In a country like India, where medical expenses can take a massive toll on personal finances, tax deductions for health-related expenditures are a huge relief. While most people know about deductions for health insurance premiums, many are unaware that Section 80D of the Income Tax Act also covers medical expenditure, especially for senior citizens and those with specific diseases.

Let’s explore the diseases covered under Section 80D, how much deduction you can claim, and how to ensure compliance while filing your income tax return.

What Is Section 80D of the Income Tax Act?

Section 80D allows you to claim tax deductions for:

- Health insurance premiums

- Medical expenditure for senior citizens (if no insurance is available)

- Preventive health check-ups (up to ₹5,000)

While deductions for premium payments are widely claimed, the provision also extends to expenses incurred on certain pre-existing diseases and conditions, especially if you’re a senior citizen or caring for senior parents.

80D Deduction for Senior Citizens – Special Coverage

Under Section 80D, senior citizens (aged 60 and above) can claim a deduction of up to ₹50,000 for health insurance or actual medical expenditure, whichever is applicable.

What’s noteworthy is that even if a senior citizen doesn’t have health insurance, they can still claim this deduction by submitting medical bills.

This applies to:

- Your medical bills (if you're a senior citizen)

- Your senior citizen parents’ medical expenditure (if you're paying for them)

Just keep in mind: medical bills – senior citizen proof is essential. Documents like age proof, PAN, prescription, and hospital receipts should be maintained for tax records.

Medical Expenditure Covered Under Section 80D

There’s no exhaustive diseases list under Section 80D, but based on current practice, reasonable medical expenses for chronic conditions are allowed, including:

- Heart disease

- Diabetes

- Arthritis

- Hypertension

- Asthma

- Chronic kidney disease

Some rare conditions like Dystonia Musculorum, which is a neuromuscular disorder, may also qualify under pre-existing diseases cover if they require ongoing medical attention.

What matters is that the disease must be certified by a medical specialist, especially in the case of neurological diseases. The income tax rules allow such expenses only when substantiated with valid prescriptions, bills, and diagnostic reports. "

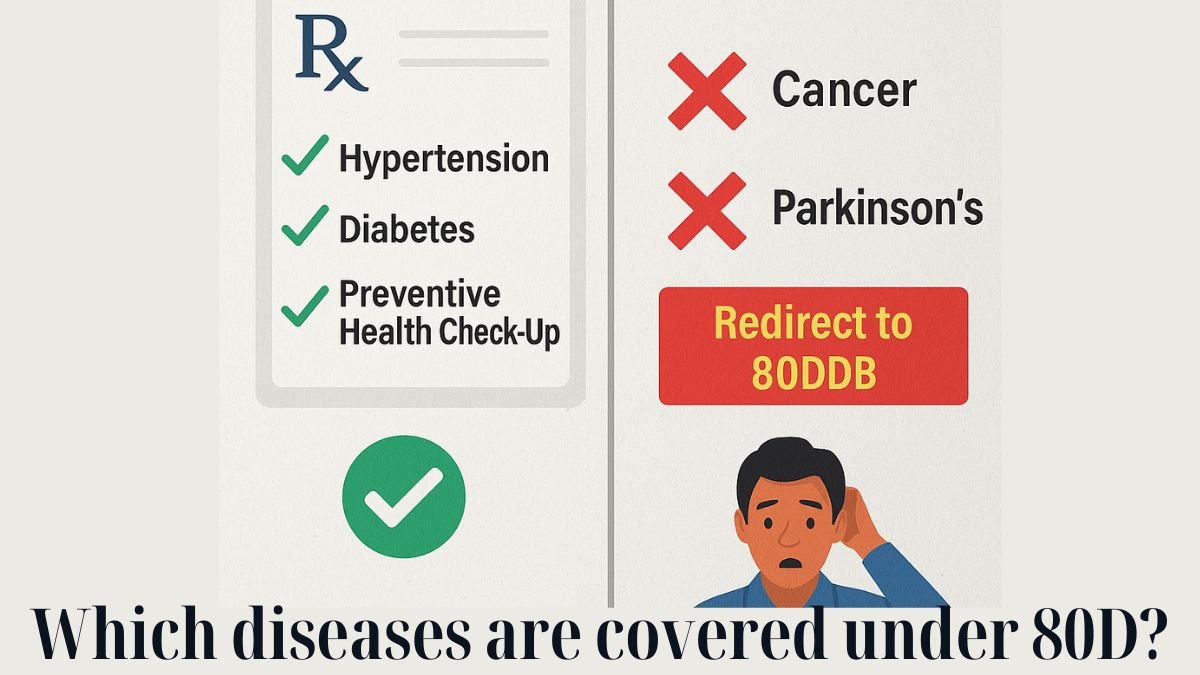

Key Distinction: Section 80D vs Section 80DDB

Many people confuse Section 80D with Section 80DDB, but there’s a major difference:

- Section 80D: Covers general medical expenditure, preventive check-ups, and insurance premiums.

- Section 80DDB: Specifically covers deduction for specified diseases, such as cancer, Parkinson’s, AIDS, renal failure, and neurological disorders with at least 40% disability.

If you’re wondering about the 80ddb deduction diseases list, here are some major ones:

- Dementia

- Parkinson’s Disease

- Haematological disorders (like Thalassemia)

- Malignant cancers

So, while Section 80D medical expenditure is broader and more general, 80DDB is highly specific and applies only to certified diseases with documentation from specialists in government hospitals.

Health Insurance Tax Benefit Under Section 80D

Most taxpayers are aware that the health insurance tax benefit 80D provides:

- ₹25,000 deduction for self, spouse, and dependent children

- Additional ₹25,000 for parents (or ₹50,000 if parents are senior citizens)

- Up to ₹5,000 within those limits for preventive health check-ups

If you have a family floater plan or have purchased a plan for your parents, don’t miss claiming this deduction!

Deduction Limit for Parents and Family

Many taxpayers forget to include the deduction limit for parents while calculating their total claim. The limits are as follows:

- If parents are below 60: ₹25,000 "

- If parents are 60 or above: ₹50,000

You can also split your deduction: For example, if you spend ₹22,000 on your premium and ₹45,000 on your senior citizen mother’s medical expenses, you can claim ₹67,000 under Section 80D.

Documentation Required

To claim medical expenses or disease-related deductions under Section 80D:

- Collect all medical bills, prescriptions, and specialist certifications

- Ensure payment was made via bank, card, UPI, etc. (Cash is not allowed for insurance premiums)

- Maintain age proof for senior citizens

- Retain documents even if not submitted—they may be required for verification or notice replies

Final Thoughts

Understanding the medical expenditure and diseases covered under Section 80D of the Income Tax Act can help you make the most of your tax benefits while ensuring your family’s well-being.

Let’s recap:

- Section 80D covers health insurance, preventive check-ups, and medical expenses

- Up to ₹50,000 deduction for senior citizens with or without insurance

- Expenses for pre-existing diseases like Dystonia Musculorum and neurological diseases, as identified by a specialist, can qualify under this section

- Distinct from Section 80DDB, which covers specific chronic illnesses

- Keep all necessary documentation for smooth filing

👉 Need help filing taxes or confused between Section 80D and 80DDB?

Visit www.callmyca.com for expert guidance and stress-free tax filing.