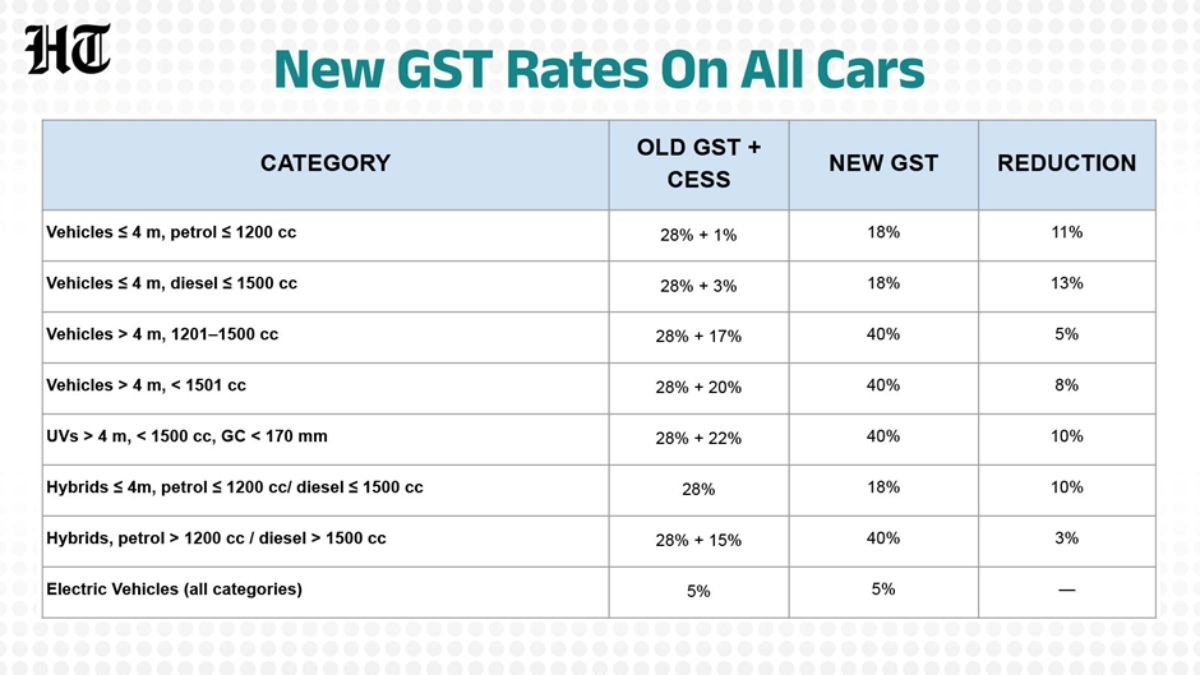

Buying a car in India is more than just choosing a model—it’s about affordability, monthly EMIs, and the final on-road price. Taxes form a huge part of that cost. Until recently, cars were broadly taxed at 28% GST plus cess, but the government has now reshaped the slabs to make the system fairer.

The new structure brings relief for budget-friendly hatchbacks and compact SUVs while making larger SUVs more expensive. With GST rates on small cars to 18% and SUVs moved into a new 40% slab, this decision is set to change the Indian car market.

Why GST Matters in Car Prices

Under the Goods and Services Tax (GST) regime, multiple taxes like excise duty, VAT, and service tax were merged into one. For cars, GST became the single biggest tax factor.

However, not all cars are taxed the same. GST is linked to:

- Engine size

- Vehicle length

- Category (hatchback, sedan, SUV)

This creates a huge difference in on-road prices. By lowering GST for smaller vehicles and increasing it for SUVs, the government is reshaping how much buyers pay for different categories.

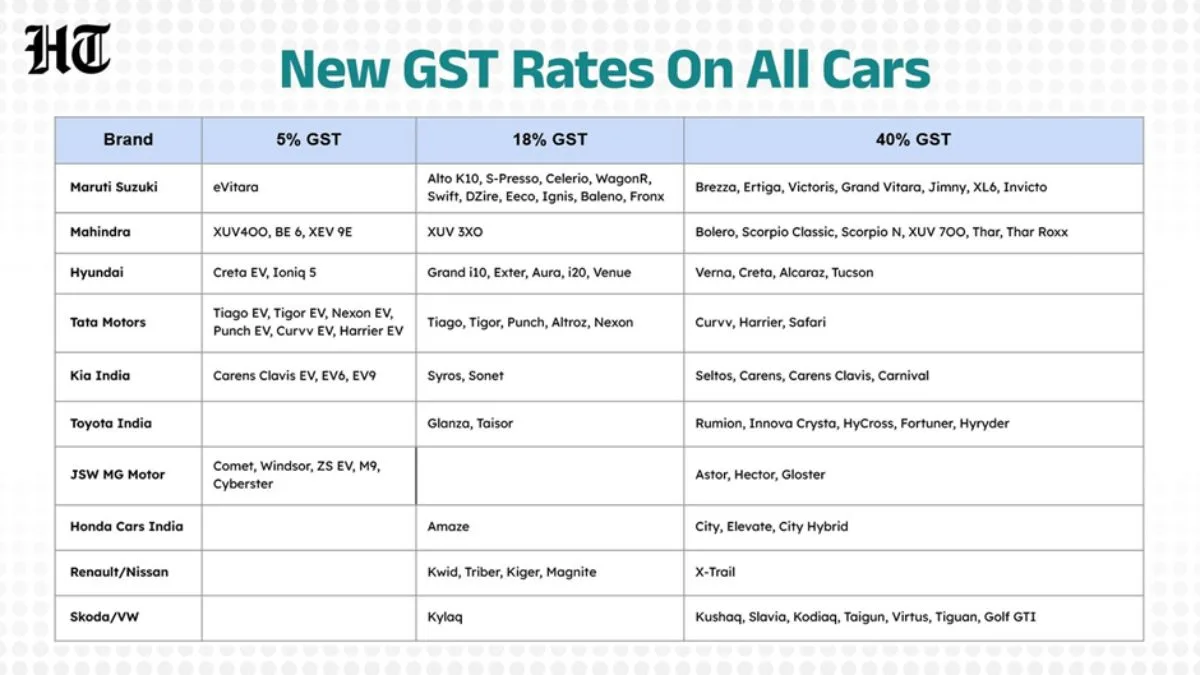

Key Highlights of the New GST Rates

Here’s what you need to know at a glance:

