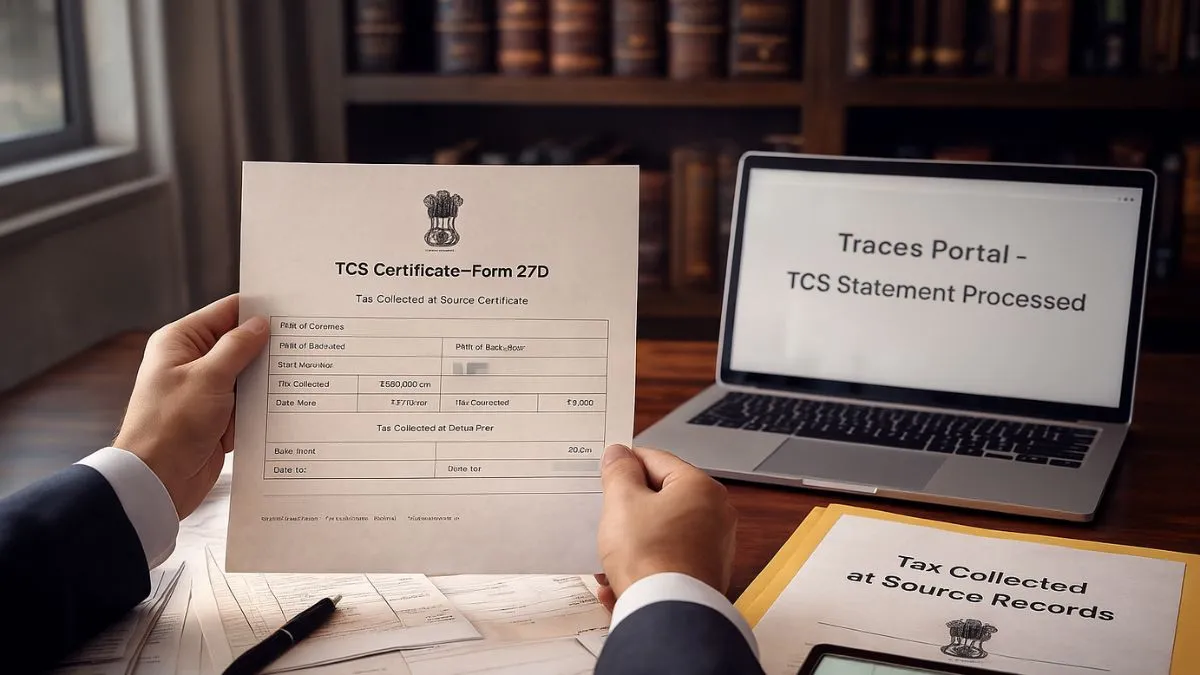

In the world of taxation, most people get familiar with TDS because it affects salaries, interest, rent & professional payments. But when it comes to TCS—Tax Collected at Source, many taxpayers pause for a moment. That is exactly why Form 27D becomes important. It is not just another document generated on the income tax portal; it is official proof that TCS has actually been collected and deposited with the government.

Form 27D is issued by the seller to the buyer, whenever tax is collected at source on certain transactions like scrap sale, tendu leaves, minerals, motor vehicles, and even foreign remittances in some cases. As per law, Form 27D is the certificate of collection of tax at source, and it is issued under the authority of Section 206C(5) of the Income Tax Act.

What creates confusion sometimes is the similarity between the section number (27D) & the form number (27D). In reality, Section 27D of the Income-tax Act, 1961, talks about penalties for not furnishing statements or certificates related to TCS, while Form 27D is the actual certificate issued to the buyer. The two are related, but very different. Most taxpayers look for Form 27D when they need official evidence of TCS, especially during audits, income-tax scrutiny, or while reconciling their annual information in AIS and Form 26AS.

Form 27D: Why This Certificate Matters

Think of Form 27D like the TCS equivalent of Form 16A (TDS certificate). Every time a seller collects tax at source, there must be a formal proof that the money was not only collected but also deposited with the government. That proof is Form 27D.

It contains essential information like:

- Name and TAN of the collector

- PAN details of the buyer

- Nature of goods or services on which TCS was collected"

- Amount collected

- Amount of TCS

- Date of collection & deposit

- Challan details

This is why Form 27D serves as proof that the required tax has been deducted or collected at source. Without this certificate, a buyer may find it difficult to claim the collected tax as a credit while filing their income tax return. For large companies, exporters, manufacturers, traders, and dealers, Form 27D plays a major compliance role during statutory audits.

