Democracy thrives on participation, and money is one of the most powerful tools of political engagement. While every citizen can make a political donation, the role of billionaire political donations by party has grown significantly in recent decades.

Across the globe, billionaires fund parties, candidates, and campaigns to advance their ideologies, business interests, or philanthropic causes. Some argue this helps strengthen democracy by providing resources for elections. Others worry it gives a handful of wealthy individuals outsized influence over public policy.

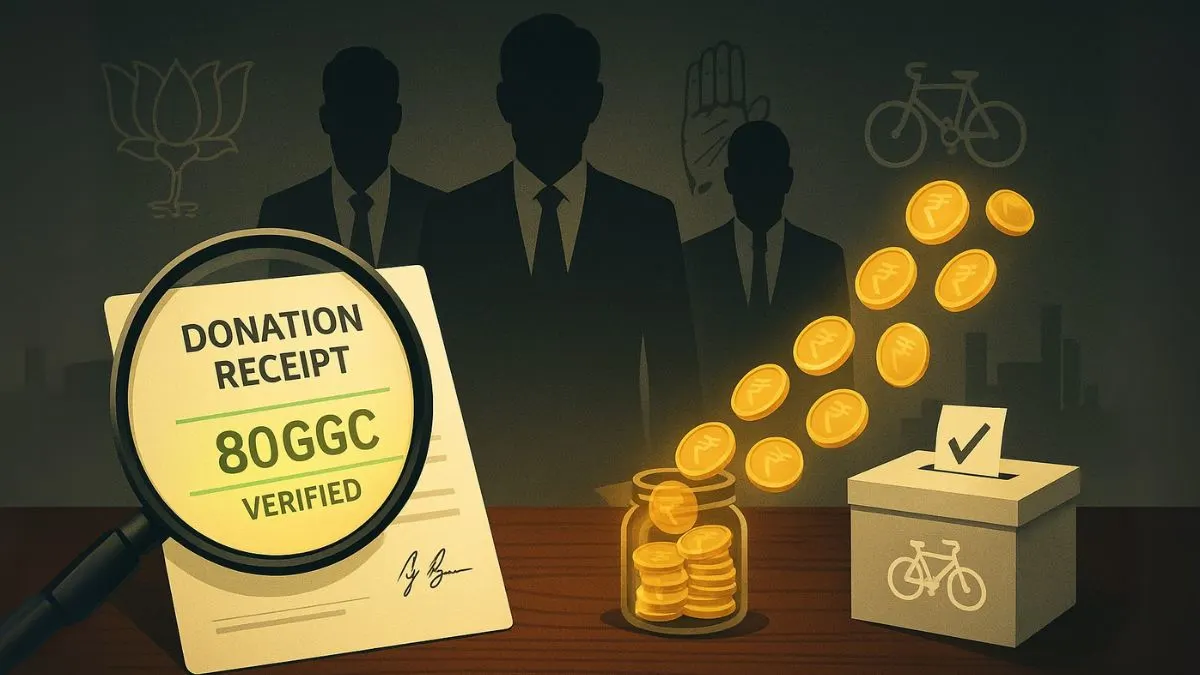

In India too, political donations from corporates, high-net-worth individuals, and billionaires make up a large share of campaign funding. This article explores how billionaire political donations shape the democratic process, why transparency matters, and what the law says about such contributions.

What are Billionaire Political Donations?

A billionaire political donation refers to financial contributions made by ultra-wealthy individuals to political parties or candidates. These may include:

- Direct donations to parties.

- Contributions through electoral bonds in India.

- Sponsorship of campaign activities or rallies.

- Funding think tanks, advocacy groups, or political action committees (PACs) abroad."

The growing size of billionaire political donations raises critical questions about balance in democracy.

Why Do Billionaires Donate to Political Parties?

- Democratic Participation: To actively support the democratic process.

- Policy Influence: To promote policies favorable to their industries.

- Philanthropic Vision: To back reforms in education, healthcare, or environment.

- Ideological Belief: To support a party’s philosophy or governance model.

- Relationship Building: To maintain strong ties with policymakers.

Thus, billionaire political donations by party are not always about profit—they can also reflect personal convictions & civic engagement.

