Businesses collect TCS on specific transactions — like sale of alcohol, scrap, minerals, or even overseas remittances & luxury car sales. The government wants visibility of who collected the tax and whether it reached the exchequer.

That is exactly where Form 27EQ comes in.

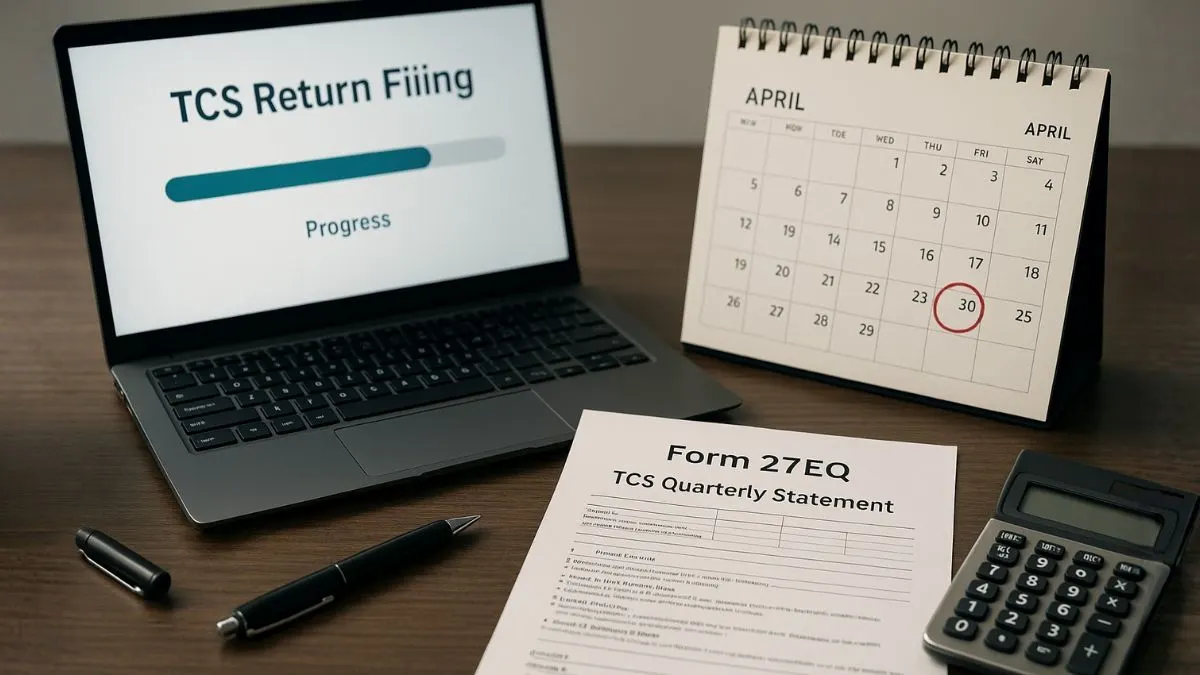

Form 27EQ is a quarterly statement that must be filed by all entities — corporate or government collectors — who are required to collect TCS under Section 206C of the Income Tax Act, 1961.

It reports:

- How much TCS was collected

- From whom it was collected (buyer details)

- The nature of the transaction & the section code

- Challan details showing the deposit of TCS

In simple terms:

“Collect TCS → Deposit it → Report it in Form 27EQ.”

The Income Tax Department treats Form 27EQ as a primary compliance document to track revenue leakage & ensure complete TCS traceability.

Legal Backbone

Form 27EQ filing is directly linked with:

- Section 206C – the provision that mandates TCS collection on specified transactions.

- Form 27EQ is a return form that contains details pertaining to the tax collected at source."

- All entities that are liable to collect Tax Collected at Source must file Form 27EQ.

If you are collecting tax, you must file — even if:

- No TCS was collected in that quarter (file a NIL return)

- The buyer later claims refund or credit

The obligation arises from the moment you become a collector under Section 206C.

Also Read: Penalty for Failure to File TDS/TCS Returns

Who Must File Form 27EQ?