Legal Backbone: Section 206C(5) and Section 27D

Form 27D is issued under Section 206C(5). This section clearly states that the person collecting tax at source must furnish a Certificate of collection of tax at source under sub-section (5) of Section 206C. That certificate is none other than Form 27D.

Then comes Section 27D of the Income-tax Act, 1961. This section deals with penalties for failing to furnish statements or certificates relating to TCS. If a seller delays or fails to issue Form 27D, the Income Tax Department can levy a penalty. The logic is simple — TCS affects the tax credit of the buyer. So, if Form 27D is not issued, it interrupts the buyer’s ability to claim this credit.

This is why every seller collecting TCS must issue Form 27D on time, & every buyer must ask for it.

Also Read: Penalty for Failure to File TDS/TCS Returns

How Form 27D Is Generated and Issued

Form 27D is not prepared manually. It is generated through the income tax or TRACES system after the seller files the TCS return in Form 27EQ. Only after the return is processed can Form 27D be downloaded.

The steps are straightforward:

- Seller files quarterly TCS return (Form 27EQ)

- TRACES processes the return

- Form 27D becomes available for download

- Seller verifies and digitally signs it

- Seller issues the certificate to the buyer

Once downloaded, the seller can issue the certificate either digitally or in physical form. Most companies prefer a digitally signed PDF because it is secure & easily traceable.

Key Information Contained in Form 27D

The certificate includes all relevant details that confirm TCS activity:

- Collector’s TAN

- Buyer’s PAN

- Total amount collected

- Total TCS deposited

- Challan identification"

- Section under which tax was collected

- Assessment year

- Verification details

Because it is government-issued & digitally verifiable, it becomes a trusted document during assessments, reconciliations, and audits.

Penalties for Non-Issue: What Section 27D Means in Practice

Many businesses underestimate the importance of issuing Form 27D on time. But the law doesn’t. Under Section 27D, penalties can apply when:

- The TCS certificate is not issued

- The certificate contains incorrect details

- The certificate is delayed without reasonable cause

The law ensures compliance & transparency in all TCS-related transactions. Delayed certificates affect the buyer’s ability to claim tax credit, which is why the penalty is taken seriously.

Also Read: Guide to TCS on Sale of Goods

Common Scenarios Where Form 27D Is Needed

Here are cases where Form 27D becomes essential:

- Buyer claims TCS credit in income tax return

- Auditor requests TCS documentation

- Income Tax Department sends a mismatch notice (AIS vs. 26AS)

- Bank or financial institution asks for tax proof during loan processing

- Reconciliation of vendor accounts

- Compliance checks during scrutiny assessments

For many businesses, not having this certificate can create practical problems, especially in high-value transactions where TCS is mandatory.

Form 27D vs Form 27EQ — Clearing the Confusion

A lot of taxpayers confuse these two:

|

Form 27EQ |

Form 27D |

|

Quarterly TCS return filed by seller |

Certificate issued to buyer |

|

Filed online |

Downloaded & shared |

|

Legal obligation to file |

Legal obligation to furnish |

|

Without Form 27EQ → Form 27D cannot be generated |

Without Form 27D → buyer cannot claim TCS credit |

Both are essential, but they serve very different purposes.

Why Form 27D Is Crucial for Buyers

Buyers often ignore TCS because they assume it is a seller-side obligation. But it directly impacts buyers:

- TCS appears in Form 26AS and AIS

- Buyers can claim it as a tax credit

- Non-receipt of Form 27D affects annual tax computation"

- Errors in Form 27D cause reconciliation issues

Ultimately, it improves transparency & protects the buyer during assessments.

Also Read: Mandatory PAN Requirement and TCS at Higher Rates

Final Thoughts: Why You Should Not Ignore Form 27D

Form 27D may look like a small certificate, but it has a significant compliance impact. It is official proof of tax collection, ensures that both parties stay compliant, and reduces the risk of mismatches during assessment. Whether you are a seller who collects TCS or a buyer who pays it, Form 27D acts as your protection in the tax system.

If your business regularly deals with TCS-covered transactions, maintaining Form 27D records is not optional — it’s smart tax practice.

Let our expert CAs handle it smoothly for you. Visit Callmyca.com to get professional support that protects you from notices, penalties, & compliance errors.