When it comes to property transactions in India, Section 43CA of the Income Tax Act plays a significant role in determining how profits from the transfer of certain assets are taxed. This section introduces a special provision for the full value of consideration for the transfer of assets & applies specifically to immovable property held as stock-in-trade. If you're dealing in real estate or planning to transfer property, knowing Section 43CA of the Income Tax Act can help you avoid unnecessary tax surprises.

Let’s break it down into simple, understandable language.

What is Section 43CA of the Income Tax Act?

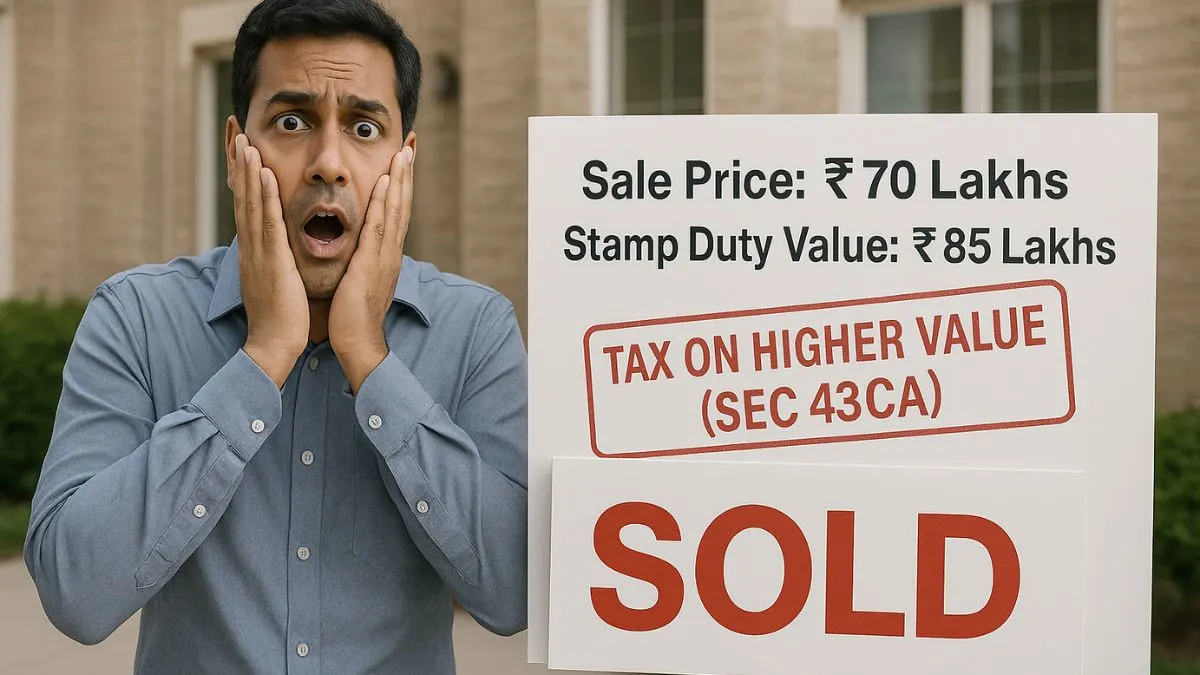

In general, when a person sells an asset, the sale consideration—the price at which the asset is sold—is used to compute the profits. However, Section 43CA comes into play when the asset involved is immovable property, such as land or building, held as stock-in-trade.

According to this special provision for full value of consideration for the transfer of assets, if the actual sale consideration is less than the value determined by the Stamp Valuation Authority (SVA), then the SVA value will be considered as the full value of consideration for tax purposes.

In simple words:

If you sell a property for ₹70 lakhs but the stamp duty valuation is ₹80 lakhs, the Income Tax Department will calculate your income as if you sold it for ₹80 lakhs."

Why Does Section 43CA Matter?

This section primarily deals with the taxation of certain transactions related to immovable property. It aims to curb the practice of under-reporting the sale price of properties to evade taxes.

The value set by the Stamp Valuation Authority (SVA) is considered the fair market value for taxation, & not the actual sale price, in cases where there's a discrepancy between the two.

Key Features of Section 43CA

Here are some of the special provisions that Section 43CA of the Income Tax Act introduces:

- Applicable to Business Assets:

It applies only to properties held as stock-in-trade & not to capital assets. For example, if a real estate builder sells flats, this section applies. - Stamp Valuation Authority Rule:

The consideration value for tax purposes is not what the buyer & seller agree on, but what the SVA determines. - Safe Harbour Limit:

To provide some relief, a tolerance band (safe harbour) is allowed. If the difference between the SVA value & the actual consideration is within a certain percentage (usually 10% or 20% as per recent amendments), the actual consideration can be accepted for taxation."

Example of Section 43CA in Action

Let’s say:

- Agreed property sale price: ₹50 lakhs

- Stamp Valuation: ₹55 lakhs

If the safe harbour threshold is 10%, the actual sale price (₹50 lakhs) is within the permissible limit, & no adjustment is needed.

But if the SVA value exceeds this limit, say it's ₹60 lakhs, then ₹60 lakhs becomes your taxable sale value.

This is why Section 43CA of the Income Tax Act, for example, is often searched—because real-world scenarios help taxpayers understand the law better.

Amendments and Case Laws

Over time, Section 43CA has seen several amendments to ensure fair taxation while avoiding undue hardship to taxpayers. For instance, recent changes have increased the safe harbour limit for certain periods & transactions.

There have also been notable case laws on Section 43CA of the Income Tax Act 1961, which have provided clarity on grey areas. These judgments have helped shape how Section 43CA is interpreted, particularly in disputes where fair market value is contested.

Difference Between Section 43CA and Section 50C

A common confusion arises between Section 43CA and Section 50C. While both use SVA value for tax computation, they apply to different situations:

- Section 50C applies when an individual sells a capital asset like land/building not held for business.

- Section 43CA applies when the property is part of business stock-in-trade (such as for real estate developers).

Knowing this difference between Section 43CA & 50C of the Income Tax Act is crucial to applying the right provision.

Practical Implications of Section 43CA

- It prevents the undervaluation of property transactions.

- It ensures uniformity by relying on SVA valuation.

- It can sometimes lead to higher tax liabilities even when the actual transaction is genuine.

This is why many real estate businesses & property sellers should consult tax professionals before finalising sale agreements.

Need help understanding how Section 43CA of the Income Tax Act affects your property transactions or business? Get expert tax filing & consultation services at Callmyca.com—because smart tax planning starts with the right advice!