Also Read: Political Party Donations: The Hidden List That Shapes Tax Breaks & Power

Billionaire Political Donations in India

In India, political donations by billionaires are governed by strict rules under the Income Tax Act, 1961 and the Representation of People Act, 1951.

Key points:

- Donations above ₹2,000 cannot be made in cash.

- Donations can be made through cheques, bank transfers, or electoral bonds.

- Political parties must disclose contributions above ₹20,000 to the Election Commission of India (ECI).

- Billionaires and corporates enjoy tax benefits on donations under Section 80GGC (for individuals) & 80GGB (for companies).

Despite these rules, the opacity of electoral bonds has sparked debates about transparency in billionaire political funding.

Global Perspective on Billionaire Donations

- United States: Billionaires contribute heavily through Super PACs. Figures like Elon Musk, Jeff Bezos, and George Soros have shaped debates.

- United Kingdom: Donations above a threshold must be publicly declared, making billionaire donations visible to voters.

- India: Electoral bonds have modernized donations but also reduced public disclosure of billionaire donors.

Across democracies, billionaire political donations by party remain controversial but central to modern campaigns.

Impact of Billionaire Political Donations

- Boosts Campaign Resources: Enables parties to run nationwide campaigns, rallies, and digital outreach.

- Shapes Policy Agendas: Donations may indirectly influence laws, regulations, and budgets.

- Strengthens Dominant Parties: Big donations often flow toward ruling parties, creating imbalance.

- Raises Transparency Concerns: Citizens may not always know which billionaire funds which party.

- Promotes Ideological Causes: Wealthy donors can champion reforms in climate action, social welfare, or economic policies.

Also Read: Received a Notice for Political Donations? Here's What You Must Know

Transparency and Accountability

For democracy to be fair, billionaire donations must come with disclosure & accountability.

- The political party donation list published by ECI plays a crucial role.

- Mandatory auditing of party accounts ensures compliance.

- Public awareness campaigns demand better transparency of billionaire contributions.

Without transparency, billionaire donations risk creating policy capture, where laws benefit a few at the expense of many.

Example of Billionaire Political Donations by Party

Imagine two billionaires:

- Mr. A donates ₹50 crore to Party X through electoral bonds.

- Ms. B donates ₹25 crore to Party Y directly via bank transfer."

Both donations are legal, but while Ms. B’s donation appears in public disclosures, Mr. A’s identity remains hidden due to electoral bond rules. This example highlights the debate between transparency & privacy in billionaire political donations.

Tax Benefits for Billionaire Donors

Indian law incentivizes clean political donations:

- Individuals (including billionaires): Section 80GGC of the Income Tax Act allows full tax deduction on contributions to political parties.

- Companies owned by billionaires: Section 80GGB offers similar deductions for corporate donations.

Thus, political donations not only influence democracy but also provide tax savings for billionaires.

Challenges of Billionaire Political Donations

- Unequal Influence: Wealthy donors may enjoy greater political access.

- Opacity: Electoral bonds reduce voter knowledge of billionaire donations.

- Risk of Favoritism: Policy bias toward donor-driven interests."

- Public Distrust: Citizens may feel governance is for the rich, not the people.

The Democratic Balance

While billionaire political donations bring resources into democracy, checks are essential to prevent misuse. Possible solutions include:

- Stricter disclosure norms.

- Capping maximum contributions.

- Enhancing voter awareness."

- Independent monitoring of donations.

This balance ensures that democracy remains truly representative, not just resource-driven.

Also Read: Section 13A of Income Tax Act – Tax Exemptions for Political Parties

Conclusion

Billionaire political donations by party are reshaping democracies around the world. They provide essential funds for campaigns, but they also raise questions about fairness, influence, and transparency.

In India, laws under the Income Tax Act & the Representation of People Act regulate such donations, while tax benefits under Section 80GGC and 80GGB encourage clean contributions. Still, debates around electoral bonds & billionaire influence continue to dominate discussions.

Ultimately, billionaire donations are not inherently negative. What matters is how transparent, accountable, and democratic the system is.

💡 Curious about how political donations affect your taxes?

Our experts at Callmyca.com can guide you through tax benefits on political contributions while ensuring compliance with all legal requirements.