You are required to file Form 27EQ if you:

✅ Collect TCS on specified goods or services

✅ Fall under any of these entity types:

|

Entity Type |

Filing Requirement |

|

Private/Public Limited Company |

Mandatory |

|

Partnership firm / LLP |

Mandatory |

|

Government department |

Mandatory |

|

Local authority / Municipality |

Mandatory |

|

Trust / NGO collecting TCS |

Mandatory |

The form applies even if you collect TCS from only one transaction.

Due Dates for Filing Form 27EQ

|

Quarter (Financial Year) |

Period Covered |

Due date for filing |

|

Q1 |

April – June |

15th July |

|

Q2 |

July – Sept |

15th October |

|

Q3 |

Oct – Dec |

15th January |

|

Q4 |

Jan – March |

15th May |

Filing the return late attracts penalty and interest. The Income Tax Department takes TCS reporting as seriously as TDS reporting.

What Information Gets Reported in Form 27EQ?

Your Form 27EQ quarterly return includes:

- Collector’s TAN and PAN

- Buyer’s PAN & details

- Section code under 206C"

- TCS amount collected

- Deposited challan details

- Date on which tax was deposited

Each line item in the form must match the challan data, or the return will be rejected.

TCS vs TDS — Don’t Confuse Them

|

Parameter |

TDS |

TCS |

|

Who deducts |

Payer |

Seller / Collector |

|

On what |

Payments |

Sales |

|

Form used |

24Q, 26Q |

Form 27EQ |

|

Returns filed by |

Deductor |

Collector |

Many businesses mistakenly tag TCS transactions as TDS. That error will block your credit claim & invite scrutiny.

Also Read: Guide to TCS on Sale of Goods

How to File Form 27EQ — Step-by-Step (TRACES Portal)

Step 1: Log in to TRACES using TAN

Step 2: Navigate → TCS → Upload TCS return

Step 3: Prepare the return file using RPU (Return Preparation Utility)

Step 4: Validate with FVU

Step 5: Upload on TRACES or NSDL

Step 6: Download acknowledgement

After validation, TCS credits appear in Form 26AS & AIS of the buyer.

The Importance of PAN in Form 27EQ

When you file Form 27EQ:

- PAN of buyer is mandatory

- If PAN is incorrect → buyer will NOT get TCS credit

- It affects their ability to claim refund or adjustment

Pro Tip: Always collect PAN at the transaction stage, not later.

Penalties for Non-Compliance

|

Failure |

Penalty/Interest |

|

Late filing |

₹200/day (u/s 234E) until filed, capped at TCS amount |

|

Incorrect filing |

Penalty from ₹10,000 to ₹1,00,000 (u/s 271H) |

|

Failure to collect or deposit TCS |

Interest @ 1% / 1.5% per month |

Non-filing affects your buyers too — their income tax credit will not reflect.

Real Case Scenario

A car dealership collects TCS on sale of a ₹60 lakh SUV.

TCS collected = ₹1,20,000 (at 0.2%)

If the dealership fails to file Form 27EQ:

❌ Buyer won’t get TCS credit

❌ Interest penalty applies

❌ Scrutiny notice may follow for mismatch

This is where many businesses unknowingly invite legal hassles.

Also Read: Mandatory PAN Requirement and TCS at Higher Rates

Benefits of Timely Filing

- Smooth credit reflection in Form 26AS

- Zero penalty or late fee

- Avoids compliance notices

- Strengthens audit trail

Most importantly — buyers trust you more when their TCS reflects correctly.

Documents Required to File Form 27EQ

- TAN PAN of entity

- PAN of buyers

- Challan counterfoil

- Details of TCS collected

- Nature of transaction (with section code)

- Digital signature (if applicable)

Final Thoughts

Form 27EQ is not just a quarterly compliance — it is a financial responsibility.

If TCS is collected, the return must be filed, even if it is a NIL amount.

Timely filing saves you:

- Time

- Penalties

- Legal complications

At CallMyCA.com, we handle TDS/TCS compliances end-to-end — including filing Form 27EQ — with zero errors. Click to explore. Just send your challan & buyer details — and we will take care of the filing.