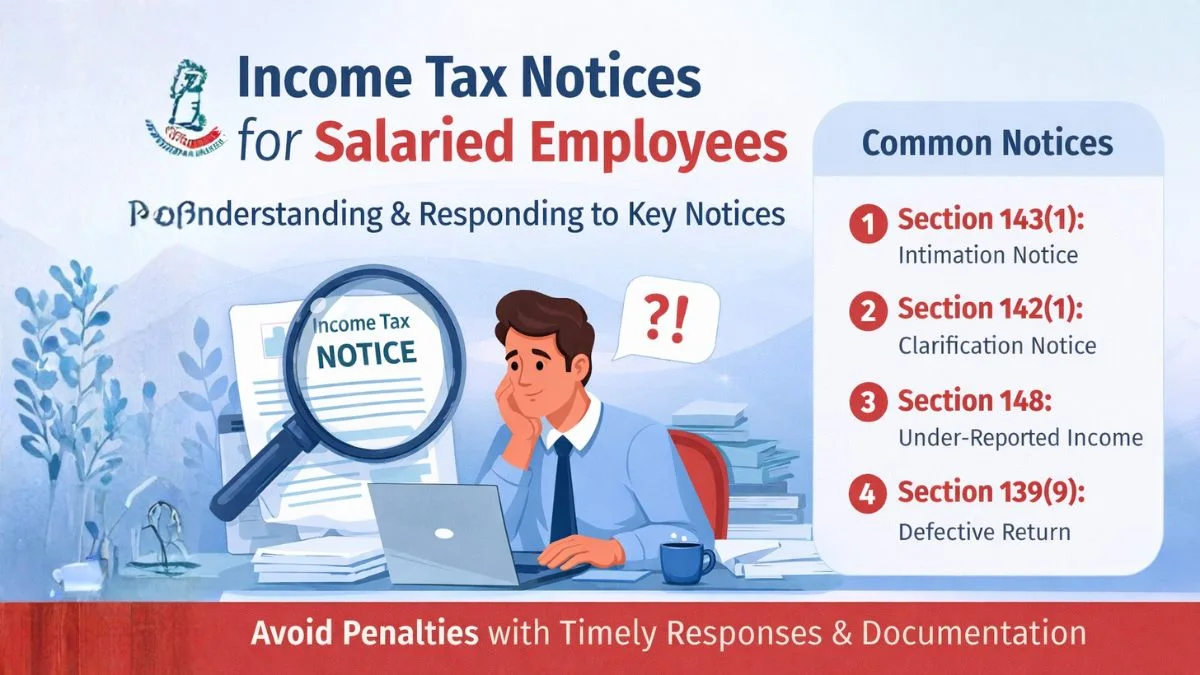

What Is a Notice Under Section 142(1) of the Income Tax Act?

At its core, an income tax notice under section 142(1) is a formal request from the Income Tax Department. It’s not an accusation or penalty—it’s simply a tool used by tax officers to gather information or documents related to your tax return.

In plain terms: the department is asking you to explain, submit, or clarify something.

You can receive this notice:

- Before filing your ITR (if you haven’t filed it)

- After filing, when the officer needs more documents or clarification

🔍 Who Can Receive a 142(1) Notice?

It can be sent to any taxpayer—individuals, companies, partnerships, or even NRIs.

But most commonly, it is issued in one of the following cases:

- The assessee still needs to file their return

- Filed ITR, but some documents are missing

- Return filed, but the officer finds an inconsistency in the numbers

- High-value transactions don’t match ITR

- Based on AIR (Annual Information Report) or AIS/TIS data triggers

It’s not a reason to panic, but it needs your attention.

🧠 What Is the Purpose of a Section 142(1) Notice?

There are three key reasons this notice is used:

- To ask for a return if it has not been filed

- To call for accounts or documents if already been filed

- To ask for information related to tax liabilities

So yes, section 142(1) of Income Tax Act empowers the officer to gather preliminary facts before taking any further steps like scrutiny or assessment. "

📃 Sample Format & PDF of Notice Under Section 142(1)

A typical notice contains:

- PAN and assessment year

- Name of the assessing officer

- Sections applicable (in this case, 142(1))

- Nature of requirement: File return / Submit bank statement / Explanation for mismatch

- Deadline for response

If you're looking for the income tax notice section 142 1 PDF, you can download a sample from the e-filing portal or request it via your e-proceedings tab.

🕓 Is There a Time Limit for Issuing Notice u/s 142(1)?

Now here’s the twist.

There is no explicitly mentioned time limit for the issue of notice u/s 142(1). That’s right.

