Planning for retirement and saving on taxes? Section 80CCD of the Income Tax Act might just be your golden ticket! Whether you're salaried or self-employed, this section opens the doors to tax deductions under the National Pension Scheme (NPS).

What is Section 80CCD?

Section 80CCD provides tax benefits on contributions made to the pension scheme notified by the Central Government, i.e., the National Pension System (NPS). It encourages individuals to save for retirement while enjoying immediate tax savings.

This section has three sub-clauses:

- 80CCD(1): For employee/self-employed contributions.

- 80CCD(1B): An additional deduction introduced over and above 80C.

- 80CCD(2): Employer’s contribution. "

Types of Deductions Allowed Under Section 80CCD

🔹 1. Section 80CCD(1): Contribution by the individual

- Available to both salaried and self-employed individuals.

- For salaried: Deduction is allowed up to 10% of salary (Basic DA).

- For self-employed: Deduction is allowed up to 20% of the gross total income.

- However, the total deduction under 80C 80CCC 80CCD(1) is capped at ₹1.5 lakh.

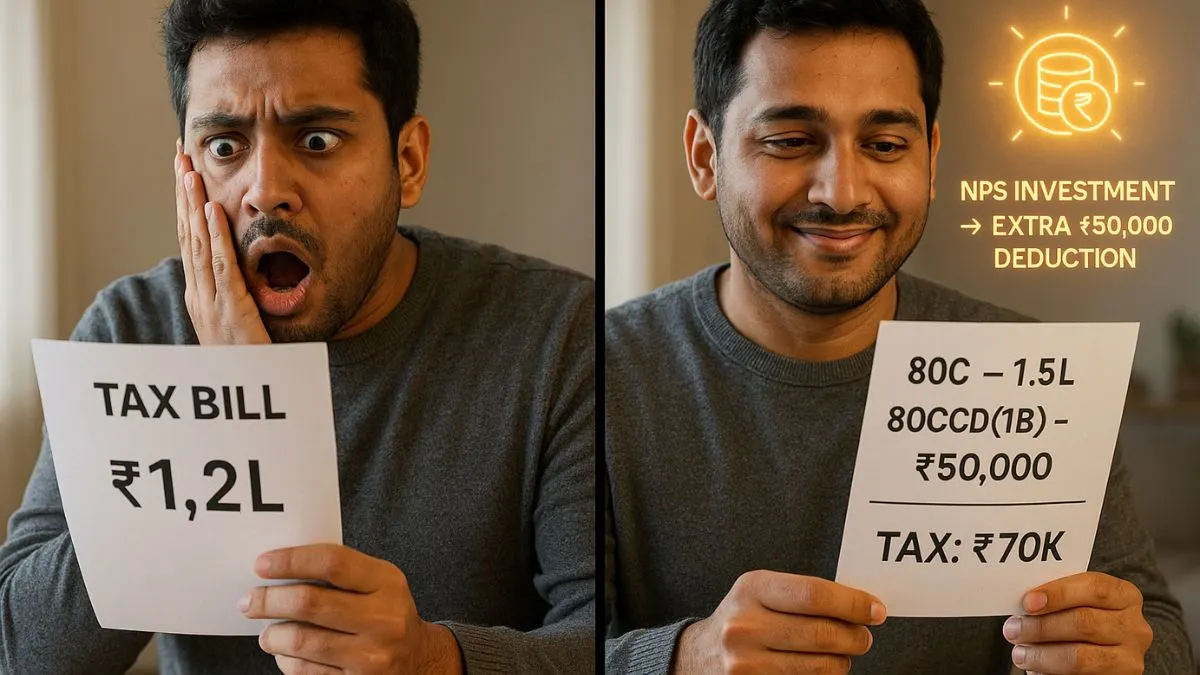

🔹 2. Section 80CCD(1B): Additional Deduction

- Introduced in Budget 2015.

- Offers an additional tax deduction of up to ₹50,000 exclusively for NPS investments.

- This is over and above the ₹1.5 lakh limit under section 80C.

- This makes the total possible deduction ₹2 lakh if you invest accordingly. "

🔹 3. Section 80CCD(2): Employer’s Contribution

- Only applicable for salaried employees.

- If your employer contributes to your NPS account, you can claim 10% of your salary (basic DA) as a deduction.

- This benefit is over and above the limits under 80C and 80CCD(1B).

Who Can Claim a Deduction Under Section 80CCD?

- Salaried individuals working in the private or public sector.

- Self-employed individuals.

- Central Government employees mandatorily enrolled under NPS post-2004.

Key Benefits You Shouldn’t Miss

- ✅ Gives a tax deduction on NPS contributions up to 10% of salary (salaried).

- ✅ Tax deduction up to 20% of gross income under Section 80CCD (self-employed).

- ✅ Deduction in respect of contribution to the pension scheme of the Central Government.

- ✅ Allows tax deduction benefits to salaried and self-employed individuals.

- ✅ Additional deduction of ₹50,000 under 80CCD(1B) – perfect for maxing out your tax-saving limit.

Tax Implications on Maturity

While the contributions and earnings during the accumulation phase are tax-free, the maturity amount is partially exempt. On retirement:

- 60% of the corpus can be withdrawn tax-free.

- The remaining 40% must be used to purchase an annuity, which is taxable as per the applicable slab in the year of receipt.

Quick FAQs

Q: Can I claim both 80C and 80CCD(1B)?

Yes! 80C covers your EPF, LIC, tuition fees, etc., while 80CCD(1B) gives you additional savings for NPS.

Q: Can a government employee claim benefits under 80CCD(2)?

Absolutely, as long as the employer contributes to the NPS account.

Q: What is the maximum deduction I can get under Section 80CCD?

Up to ₹2 lakh (₹1.5 lakh under 80CCD(1) ₹50,000 under 80CCD(1B)), and even more if your employer contributes under 80CCD(2).

💡 Want to save more taxes with NPS & claim every possible deduction without errors? [Explore expert filing services on Callmyca.com and get your tax game sorted like a pro!]