- GST on small cars is reduced to 18% – Maruti Alto, Hyundai Santro, and other entry-level cars now fall in this category.

- GST new rates: under 18% – Compact SUVs like Tata Nexon, Hyundai Venue, and Maruti Brezza benefit.

- SUVs are placed in a new 40% slab – Mahindra Thar, Toyota Fortuner, and Jeep Compass become costlier.

- Sedans remain mostly in the 28% range with additional cess depending on engine size.

This new distribution balances affordability for the middle class while taxing premium vehicles higher.

GST Rates by Category: Full Comparison

|

Category |

Popular Models |

GST Slab (Revised) |

Impact on Buyers |

|

Hatchbacks |

Maruti Alto, Hyundai Santro, WagonR |

18% |

Most affordable; lower on-road costs |

|

Sedans |

Honda City, Hyundai Verna, Maruti Ciaz |

28% ( cess) |

No big change; mid-segment stable |

|

Compact SUVs |

Tata Nexon, Maruti Brezza, Venue |

18% slab |

Best value-for-money SUV segment |

|

Large SUVs |

Mahindra Thar, Fortuner, Compass |

40% slab |

Much costlier; positioned as luxury vehicles |

This table-style view makes it clear how GST changes shift affordability across categories.

GST on Small Cars: Affordable Again

The biggest winners are small cars. By bringing GST on small cars to 18%, the government has made hatchbacks like Alto, Santro, and Tiago cheaper.

For middle-class families, this move makes buying a first car or upgrading to a newer model more affordable. Since hatchbacks dominate the Indian market, this cut is expected to boost sales significantly.

Compact SUVs and Tata Nexon: The Sweet Spot

Compact SUVs are India’s most popular segment, blending SUV styling with hatchback affordability. Models like Tata Nexon, Hyundai Venue, and Maruti Brezza have been placed in the 18 per cent slab.

This makes compact SUVs the most attractive category for young buyers and families. The GST new rates: under 18% ensure compact SUVs remain competitive, offering style, space, and affordability.

SUVs in the New 40% Slab: Mahindra Thar Takes a Hit

On the other end of the spectrum, SUVs like the Mahindra Thar, Toyota Fortuner, and Jeep Compass now fall into the new 40% slab.

This hike makes large SUVs significantly more expensive. For buyers, this means SUVs are now positioned firmly as premium vehicles, not just lifestyle choices. While demand may soften, enthusiasts who love SUVs will still consider them aspirational buys.

Sedans: Stuck in the Middle

Sedans like Honda City and Hyundai Verna remain largely unchanged, taxed at 28% plus cess. This keeps them in the mid-price range—cheaper than SUVs but costlier than hatchbacks.

While sedans have lost some popularity to compact SUVs, they continue to attract buyers who value comfort, boot space, and smooth driving over rugged looks.

How Prices Will Shift

Let’s look at how GST changes impact buyers:

- Maruti Alto – As a hatchback, it benefits directly, lowering its on-road price.

- Tata Nexon – Becomes more attractive as a compact SUV in the 18 per cent slab.

- Mahindra Thar – Now a true premium product, taxed at 40%, making it pricier than ever.

This reshuffle may boost sales in the small car and compact SUV segment while slowing demand for large SUVs.

Why Did the Government Revise GST Rates?

The government had four main objectives behind this move:

- Affordability for middle-class buyers – By cutting GST on small cars to 18%, entry-level vehicles are easier to buy.

- Boosting compact SUV demand – India’s fastest-growing category remains affordable.

- Higher revenue from premium buyers – By creating a 40% slab, luxury SUV buyers contribute more taxes.

- Simplification of slabs – A cleaner, category-based GST system helps buyers and manufacturers understand tax better.

Industry Reaction

Car dealers and manufacturers have welcomed the reduced GST for hatchbacks and compact SUVs. They expect a surge in demand for entry-level and mid-segment cars. The Tata Nexon, already a top-seller, may see even higher bookings.

On the flip side, premium SUV makers are concerned. With models like Mahindra Thar and Toyota Fortuner now taxed heavily, their demand may cool down in price-sensitive India.

Buyer’s Guide: Who Wins, Who Loses

- Winners: Middle-class buyers, first-time car owners, and compact SUV fans.

- Neutral: Sedan buyers, as no major GST revision happened for their segment.

- Losers: SUV enthusiasts, who will now pay significantly more for large SUVs.

Final Word

The revision of GST rates on all cars in India is a landmark change. By placing GST rates on small cars to 18% and including compact SUVs like Tata Nexon in the 18 per cent slab, affordability returns to the market. At the same time, SUVs like the Mahindra Thar face a higher tax under the 40% slab, making them aspirational luxury buys.

For buyers, the choice is clearer than ever: opt for hatchbacks and compact SUVs for value, or stretch your budget for premium SUVs now firmly taxed as luxury.