Section 10(15) of the Income Tax Act offers a lesser-known but powerful tax-saving opportunity, especially for those who earn income through interest. But here’s the catch: most people don’t even know this exemption exists!

This section provides exemption towards various interest incomes—yes, you read that right—interest income earned by individuals is exempted from taxation under certain conditions. Whether it's interest, premium on redemption, or other payments received from specified government schemes or bonds, Section 10(15) might be your secret weapon to reduce taxable income.

What Is Section 10(15) of the Income Tax Act?

Simply put, Section 10(15) covers income by way of interest, premium on redemption or other payment received from specific sources. These sources include:

- Savings certificates

- Post office deposit schemes

- Notified bonds

- Tax-free infrastructure bonds

- Gold deposit bonds issued under government schemes

When these conditions are met, the income earned from interest on such investments is completely tax-free. "

Who Can Claim Exemption?

This section applies to:

- Individual taxpayers, including both resident & non-resident Indians

- HUFs, companies, & trusts in certain cases

- Entities receiving interest from specified institutions or government bodies

But the real benefit is felt by small investors & senior citizens who rely heavily on interest income from post office schemes or bonds. "

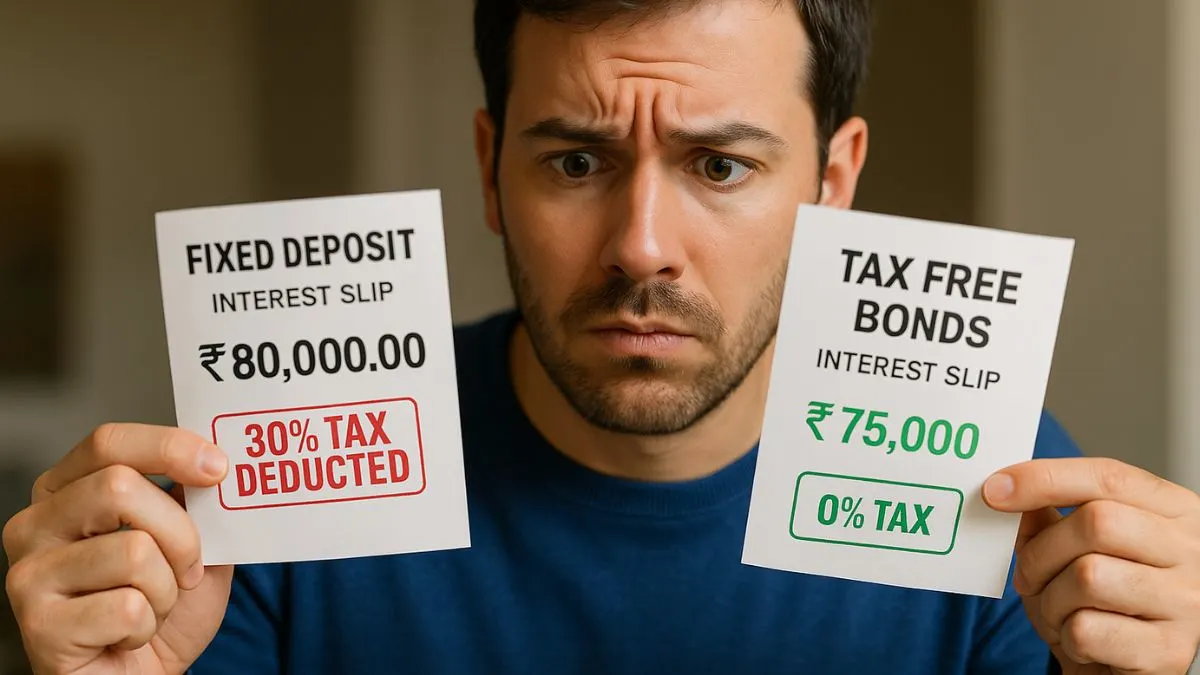

Why It Matters – Real Impact on Your Taxes

Imagine earning ₹20,000 from post office savings or infrastructure bonds & realising it’s fully exempt under Section 10(15). That’s tax-free income you don’t even need to report under “Income from Other Sources.”

It’s like having an invisible tax shield on certain investments—no TDS, no inclusion in total taxable income, & no tax liability.

Examples of Tax-Free Interest under Section 10(15)

- Interest on Post Office Savings Bank Account (up to ₹3,500 for individuals and ₹7,000 for joint accounts).

- Interest from NSC (National Savings Certificate) issued before a particular date.

- Interest on certain bonds notified by the central government.

- Interest from the Sukanya Samriddhi Yojana applies only to the girl child’s guardian.

Common Mistakes People Make

- Not checking the issue date: Some exemptions only apply to bonds issued before specific dates.

- Missing declaration requirements: In a few cases, you may need to submit Form 15G/15H or other declarations.

- Clubbing with taxable interest: Interest from fixed deposits & recurring deposits is not exempt under this section, so don’t mix them up!

Why This Is Especially Relevant in 2025

With growing interest in post office deposit schemes & tax-free bonds during uncertain markets, Section 10(15) of the Income Tax Act has seen renewed attention. It helps conservative investors legally reduce tax without taking any risk.

Final Takeaway

If you have interest income & want to legally avoid tax on it, Section 10(15) is a must-know provision. Whether it’s post office interest, infrastructure bonds, or government-backed savings, explore your eligibility & make smart investment choices.

👉 Want to check if your interest income qualifies under Section 10(15)? Let our experts at Callmyca.com help you save on taxes while staying 100% compliant.

Let your money earn without being taxed—legally!