The Indian Income Tax Act has always tried to balance two things — fair taxation & fair relief. One of its lesser-known but very relevant provisions is Section 10(37A). It quietly protects people who receive compensation either from land acquisition or from certain employer-related expenses, ensuring they aren’t unfairly taxed on income that’s not really “profit.”

Let’s decode this section in plain English, understand when it applies, and see how you can benefit from it — whether you’re a farmer, property owner, or an employee reimbursed for company-related costs.

Understanding Section 10(37A) — The Core Idea

At its heart, Section 10(37A) deals with any income chargeable under the head “Capital Gains” when land or property is compulsorily acquired by the government or any approved authority.

It specifically provides exemption in respect of capital gain if such land belongs to an individual or a Hindu Undivided Family (HUF) & is used for agricultural purposes.

Later amendments expanded its scope to cover certain situations where compensation or reimbursement is received — not as a “gain,” but as a genuine recovery of loss or expense incurred due to your employer’s business.

A Little Background — Why This Section Exists

Before this clause was introduced, taxpayers receiving compensation for compulsory acquisition or employer reimbursements often faced double trouble.

Imagine this:

Your agricultural land is acquired by the government for a public project. You get compensated, but technically, that money could be considered capital gains — and you’d be taxed for it."

Similarly, let’s say your company relocates you or compensates you for certain expenses incurred due to your employer’s business — travel, housing, or official relocation costs. Without clear exemption, these too could be seen as “income.”

Section 10(37A) was designed to stop that unfairness.

Also Read: Form 15H: The Declaration That Saves Senior Citizens from TDS

Who Can Claim Exemption Under Section 10(37A)

To qualify for this exemption, you must fit within a few simple conditions:

- The income must fall under “capital gains” in the first place.

- The capital gain must arise because of compulsory acquisition of an urban agricultural land.

- The land must have been used for agricultural purposes by you or your family for at least two years before acquisition.

- Compensation should be received after April 1, 2004 (for most cases).

If all these boxes are ticked, your compensation is fully exempt from tax — you keep what’s paid, without sharing a rupee with the tax department.

For Employees — When Your Reimbursements Are Not Taxable

Section 10(37A) also provides exemptions for expenses incurred due to your employer’s business.

Let’s say your company transfers you to another city & reimburses your relocation expenses — movers, temporary accommodation, or even travel for your family. Normally, this could be treated as a “perquisite” (a taxable benefit).

But when such payments are wholly and exclusively related to the employer’s business — not personal gain — they fall under Section 10(37A)’s relief umbrella.

The government’s logic is simple: if you didn’t “earn” the money but merely got reimbursed for something your employer needed you to do, it shouldn’t be taxed.

Example 1 — Land Acquisition Case

Ramesh owns a small piece of agricultural land in an urban area. The local development authority acquires it for a public project and pays him ₹30 lakh as compensation.

Since the land was used for agriculture for more than two years before acquisition, and compensation was received after April 2004, the entire amount is exempt under Section 10(37A).

Ramesh doesn’t need to pay any capital gains tax on this income — a big relief for thousands of farmers & small landowners in similar situations.

Example 2 — Employee Reimbursement

Neha works for an MNC that relocates her from Mumbai to Bengaluru. Her company reimburses ₹1 lakh for shifting costs & temporary accommodation.

This payment isn’t “income” in the usual sense — it’s a reimbursement of expenses incurred due to her employer’s business.

Hence, it’s exempt from tax under Section 10(37A).

How This Section Differs from Section 10(37)

Section 10(37) covers compensation for individuals & HUFs on the compulsory acquisition of agricultural land in certain areas.

Section 10(37A)** is its extended cousin —** introduced to include other forms of compensation or reimbursement that don’t truly represent “profit.” It plugs a practical gap that real people often face in both land and employment contexts.

Also Read: The New Tax Exemption Rule for Specified Authorities

Key Takeaways

✅ Any income chargeable under the head “Capital Gains” is exempt if it arises from compulsory acquisition of agricultural land.

✅ Compensation or reimbursement related to employer’s business expenses is also exempt.

✅ This section applies mainly to individuals & HUFs."

✅ It prevents taxpayers from being taxed twice — once on loss, and again on its recovery.

✅ It supports fair treatment for farmers, employees, and small business owners alike.

Connection with Other Sections

While Section 10(37A) focuses on capital gain & reimbursements, it co-exists with other exemptions under the Income Tax Act — like Section 10(37) (agricultural land), Section 10(46A) (specified funds and institutions), & even Section 15H (income exemptions for senior citizens).

Together, these clauses form a larger relief network within the Act, ensuring that genuine hardships — be it loss of land or mandatory expenses — aren’t taxed as income.

Practical Implications

For taxpayers, the benefits of Section 10(37A) are twofold:

- For Landowners:

No capital gains tax on compulsory acquisition of agricultural land used for genuine farming.

This helps farmers and families retain their compensation fully & encourages smoother land acquisition processes. - For Employees:

If you receive payments or reimbursements strictly connected to company business (like travel, transfer, or project-related costs), they’re safe from taxation.