The Income Tax Officer can issue this notice:

- Before filing of return (if delayed)

- After filing, anytime during the assessment or reassessment window

But generally, it happens within a few months of ITR submission. "

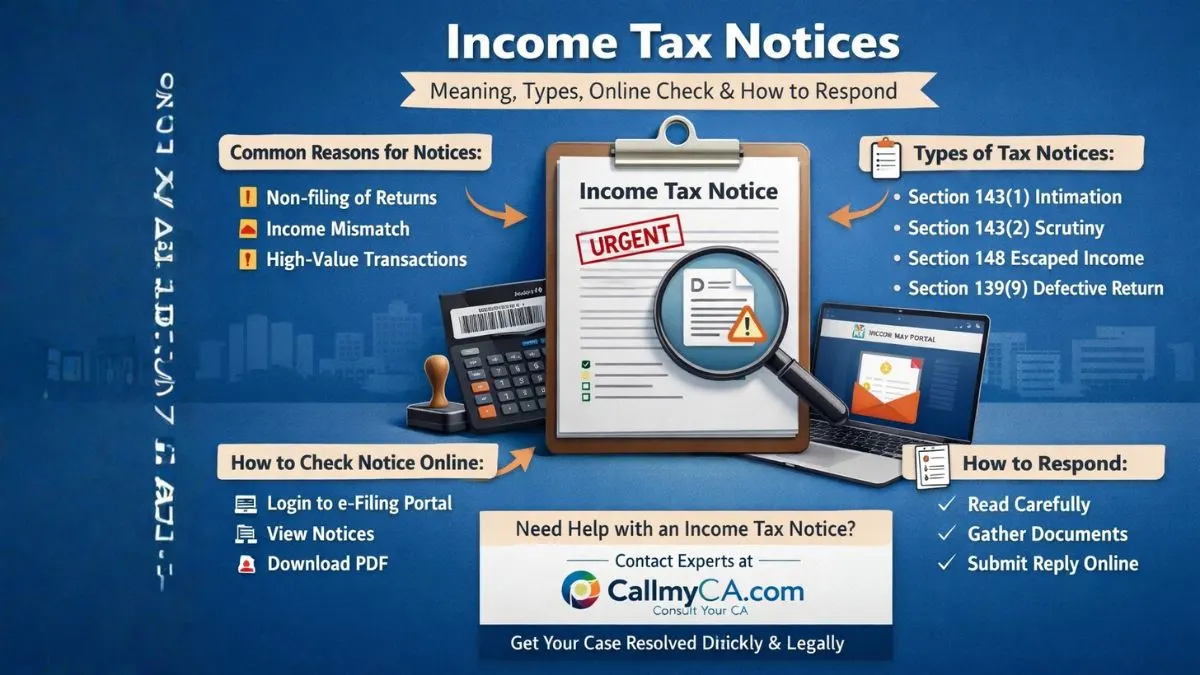

💡 What Triggers a 142(1) Notice?

Several real-life scenarios could lead to this:

- You made a large deposit but didn’t report the interest

- Salary declared doesn’t match Form 26AS

- Real estate transactions are not in sync with AIS

- You claimed high deductions but didn’t upload documents

- You didn’t file ITR at all, even though TDS was deducted

So don’t take your AIS lightly. A mismatch between your income details & government data is often the trigger.

