Ever heard of “penalty for concealment of income” while filing taxes? That’s where Section 271(1)(c) of the Income Tax Act, 1961 comes in. This provision empowers the Income Tax Authorities to penalise individuals & businesses who either conceal their income or furnish inaccurate particulars in their return.

Let’s simplify what this section means, how it applies, & what every taxpayer must be aware of.

What is Section 271(1)(c)?

Section 271(1)(c) empowers the Assessing Officer (AO) or the Commissioner of Income Tax (Appeals) [CIT(A)] to levy a penalty if an assessee:

- Conceals income, or

- Furnishes inaccurate particulars of such income.

This is applicable when an assessee fails to disclose fully & truly all the income in their tax return & tries to reduce their tax liability fraudulently.

What Triggers Penalty Under Section 271(1)(c)?

There are two faults or omissions which expose the assessee to a concealment penalty:

- Failure to furnish returns: Not filing your return at all can invite penalty proceedings.

- Concealment or misreporting: Deliberately hiding income, or furnishing wrong claims or expenses, can lead to a penalty under this clause.

Even minor misreporting or discrepancies found during scrutiny or reassessment can be taken seriously by tax authorities.

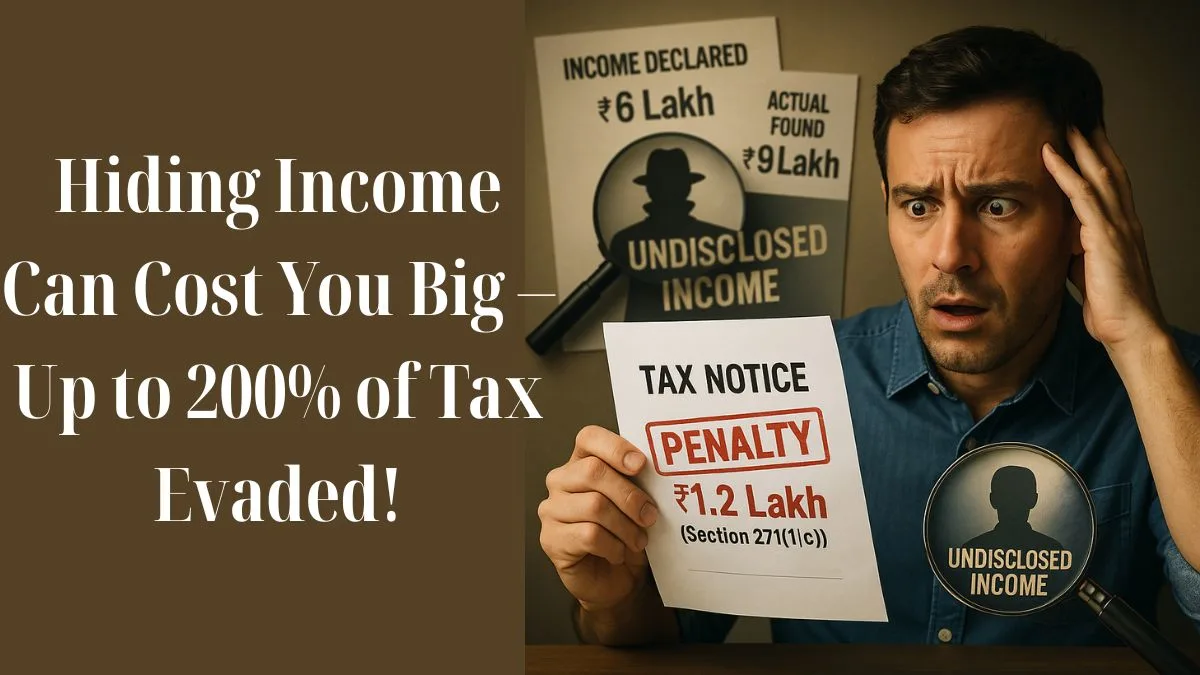

Penalty Amount Under Section 271(1)(c)

The penalty under this section is not automatic but is discretionary & depends on the case's facts. Here's how it works:

- The penalty can be a minimum of 100% & up to 300% of the amount of tax sought to be evaded.

- Example: If you under-reported income & evaded ₹1,00,000 in tax, the penalty could range from ₹1,00,000 to ₹3,00,000.

Penalty Proceedings Can Be Initiated When:

- A return has been filed, but inaccurate income is disclosed.

- Expenses are inflated, or ineligible deductions are claimed.

- Unexplained assets or cash are discovered during a search or a survey.

- Even in cases of revised returns, if the revision follows detection, a penalty may apply.

How Does the Income Tax Department Prove ‘Concealment’?

Good question.

It’s not enough for the AO to just say that income is concealed. There has to be a clear finding that the assessee deliberately:

- Suppressed income

- Made false claims

- Misrepresented facts

The burden of proof is on the department, unless the assessee’s behaviour or return clearly shows mischief.

Exceptions and Reliefs

There are some cases where the penalty may not be levied:

- If the assessee voluntarily revises the return before any scrutiny is initiated.

- If the assessee offers a valid explanation & proves there was no fraudulent intent.

- If the error is genuine, clerical, or due to reliance on professional advice, & not deliberate.

Famous Case Laws Around Section 271(1)(c)

Several judgments have provided relief to taxpayers in genuine cases. For instance:

- Price Waterhouse Coopers Pvt Ltd vs CIT: A clerical error in tax computation was held not to attract a penalty.

- Reliance Petroproducts case: Merely making a claim which was not accepted by the AO is not furnishing inaccurate particulars.

These cases emphasise that not all mistakes are penalised—intention matters.

Final Thoughts

If you’re unsure whether your income declarations are compliant or if you've received a notice under Section 271(1)(c), it's wise to consult a tax expert. Penalty proceedings can be tough, but they're also avoidable if you maintain transparency & accurate records.

👉 Confused about a notice under Section 271(1)(c) or want to file your return correctly? Get expert help at Callmyca.com—your one-stop solution for all tax matters. We deal with notices, penalties, & filings, so you don’t have to!