It motivates mobility & compliance without creating unfair tax burdens.

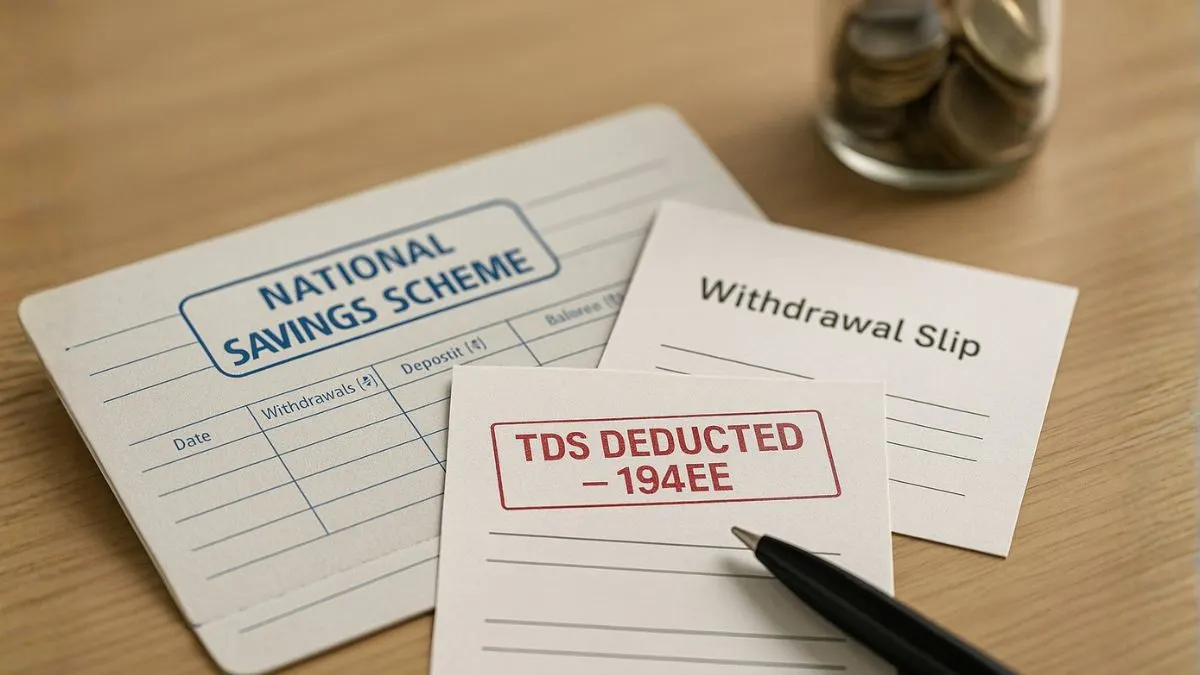

What Documents You Should Keep

To safely claim exemption, maintain:

- Proof of land ownership & agricultural use (revenue records, crop receipts, etc.)

- Copy of acquisition notice & compensation order

- Bank statements showing compensation receipt

- Employer communication regarding reimbursement or relocation payments

Keeping documentation clear ensures smoother processing if your return is ever reviewed.

Also Read: Capital Gain Exemption on Compulsory Acquisition of Urban Agricultural Land

Common Misunderstandings

🔹 Many people think all compensation is taxable — not true. Only income that actually qualifies as a gain is.

🔹 Some employees assume every reimbursement is exempt — again, only those incurred for employer’s business qualify.

🔹 Compensation for non-agricultural urban plots does not get this benefit.

When in doubt, consult a CA — one misinterpretation can cost a lot in taxes & interest.

Judicial Support and Intent of Law

Over the years, courts have backed the principle behind Section 10(37A): taxation must reflect real income, not just movement of money.

In land acquisition cases, courts have reiterated that capital gain exemption under this section protects genuine farmers.

For employees, tribunals have upheld that reimbursements wholly for employer’s business are not taxable income.

In short, the law stands on your side — if your compensation isn’t a profit, it shouldn’t be taxed.

Human Perspective — Why It Matters

For a farmer losing ancestral land or an employee uprooting their family for work, compensation isn’t a luxury — it’s a necessity.

Section 10(37A) acknowledges that truth.

It humanizes the tax law, ensuring fairness where it’s needed most. That’s what makes this provision special — it doesn’t just count numbers; it understands people.

Final Thoughts

The Income Tax Act is full of numbers, but behind every number is a human story. Section 10(37A) quietly makes sure those stories get fair treatment.

Whether it’s capital gain from compulsory land acquisition or expenses incurred due to your employer’s business, this section provides exemption in respect of capital gain that isn’t truly a profit.

For anyone dealing with compensation, reimbursement, or acquisition payments, knowing this clause can save you from unnecessary tax stress — & maybe a few sleepless nights.

Received compensation for land acquisition or reimbursement from your employer? Don’t file your return blindly.

Our experts at Callmyca.com can help you claim the Section 10(37A) exemption correctly — saving you tax, stress, and time. Click to connect & make sure your hard-earned money stays with you.