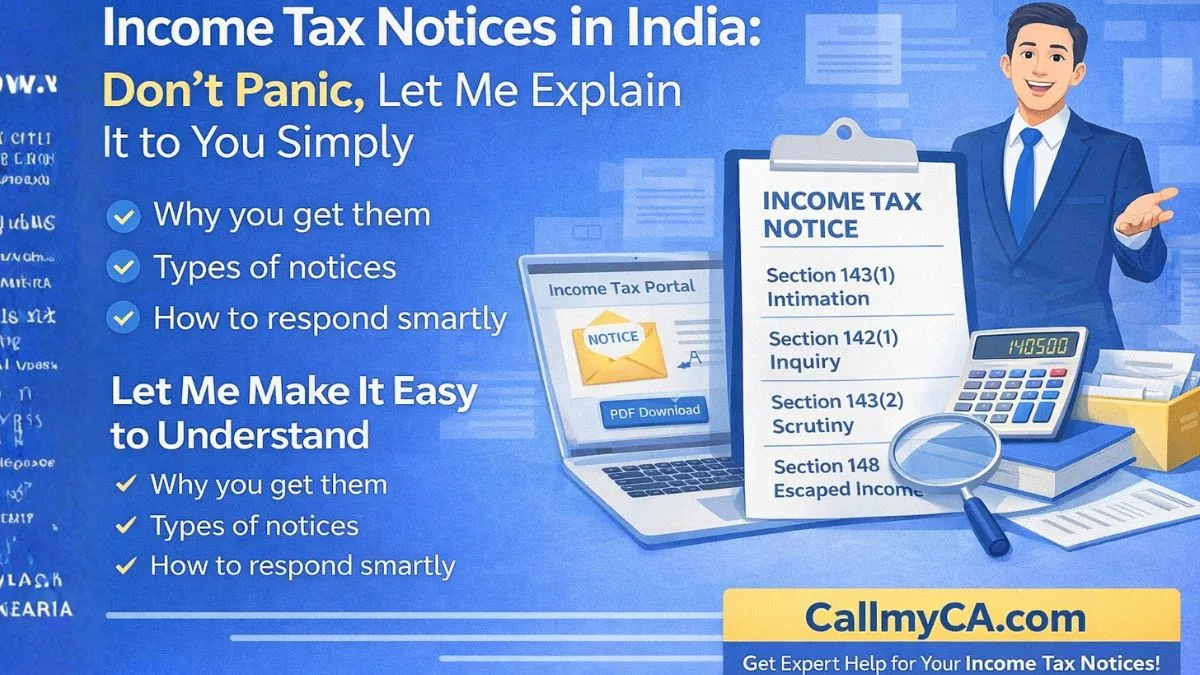

🛠️ How to Reply to Income Tax Notice Section 142(1)

Here’s a step-by-step guide:

- Log in to https://incometax.gov.in

- Go to e-Proceedings

- Select the correct assessment year

- Click on the notice under section 142(1)

- Read the details carefully

- Upload the required documents or explanations

- Submit digitally

Always reply within the date mentioned in the notice. Missed deadlines lead to penalties or even best judgment assessments.

🧾 Hindi Explanation: Income Tax Notice Section 142(1) in Hindi

Many taxpayers search for:

Income tax notice section 142, 1 in Hindi or Hindi meaning

Here’s a simple version:

“आयकर अधिनियम की धारा 142(1) के तहत नोटिस तब जारी किया जाता है जब आकलन अधिकारी करदाता से रिटर्न या दस्तावेज़ की माँग करता है। यह नोटिस जांच प्रक्रिया की शुरुआत के रूप में कार्य करता है।”

💬 Common FAQs About 142(1) Notices

Q1. Is it the same as a scrutiny notice?

No. Scrutiny falls under Section 143(2). This is a preliminary notice to collect data.

Q2. What if I ignore the notice?

If you don’t respond, the officer may proceed with a “best judgment assessment” under section 144. That can lead to higher tax liability or penalties.

Q3. Do I need a CA to reply?

If the query is simple (e.g., a bank statement), you can handle it. But if the notice asks for books of account or legal explanations, consult a CA.

Q4. Can I get this notice even if I’ve filed my ITR?

Yes. An income tax notice under section 142(1) can be issued for clarification, even after filing.

📌 Quick Summary Table

|

Aspect |

Details |

|

What is it? |

Formal notice to ask for ITR or documents |

|

Applies to |

Anyone with PAN who has filed or missed filing |

|

When issued? |

Before or after ITR filing |

|

Time limit? |

No fixed statutory deadline |

|

Mode |

Sent via email reflected on the portal |

|

Response required? |

Yes, always |

|

Where to reply? |

Via the e-filing portal, e-proceedings tab |

🚫 Common Mistakes to Avoid

- Ignoring the notice and thinking “I already filed ITR”

- Uploading half documents or illegible scans

- Replying verbally or offline—always use the portal

- Missing the due date (usually 10–15 days)

✅ What Happens After You Reply?

Once you reply, the officer may:

- Close the case (if satisfied)

- Send a follow-up notice (e.g., u/s 143(2) for scrutiny)

- Issue a final assessment order

So respond well. Clear explanations can stop the case right there.

🧾 Legal Base – Section 142(1) Bare Act Summary

The section empowers the Assessing Officer to:

“Serve a notice requiring the assessee to furnish the return of income or produce such accounts or documents as deemed necessary to make the assessment.”

This power is flexible, yet legally bound by fair opportunity.

📣 Final Words

If you received an income tax notice under section 142(1), don’t ignore it. It’s not a threat—just a formal request from the Income Tax Department to help them do their job.

And yes, replying correctly helps you stay compliant and stress-free.

Whether the assessee still needs to file or has already filed & missed details, this notice gives you a second chance to set things right. Connect with our experts on Callmyca.com for more details.