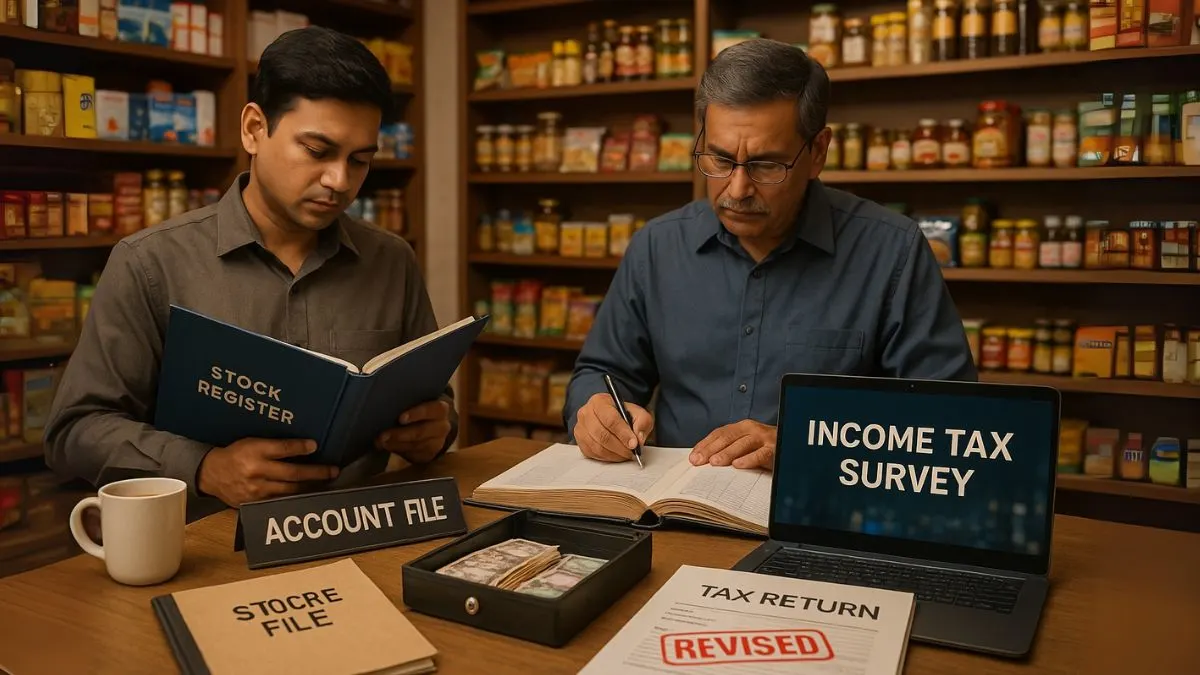

When it comes to tax compliance, most businesses and professionals think only about filing returns and maintaining records. But the Income Tax Department has powerful tools to ensure that tax evasion does not slip through the cracks. One such tool is the survey conducted under Section 133A of Income Tax Act, 1961.

This section gives wide-ranging powers to the tax department to enter business premises and verify records. Many taxpayers are aware of raids under Section 132, but very few understand the scope of surveys under Section 133A. Unlike a raid, a survey is limited, but it can still have significant consequences. That’s why understanding it is critical for every business owner & professional in India.

What is Section 133A of Income Tax Act?

Section 133A of Income Tax Act empowers the income-tax authority to verify if a person is correctly disclosing income and paying due taxes. Under this section, an income-tax authority may enter any place of business or profession during working hours and check the books of accounts, cash, stock, or other valuable items related to income.

The idea behind this provision is to curb tax evasion by ensuring that the declared figures in income tax returns match the actual situation of the business.

In simple terms, this section allows the revenue department to conduct surprise checks, also known as survey u/s 133A, to ensure compliance & transparency."

Why are Surveys Conducted Under Section 133A?

A survey u/s 133A is not a random activity. It usually happens when the income-tax department suspects discrepancies in a taxpayer’s returns. The objective is to collect information that can be used to ensure accurate reporting of income.

Reasons for conducting such a survey may include:

- Large mismatch between turnover & tax paid.

- Information received from third-party sources about undisclosed income.

- Sudden growth in business profits without proper records.

- Complaints or intelligence inputs about tax evasion.

The main purpose is to verify cash, stock, books of accounts, and ensure everything tallies with the returns filed.

