For many senior citizens, interest income from fixed deposits, recurring deposits, or other investments is a major source of livelihood after retirement. However, banks are required to deduct TDS (Tax Deducted at Source) on interest if it crosses the specified threshold. This deduction often creates confusion and financial hardship, especially when the total annual income is not even taxable.

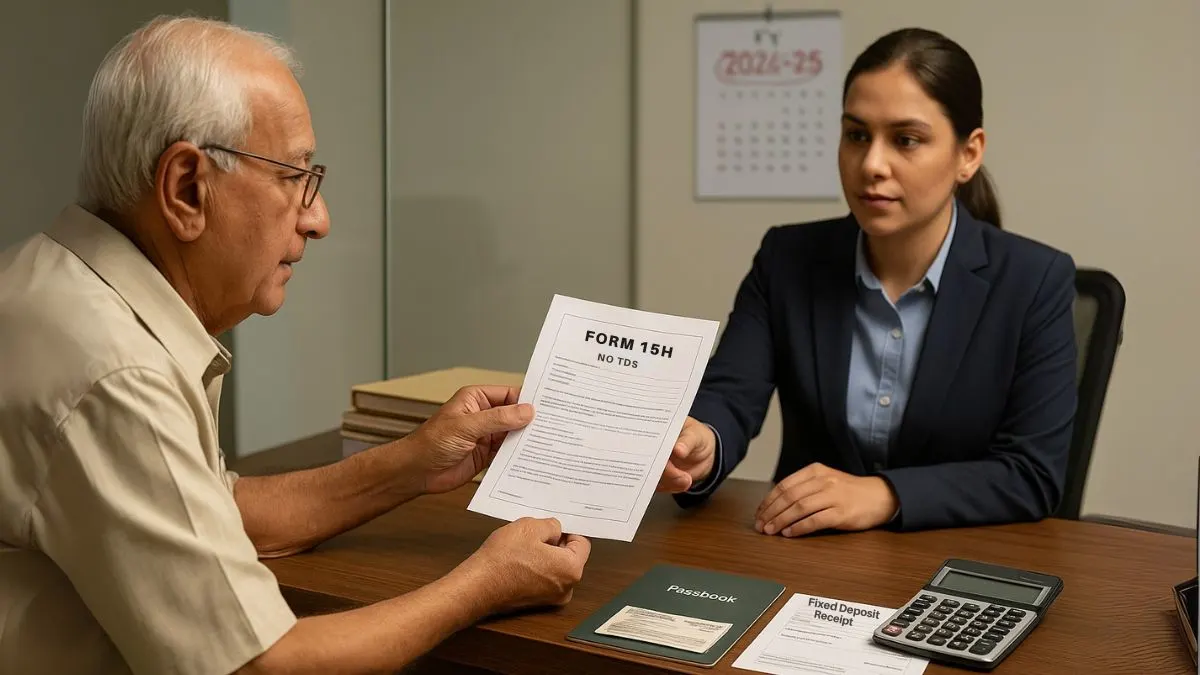

To address this, the Income Tax Act provides relief through Form 15H. This declaration form allows senior citizens to avoid unnecessary deduction of TDS on their interest income, provided their overall income falls below the taxable limit.

In this article, we will explore what Form 15H is, eligibility, how to file, differences from Form 15G, & common mistakes to avoid.

What is Form 15H?

Form 15H can be submitted by senior citizens to their bank or financial institution to ensure that no TDS is deducted on their interest income.

- It is a self-declaration form.

- It states that the total income of the individual is below the taxable threshold.

- Once submitted, banks do not deduct TDS on interest payments.

Essentially, the 15H Form is a declaration under Section 197A(1C) of the Income Tax Act. This section specifically caters to senior citizens, offering them tax relief on income streams where TDS would otherwise apply.

Who Can Submit Form 15H?

Not everyone can submit this form. It is specifically designed for:

- Senior Citizens (aged 60 years or above)."

- Residents of India only.

- Individuals whose total estimated income for the financial year is below the basic exemption limit.

For example, if a 65-year-old individual earns ₹2.5 lakh annually (which is below the basic exemption limit for senior citizens), they can submit Form 15H to avoid TDS deductions on their interest income.

