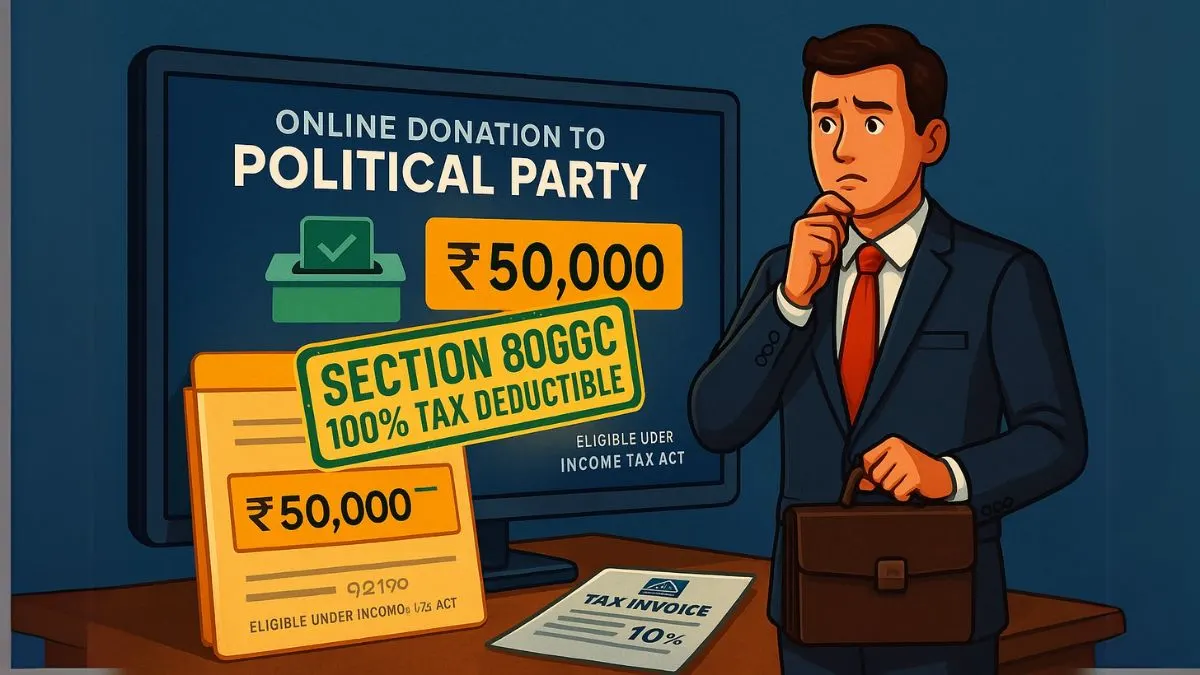

When it comes to income tax planning, most of us look at traditional deductions like Section 80C or Section 80D. But did you know that your donations to political parties can also get you tax benefits? Yes, under Section 80GGC of the Income Tax Act, 1961, individuals making contributions to political parties or electoral trusts are eligible for deductions. It’s a smart way to support democracy & save taxes at the same time.

What is Section 80GGC of the Income Tax Act?

Section 80GGC of the Income Tax Act, 1961, allows taxpayers to claim a deduction for donations made to political parties or electoral trusts. The idea behind this provision is to encourage transparency & regulated funding of political parties through proper banking channels.

This section falls under Chapter VI-A of the Act, which deals with deductions from gross total income. The entire amount donated (without any upper limit) is eligible for deduction, provided it meets the conditions laid down. “

Who Can Claim Deduction Under Section 80GGC?

This section is available to any individual taxpayer, as long as they are not:

- A company,

- A local authority, or

- An artificial juridical person wholly or partly funded by the government.

In simple words, if you’re a salaried employee, freelancer, or self-employed individual, you’re eligible to avail of this benefit.

Where Should the Donation Go?

The deduction under this section can only be claimed if your donation is made to either:

- A registered political party (recognised under Section 29A of the Representation of the People Act, 1951), or

- An electoral trust approved by the Central Board of Direct Taxes (CBDT).

This ensures your contributions are legitimate & routed through the right channels. “

Important Conditions to Claim 80GGC Deduction

There are a few conditions to keep in mind:

- No cash donations are allowed. Your contribution must be made via cheque, demand draft, or digital banking methods (like UPI, net banking, etc.).

- The donor must retain proof of payment, like a bank receipt or acknowledgement from the political party or trust.

- The deduction is only available for contributions made during the financial year & must be claimed while filing your income tax return (ITR).

Why This Deduction Matters

The deduction under Section 80GGC offers tax benefits on donations made by any individual to political parties, which:

- Encourages clean funding & discourages black money in politics,

- Empowers citizens to participate in the democratic process meaningfully, &

- Allows the deductions from the total income of an individual taxpayer, helping them reduce their tax burden.

Example to Understand Section 80GGC

Let’s say Rahul, a salaried individual, donates ₹20,000 to a registered political party through UPI. He earns ₹8,00,000 annually. By claiming a deduction under Section 80GGC, Rahul can reduce his taxable income from ₹8,00,000 to ₹7,80,000. This directly lowers his tax outgo under the old regime.

Quick Snapshot

|

Feature |

Details |

|

Applicable to |

Individual taxpayers (excluding companies/local authorities) |

|

Deduction Allowed |

100% of the donated amount |

|

Donation Mode |

Non-cash only (cheque, DD, digital payment) |

|

Donation Made To |

Registered political parties or electoral trusts |

|

Limit |

No monetary limit specified |

|

Excluded Donors |

Companies, government-funded bodies |

Frequently Asked Questions

Q1. Can I claim 80GGC if I donated in cash?

Ans: No. Only non-cash donations are eligible for deduction.

Q2. Is there any upper limit on the amount I can donate under this section?

Ans: No limit, but it must be within your taxable income and through legal channels.

Q3. Can I claim 80GGC deduction under the new tax regime?

Ans: No. Under the new tax regime (Section 115BAC), most Chapter VI-A deductions, including 80GGC, are not available.

Final Thoughts

Section 80GGC of the Income Tax Act is a powerful provision that lets you support political change & save taxes at the same time. It not only gives you the right to influence political funding transparently but also helps you plan your taxes more efficiently. If you're making such contributions, make sure to keep the receipts and claim your deduction before the ITR deadline.

To file your ITR, contact our experts at Callmyca.com.