tax Act applies broadly to companies, there are some exceptions. For instance:

- Companies whose principal business is banking or the granting of loans and advances are not covered under the speculative loss rules.

- Certain transactions in derivatives and forward contracts are also excluded, especially after recent amendments.

These nuances are essential to determine whether your trading business will be treated under Section 73 or not.

Why Speculation Losses Need Special Treatment?

The idea behind giving separate treatment to speculative losses lies in the risky nature of speculative business. Since such activities do not involve actual delivery and can be highly volatile, the law doesn’t allow setting off these losses against regular income, which can reduce tax arbitrarily.

Therefore, the Income Tax Act section 73 introduces stricter norms for such businesses.

Section 73a of Income Tax Act

You may also come across Section 73a of the Income Tax Act, which deals with losses from business specified in section 35AD, and is relevant in a different context but often confused with Section 73 due to the naming similarity.

Likewise, Section 73(3) of the Income Tax Act refers to how speculation losses, even if they are carried forward, must be claimed by filing returns within the due dates under section 139(1).

Important Judicial Interpretations

Over the years, the explanation to Section 73 of Income Tax Act has been interpreted in multiple rulings. Courts have clarified that just trading in shares or intraday trading doesn't always amount to speculation unless the company doesn’t have delivery-based transactions or its principal business isn't trading.

These interpretations are essential in determining whether your business falls under speculative or non-speculative trading."

Example to Understand Section 73

Suppose a trader made a profit of ₹2,00,000 in regular delivery-based trades but incurred a loss of ₹1,50,000 in intraday equity trades. Under section 73 of the Income Tax Act 1961, the ₹1,50,000 speculative loss cannot be adjusted against the ₹2,00,000 gain. Instead, it can only be adjusted against future speculative profits, subject to the 4-year carry-forward rule."

Final Thoughts

Section 73 of the Income Tax Act is a critical provision for taxpayers engaged in speculative businesses like intraday stock trading. Understanding this section not only helps you file returns accurately but also enables you to make strategic decisions about carrying forward or adjusting losses.

💼 Need help in correctly declaring speculative income and losses in your ITR? Connect with experts at Callmyca.com — India’s trusted platform for all your tax filing and financial compliance needs. File it right before it’s too late!