Also Read: Lower or NIL TDS Deduction Simplified

Difference Between Form 15G and Form 15H

While both forms serve the same purpose of avoiding TDS, the eligibility criteria are different.

- Form 15G – For individuals below 60 years of age & HUFs (Hindu Undivided Families).

- Form 15H – Exclusively for senior citizens (aged 60 years or above).

Thus, Form 15G & 15H is a declaration submitted by an individual, but the age criteria separate them.

When to Submit Form 15H?

Form 15H should ideally be submitted at the beginning of the financial year to ensure that banks do not deduct TDS from your interest.

If you miss submitting it early, any TDS already deducted can only be claimed as a refund while filing your Income Tax Return (ITR), which delays access to funds.

How to Fill Form 15H

Filling out the form correctly is very important to ensure acceptance by banks & avoid compliance issues.

- Personal Details – Name, PAN, Date of Birth, Address, and Contact information.

- Residential Status – Must confirm that you are a resident of India.

- Income Details – Mention estimated total income & details of interest income.

- Declaration – Confirm that your income is below the taxable limit.

- Submission – Provide it to the bank or institution where your deposit is held.

Many banks now allow online submission of Form 15H through internet banking, making the process hassle-free.

Importance of PAN in Form 15H

It is mandatory to provide your PAN number when submitting Form 15H.

- Without PAN, banks will not accept the form.

- If PAN is missing, TDS is deducted at the higher rate of 20%."

Hence, keeping your PAN updated with the bank is a must.

Also Read: Simplifying Tax for Senior Citizens Aged 75

Scenarios Where Form 15H is Useful

- Fixed Deposit Interest – If a senior citizen earns interest exceeding ₹40,000 (₹50,000 for senior citizens) in a year, banks are bound to deduct TDS. Form 15H prevents this deduction.

- Post Office Deposits – Similar rules apply here.

- Recurring Deposits & Company Deposits – TDS can be avoided with this declaration.

- EPF Withdrawal – Senior citizens withdrawing large amounts can also submit this form to avoid TDS if their total income remains non-taxable.

Key Points About Section 197A(1C)

The provision that governs Form 15H is Section 197A(1C) of the Income Tax Act. It specifies that:

- Senior citizens can declare their income is below the taxable limit.

- Banks & institutions, after receiving the form, cannot deduct TDS on interest income.

This section provides much-needed financial relief to retirees who rely heavily on interest income.

Example to Understand Better

Suppose Mr. Sharma, aged 65, earns the following income in a financial year:

- Pension: ₹1,60,000

- Interest from Fixed Deposit: ₹70,000

Total Income = ₹2,30,000

This is below the taxable limit for senior citizens (₹3,00,000). By submitting Form 15H, Mr. Sharma ensures that the bank does not deduct TDS on his ₹70,000 interest income.

Common Mistakes to Avoid

- Late Submission – Always file at the beginning of the year.

- Providing Wrong PAN – Leads to rejection of the form.

- Filing Without Eligibility – If your total income exceeds the taxable limit, filing Form 15H can be treated as false declaration, which has legal consequences.

- Not Keeping Acknowledgement – Always keep proof of submission.

Also Read: Retired But Rewarded: Senior Citizen Tax Perks You Probably Overlooked in FY 2024–25

Penalty for False Declaration

While Form 15H is designed to help taxpayers, submitting it falsely can lead to penalty & prosecution under the Income Tax Act. Therefore, ensure that you are genuinely eligible before filing it.

Digital Submission of Form 15H

With the push towards digitalization, most banks now accept Form 15H online through internet banking or mobile banking apps. This avoids paperwork & makes it convenient for senior citizens.

Final Thoughts

Form 15H can be submitted by senior citizens who want to ensure that no TDS is deducted on their interest income when their total annual income is below the taxable limit. The 15H Form is a declaration under Section 197A(1C) of the Income Tax Act, making it an essential tax-saving tool for retirees.

By correctly filing Form 15G & 15H, individuals can avoid unnecessary tax deductions and manage their cash flows better.

👉 Want to make sure your tax filings and declarations like Form 15H are done accurately? Visit Callmyca.com today & let our experts simplify your tax compliance in just a few clicks!