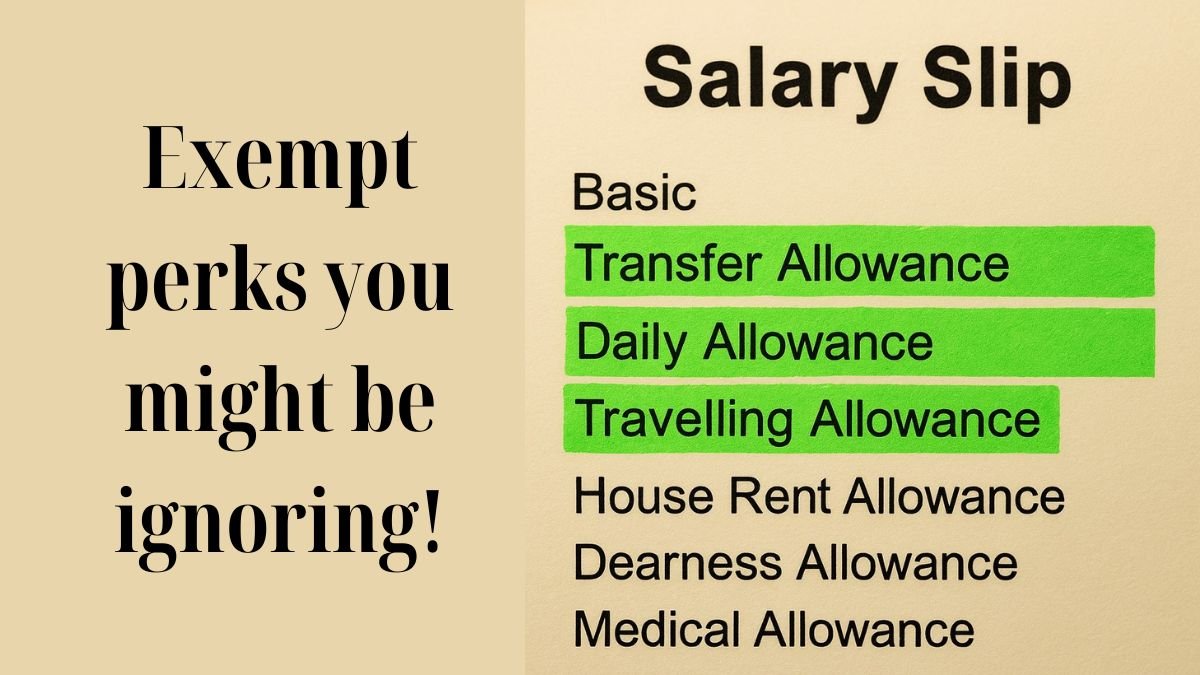

Every salaried person looks for ways to save tax, and one smart way to do that is by understanding allowances that are exempt under the Income Tax Act. One such important clause is Section 10(14)(ii).

Not every allowance you receive from your employer is taxable. There are several prescribed allowances or benefits granted to meet personal expenses or specific working conditions that are fully or partially tax-free.

Let’s break it down and see how you can benefit from this section.

What Is Section 10(14)(ii)?

Section 10(14)(ii) of the Income Tax Act allows exemptions for allowances granted to meet the increased cost of living or for performing duties under specific working conditions.

In simple terms, (ii) any such allowance granted to the assessee, which is:

- For official duties

- Or to offset the cost of living due to hardship

...is eligible for tax exemption, subject to certain rules.

This section comes in handy for employees working in challenging conditions, remote locations, or in roles where specific expenses (like uniform costs) are necessary.

Difference Between 10(14)(i) and 10(14)(ii)

Before we move forward, let’s clarify the common confusion between the two sub-clauses:

- Section 10(14)(i) deals with allowances granted to meet expenses wholly, necessarily, and exclusively incurred in the performance of duties (like travel or tour allowances).

- Section 10(14)(ii) refers to the allowance granted to employees for working under a certain set of conditions while on duty.

In both cases, exemptions are allowed, but the types of allowances covered are different.

Prescribed Allowances Under Section 10(14)(ii)

The Central Government has notified a list of Prescribed Allowances or benefits granted to meet personal expenses, which are exempt under Section 10(14)(ii). Some of the most common ones include:

- Uniform Allowance – If the employee is required to wear a specific uniform for official duty, the total expenditure incurred by an employee for maintaining his/her official uniform is exempt from taxation.

- Hill Compensatory Allowance – For employees working in hilly or high-altitude areas.

- Tribal Area Allowance – Given to those working in scheduled or tribal areas.

- Remote Area Allowance – When employees are posted in difficult terrains or isolated locations.

- Field Area Allowance – For defence personnel posted in operational or field areas.

Each of these allowances has a specified monthly exemption limit. If the allowance received is higher than the prescribed limit, the extra portion is taxable.

How Is the Exemption Calculated?

Let’s say an employee receives ₹1,200 per month as uniform allowance, and they spend the full amount on maintaining uniforms. As per rules, the entire ₹1,200 may be exempt if:

- The uniform is compulsory and specific to the job, and

- The employer certifies that the allowance is spent for its intended purpose.

However, if the amount received exceeds the government-prescribed limit, the extra portion becomes taxable income.

Real-Life Examples

- Army officer posted in Siachen receives:

- Field Area Allowance – ₹4,200/month

- High Altitude Allowance – ₹1,060/month

Both are exempt under Section 10(14)(ii) up to the prescribed limits.

- Bank officer posted in Mizoram:

- Receives Remote Area Allowance – ₹300/month

- Allowed full exemption since it is within the allowed limit.

These cases highlight how Section 10(14)(ii) of the Income Tax Act supports employees working under special conditions.

Important Notes for Claiming the Exemption

- Allowances must be specifically mentioned in your salary structure.

- You may need to submit proof of expenditure if required by your employer.

- Exemption is not automatic; it must be declared in your income tax return correctly.

If you receive allowances but don’t declare them properly, they may be fully taxed, and that means you lose a smart tax-saving opportunity.

Why This Matters

Tax rules often sound complicated. But understanding the nuances of Section 10(14)(ii) can help salaried individuals reduce their taxable income significantly. Especially those working in special locations, with specific job roles, or who incur official expenses like uniforms.

This section ensures that employees who face higher costs due to job-related hardships or special duties don’t get penalised by taxation on genuine reimbursements.

Final Thoughts

Section 10(14)(ii) of the Income Tax Act is more than just a clause. It’s a valuable tool for salaried individuals to legally reduce their tax burden.

It covers prescribed allowances or benefits granted to meet personal expenses, allows exemptions for allowances granted to meet the increased cost of living, and applies when an allowance is granted to employees for working under a certain set of conditions while on duty.

Whether it’s maintaining a uniform, working in a remote location, or managing tough living conditions, (ii) any such allowance granted to the assessee under the prescribed list can be a tax-saving opportunity.

So, the next time you file your return, don’t forget to review the allowances in your payslip.

Need help maximising your tax exemptions?

👉 Visit www.callmyca.com to connect with India’s top CAs and get expert filing support.