Powers of Income Tax Authority Under Section 133A

The law clearly states that an income-tax authority may enter any place of business or profession during working hours. But what can they do once inside?

Here are their powers:

- Inspect books of accounts and documents.

- Verify cash, stock, and valuables.

- Record statements of employees or the proprietor.

- Collect information relevant to pending proceedings.

However, there are also restrictions. For example, they cannot seize assets like in a raid under Section 132. They can only impound documents after recording reasons.

This balance ensures that the survey is effective but not as intrusive as a full-fledged search and seizure.

Also Read: Powers of Search and Seizure Explained

Difference Between a Raid and a Survey

Many people confuse a survey with a raid. Let’s simplify:

- Survey u/s 133A: Limited in scope, conducted only at places of business or profession during working hours. The objective is verification, not seizure.

- Raid u/s 132: Far more intrusive, can happen even at residential premises, involves seizure of assets, and is aimed at uncovering black money.

Thus, while a raid creates fear, a survey acts as a compliance check. Businesses must take surveys seriously because findings can still lead to reassessment or penalty.

Types of Surveys Under Section 133A

Section 133A allows for different types of surveys depending on the objective of the tax department:

- Routine Surveys – To verify compliance & cross-check records.

- Specific Purpose Surveys – Triggered by information on tax evasion or irregularities.

- Follow-Up Surveys – Conducted after a raid to cross-verify data.

In each case, the rule remains that revenue conducts survey u/s 133A only at business premises and not residential houses (unless books of accounts are stored there).

Rights and Duties of the Taxpayer During a Survey

While the tax authority has wide powers, the taxpayer also has rights. Knowing these can help reduce stress during a survey.

- You have the right to ask for identification of officers.

- You must cooperate & provide books of accounts.

- You cannot refuse access to records but can request time for clarification.

- You have the duty to answer questions truthfully.

Failure to cooperate may lead to further scrutiny, penalties, or even a raid if major discrepancies are found.

Also Read: Power to Call for Information

Consequences of a Survey Under Section 133A

A survey is not just a formality. It can have real consequences for businesses. Some of them include:

- Discovery of unaccounted cash or stock.

- Adjustments in declared turnover or income.

- Initiation of reassessment proceedings.

- Possible penalties for misreporting or concealment.

For example, if during a survey the officers find stock worth ₹50 lakhs not recorded in the books, this discrepancy may be treated as unaccounted income and taxed accordingly.

Judicial Views on Section 133A

Over time, courts have clarified the scope of surveys. Judicial precedents highlight that:

- Surveys are fact-finding tools, not punitive measures.

- Statements recorded during a survey are admissible but not conclusive.

- Excessive interference beyond the scope of Section 133A is not allowed.

These rulings protect the balance between the taxpayer’s rights & the department’s need to ensure compliance.

Practical Example of Survey u/s 133A

Consider a textile trader who reports ₹1 crore turnover but consistently pays very low tax. Based on intelligence inputs, the department decides to verify.

Officers conduct a survey u/s 133A and find cash sales not recorded in the books. They also notice stock differences. These findings can lead to reassessment, additional tax demand, and penalty.

This shows how Section 133A acts as a strong deterrent against underreporting of income."

Importance of Section 133A for Compliance

In today’s digital economy, businesses often assume that only digital trails matter. But Section 133A of Income Tax Act ensures that physical verification remains a powerful compliance tool.

It reinforces the message that tax evasion, whether small or large, will not go unnoticed. For genuine taxpayers, this law should not create fear. Instead, it should be seen as a reminder to maintain accurate records and disclose income truthfully.

Also Read: Who Are the “Specified Persons” & Why It Matters for Charitable Trusts?

Conclusion

Section 133A of Income Tax Act is a cornerstone provision that empowers the income-tax department to conduct surveys & ensure compliance. The law states that an income-tax authority may enter any place of business or profession during working hours to check records, stock, and cash. In practice, this means revenue conducts survey u/s 133A whenever discrepancies are suspected.

For businesses, the key takeaway is clear: maintain proper books of accounts, disclose everything honestly, and you won’t need to worry about such visits.

👉 If your business ever faces a tax survey or compliance challenge, don’t panic. Get expert guidance from professionals at Callmyca.com and handle income tax issues with confidence.