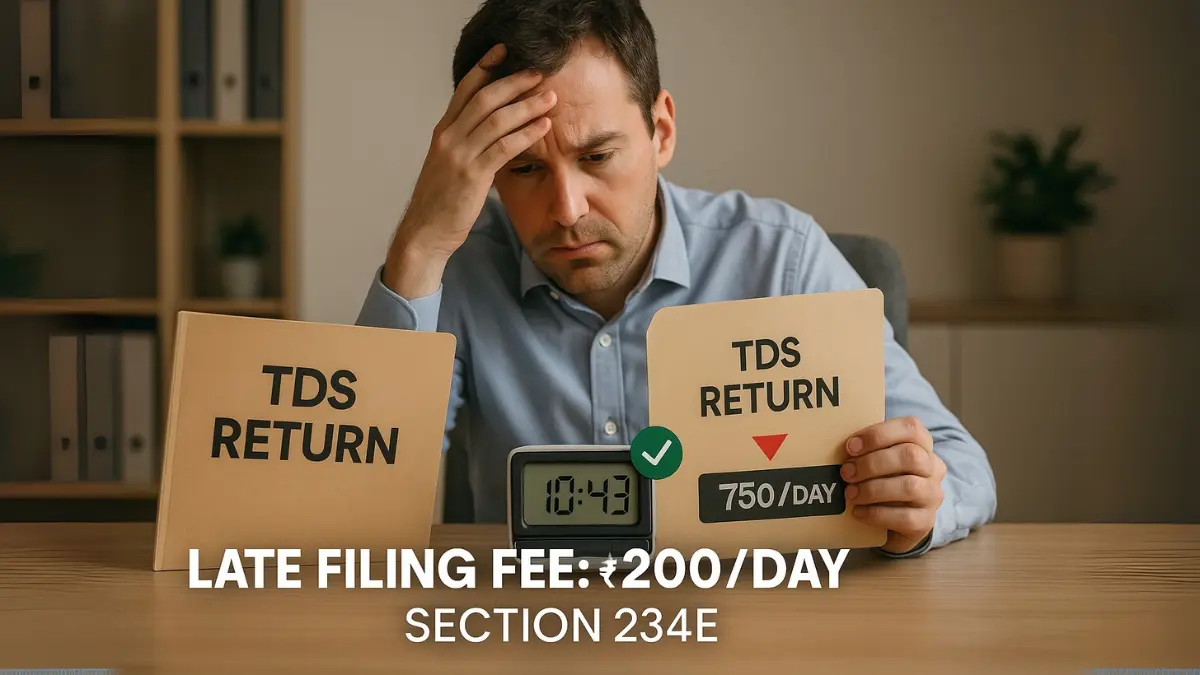

Imagine you're diligently running your business, paying salaries on time, & even deducting TDS (Tax Deducted at Source). But amidst all this, you miss the deadline to file your TDS return. What seems like a minor delay could cost you every single day—literally.

That’s the power of Section 234E of the Income Tax Act, a provision that imposes a late fee for default in furnishing TDS statements. If you've ever delayed filing TDS returns, this section is not just relevant—it's crucial.

What is Section 234E?

Section 234E penalises deductors who fail to file their TDS returns or statements of tax deduction on time. Under this section, the Income Tax Department levies a fee of ₹200 per day for each day the default continues, until the date of actual filing.

This penalty isn’t linked to the tax amount—whether the delay is for a TDS of ₹1,000 or ₹10 lakh, the daily fee remains the same. The only relief? The total late fee cannot exceed the TDS amount in default.

Applicability of Section 234E

This section applies to every person responsible for deducting or collecting tax who fails to:

- Furnish a TDS statement under Section 200(3)

- File TCS returns under Section 206C

Within the prescribed timelines.

Whether you're a company, LLP, firm, or individual deductor, if you don’t file these on time, Section 234E kicks in automatically."

Even the fee under Section 234E can’t be waived. It’s mandatory & has to be paid before you can submit your delayed return.

Late Filing Fee Structure under Section 234E

Here’s how the math works:

- ₹200 per day of delay

- Maximum limit = Total TDS amount

- No exemptions or waivers

- Applicable from the due date till the actual filing

For example, if your due date was July 31st and you file on August 10th, that’s 10 days of delay. The fee would be:

₹200 × 10 = ₹2,000

If your total TDS was ₹1,800, the fee will be capped at ₹1,800.

This late filing fee is in addition to any interest or penalty under other sections of the Income Tax Act.

Legal Backing and Notices

The levy under Section 234E is not a discretionary penalty; it is an automatic fee. That means no prior hearing or show cause notice is needed before the demand is raised.

The CPC-TDS portal automatically calculates & adds this fee when you attempt to file a delayed return. You can view this while downloading the Justification Report or the Default Summary.

Section 234E & Rule 31A(4A)

This rule states the time limits for filing TDS returns:

- Quarter 1 (April–June) – 31st July

- Quarter 2 (July–Sept) – 31st October

- Quarter 3 (Oct–Dec) – 31st January

- Quarter 4 (Jan–March) – 31st May

Failing to meet these leads directly to a penalty under Section 234E. The rule & the section are interlinked, making timely filing not just good practice, but an obligation."

How to Pay the Fee under Section 234E

You cannot file a belated return unless the fee is first paid. Here’s what you should do:

- Generate the Challan No./ITNS 281.

- Choose the option: Fee under Section 234E.

- Pay the amount online via net banking or a bank counter.

- Only after this, upload your return through the TRACES or e-filing portal.

The good news? You can avoid this completely by setting calendar reminders & delegating the responsibility of TDS compliance.

Common Questions Around Section 234E

- Can the fee under Section 234E be waived?

No. It is mandatory. Unlike interest or penalty, there is no provision for waiver or reduction of the fee. - Can I appeal against the Section 234E fee?

Not directly. Since it's a fee & not a penalty, no appeal lies unless it was wrongly computed. - Is there any relief during COVID-19?

Earlier notifications had extended due dates during lockdown, but those have expired. As of now, regular timelines apply.

Final Word

Section 234E may seem like a small technical clause, but the penalty it imposes can snowball fast. And with no scope for waiver, the only escape is timely compliance.

Need help with TDS return filing, or received a notice for the 234E fee?

👉 Visit Callmyca.com – we’ll take the compliance headache off your plate & make sure you're always on the right side of tax law.