If you’ve ever filed a TDS return or received an intimation under Section 200A of the Income Tax Act, you might have wondered what this provision means. Let’s break down Section 200A of the Income Tax Act in simple words, using real-life examples to help you understand how it impacts businesses, employers, & taxpayers alike.

What is Section 200A of the Income Tax Act?

Section 200A of the Income Tax Act is a provision that governs the processing of statements of tax deducted at source (TDS). It enables the income tax department to process the TDS returns filed by deductors & determine whether there is any tax payable, refundable, or an error in the filed statements.

Earlier, TDS returns were processed manually. But with the insertion of Section 200A, the process became automated, ensuring faster processing, quicker detection of errors, & speedier intimation under Section 200A to taxpayers.

Key Highlights of Section 200A of the Income Tax Act

- The section allows for the processing of TDS statements electronically.

- It ensures timely issuance of intimation under Section 200A which either raises a demand or processes refunds to the tax deductor.

- It helps in identifying mismatches, defaults, or inaccuracies in the TDS return.

- Any demand raised or refund processed is communicated through an electronic intimation under section 200A.

How Does Section 200A Work?

Imagine you’re an employer or business that deducts TDS from payments made to employees, vendors, or contractors. You are required to file periodic TDS returns. After submission, the Income Tax Department processes these returns under Section 200A.

Here's what happens next:

- The system checks for:

- Correctness of PAN & TAN.

- Accuracy of TDS amounts deposited.

- Matching of TDS returns with challans.

- If everything is correct:

- You’ll receive a no demand, no refund intimation.

- If discrepancies are found:

- An intimation under section 200A will be issued, highlighting the mismatch, short deduction, or excess payment."

- If there’s an excess tax paid:

- A refund is processed.

Expanded Scope of Section 200A

The original Section 200A focused solely on processing TDS statements. However, it has now been expanded to include processing schemes for statements filed by non-deductors in some cases. This means even those who were previously not required to deduct TDS but file certain information statements may come under its purview.

Why is Section 200A Important?

- Timely Correction: It helps tax deductors identify & rectify errors before they lead to penalties or prosecution.

- Transparent Communication: The intimation under Section 200A ensures deductors are kept in the loop about the status of their filings.

- Automated System: The entire processing of statements of tax deducted at source is automated, reducing manual errors & increasing efficiency.

- Legal Compliance: Non-compliance or mismatches can invite notices under Section 200A & delay refunds.

Common Reasons for Intimation under Section 200A

- Wrong PAN/TAN details.

- Short deduction or non-deduction of TDS.

- Late payment of TDS.

- Incorrect challan details."

- Filing errors.

Steps to Handle Intimation under Section 200A

- Download the intimation under section 200A from the TRACES portal.

- Carefully review the mismatches or errors mentioned.

- If you agree, make the necessary payments or corrections.

- If you disagree, file a correction statement online with valid justification.

- Respond within the stipulated time to avoid legal consequences."

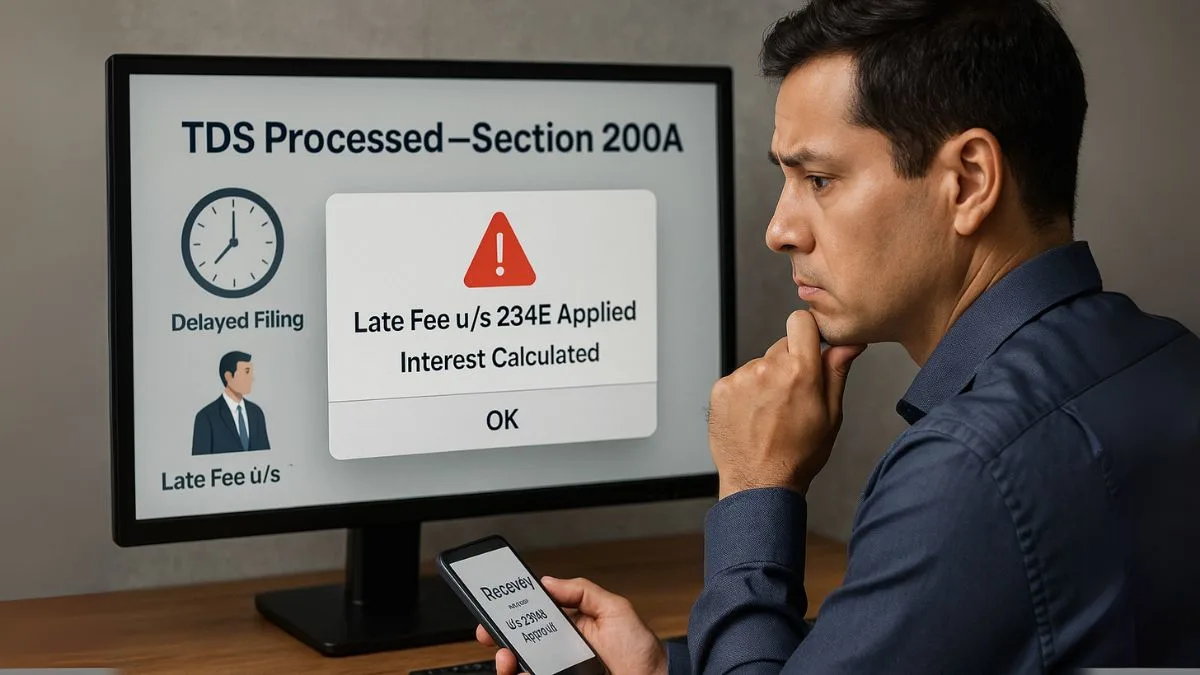

Penalty and Interest Provisions

If a demand is raised under Section 200A of the Income Tax Act, the following may apply:

- Interest under Section 201(1A) for late deposit of TDS.

- Late fees under Section 234E for delay in filing TDS returns.

- Other applicable penalties under Income Tax Law.

Real-Life Example

Let’s say XYZ Pvt Ltd deducted TDS of ₹50,000 but mistakenly reported it as ₹40,000 in the return. When processed under Section 200A, an intimation is sent to the company asking for payment of the shortfall. If not rectified, penalties & interest could apply.

Applicability of Section 200A/206CB

- All entities filing TDS/TCS returns come under Section 200A.

- For cases involving 206CB (related to TCS processing), similar processing rules apply."

Conclusion

Staying compliant with Section 200A of the Income Tax Act is crucial for businesses & deductors. The timely filing of accurate TDS returns & quick action on intimations under section 200A can save you from unnecessary legal troubles, penalties, & interest. Always double-check your filings to avoid mistakes.

👉 Need help managing your TDS compliance or handling Section 200A notices? Our experts at Callmyca.com can help you file, rectify, & stay stress-free. Visit us today for hassle-free tax solutions!