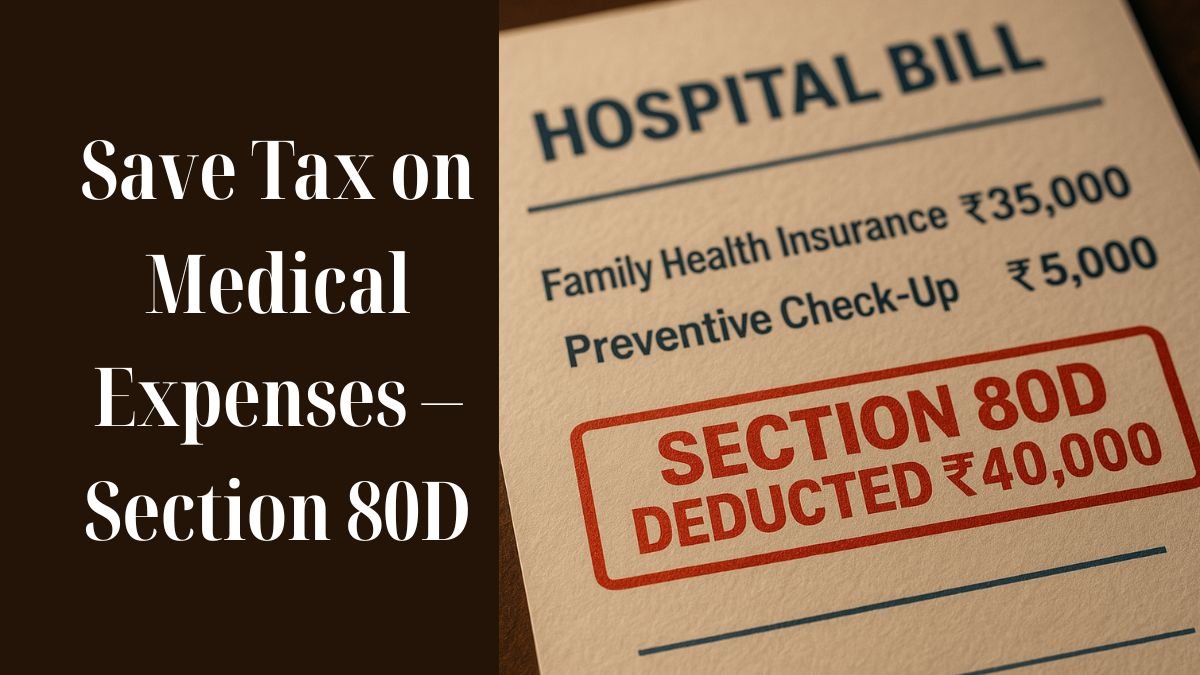

Health is wealth—but did you know it can also help you save tax? Under India's Income Tax Act, Section 80D provides taxpayers the benefit of reducing their tax burden by claiming deductions on health insurance premiums and preventive health check-ups.

This provision encourages individuals and families to invest in their health while receiving financial incentives from the government. Let’s explore everything you need to know about Section 80D of the Income Tax Act, including limits, eligibility, and how to claim the deduction.

What Is Section 80D of the Income Tax Act?

Section 80D allows taxpayers to claim tax deductions of up to ₹25,000 every financial year on health insurance premiums paid for self, their spouse, and their dependent children. If you’re also paying the premium for your senior citizen parents, the deduction limit increases even more.

This section applies to both salaried and self-employed individuals, as well as Hindu Undivided Families (HUFs).

Deduction Limits Under Section 80D

Here’s a quick breakdown of the deduction under Section 80D of the Income Tax Act:

|

Insured Persons |

Deduction Limit |

|

Self Family (below 60 years) |

Up to ₹25,000 |

|

Parents (below 60 years) |

Additional ₹25,000 |

|

Parents (above 60 years) |

Additional ₹50,000 |

|

Self/Spouse Parents (all above 60 yrs) |

Up to ₹100,000 total |

|

Preventive Health Check-up (within the above limits) |

Up to ₹5,000 |

So if you and your parents are above 60, your combined deduction could be as high as ₹100,000 per year.

Preventive Health Check-up Deduction

Many people forget this hidden benefit.

Under Section 80D, individuals can claim a deduction of up to ₹5,000 for payments made towards preventive health check-ups. This applies even if you haven’t purchased a full insurance plan but paid for a medical test or annual health screening.

This ₹5,000 is included in the overall limit, not in addition to it.

So if your total insurance premium is ₹23,000 and you spent ₹2,000 on a check-up, you can claim ₹25,000.

Who Can Claim Section 80D?

To be eligible to claim this Section 80D deduction, the payment must be made:

- For health insurance or a check-up of:

- Self

- Spouse

- Dependent children

- Parents (whether dependent or not)

- By any mode except cash (except for preventive health check-ups, which can be in cash)

These deductions are available under both the old and new tax regimes, but only if you opt for the old regime.

Section 80D of the Income Tax Act for Senior Citizens

Special attention is given to senior citizens (aged 60 ). If you’re insuring your parents or yourself and fall under this category, the deduction limit increases to ₹50,000.

If no health insurance is available due to age or health conditions, expenses incurred towards medical treatment for senior citizens can be claimed under this same section, up to ₹50,000 per year.

Documents Required

While filing ITR or during assessment, you may need the following:

- Premium payment receipt

- Policy document showing insured persons

- Age proof (for claiming senior citizen benefits)

- Bank statement if a digital payment was made

You don't need to attach these documents with your return, but keep them ready in case of a tax notice or verification. "

Common Searches Around Section 80D

You’re not alone in trying to understand this provision better. Popular online queries include:

- Section 80D of the Income Tax Act PDF – Downloadable documents for reference

- Section 80D medical expenditure – Clarifies treatment-based deductions

- Section 80D deduction for senior citizens – Highlights extended limits

- Section 80D of the Income Tax Act limits – Outlines the maximum claimable amount

- Section 80D of the Income Tax Act in Hindi – Regional language explanation

- Section 80D preventive health checkup – Talks about the ₹5,000 limit

- Section 80D of the Income Tax Act 1961 – Original legislative reference

- Section 80D of the Income Tax Act Bare Act – Legal text for deeper study

These searches reflect how widely Section 80D is used and how many people are keen to maximise their tax savings legally.

How to Claim Section 80D Deduction

While filing your Income Tax Return:

- Choose the “80D” option under Chapter VI-A deductions

- Enter the premium paid amount

- Split between self/family and parents, if applicable

- Enter preventive health check-up expenses (within ₹5,000 limit)

- Submit ITR and retain receipts for future reference

Online ITR tools or tax filing platforms usually guide you through this step-by-step. "

Final Thoughts

To summarise:

- Section 80D allows a tax deduction of up to ₹25,000 per financial year for health insurance premiums.

- Under Section 80D, individuals can also claim ₹5,000 for preventive health check-ups.

- Additional benefits are available for senior citizens, up to ₹50,000.

- Applies to insurance payments for self, spouse, dependent children, and parents.

- Cash payments are not allowed (except for check-ups).

Don’t miss out on this legal and generous tax-saving opportunity.

👉 Need expert help filing your ITR or claiming maximum benefits under Section 80D?

Visit www.callmyca.com and let our tax experts take care of your savings.