Most business owners focus on saving tax. Very few focus on proving how they arrived at those savings.

In reality, the Income Tax Department is not just interested in your final numbers — it wants to see your journey, your records, your trail of truth. That’s exactly where Section 271A of the Income Tax Act comes in. It deals with the failure to keep, maintain, or retain books of account and relevant documents, and the consequences of that carelessness.

I’ve seen countless entrepreneurs panic when asked for ledgers or vouchers they never thought they’d need. The penalty may look small — ₹25,000 — but what it signals to the tax officer can be far more damaging.

What Exactly Does Section 271A Mean?

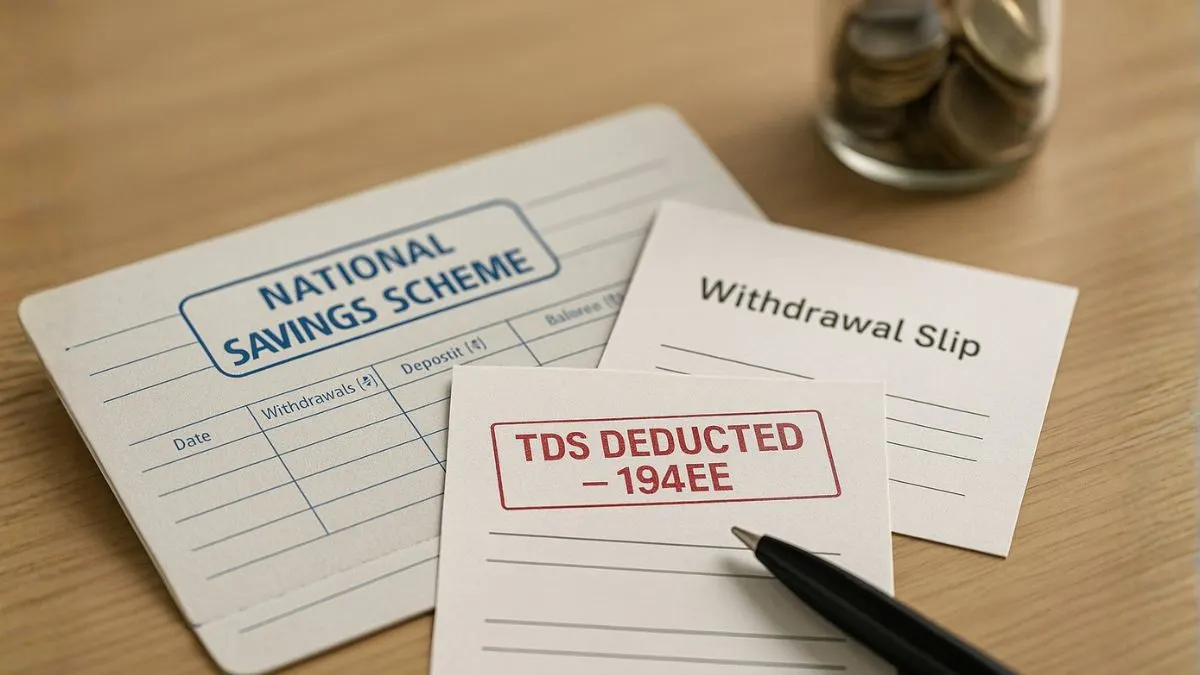

In simple terms, Section 271A authorizes the Assessing Officer to levy a penalty of ₹25,000 if a person fails to maintain or retain the required books of account or supporting documents as per Section 44AA of the Income Tax Act.

These “books” include everything that records your financial life — cash books, ledgers, journals, bills, receipts, invoices, and digital records.

If they’re incomplete, misplaced, or missing altogether, the department assumes that your reported income may not reflect the full picture. And that’s when penalties — and sometimes deeper scrutiny — begin.

Now, here’s the thing most people miss: the penalty isn’t about punishing you for tax evasion; it’s about holding you accountable for transparency. The government simply wants proof that your numbers add up.

Why the Law Cares About Bookkeeping

Let’s be honest — maintaining books sounds tedious. Most small business owners & freelancers rely on bank statements and payment apps as “records.” But when a notice arrives, these don’t qualify as proper documentation.

Your books aren’t just for the department — they protect you. They form the base for every deduction, refund, or claim you make. Without them, you lose the ability to prove your side if the assessing officer challenges your declared income."

I remember working with a small retailer once who didn’t maintain any expense register. When his case went for scrutiny, even his legitimate expenses were disallowed simply because there was no trail. That’s how Section 271A becomes real — not just a number in the law.

Who Needs to Maintain Books of Account

The obligation to maintain books isn’t for everyone, but if you fall into any of the following categories, you’re covered under Section 44AA, & consequently Section 271A if you fail to comply:

- Professionals like doctors, lawyers, architects, chartered accountants, engineers, or interior decorators whose gross receipts exceed ₹1.5 lakh in any of the last three years.

- Businesses with income above ₹2.5 lakh or turnover exceeding ₹25 lakh in any of the preceding three years.

- Taxpayers who opted for presumptive taxation under Sections 44AD, 44ADA, or 44AE but declared income lower than the presumptive limit.

These are basic thresholds, but in today’s world of digital payments, it’s almost impossible not to cross them. So, even small firms or consultants must maintain basic ledgers & receipts.

Also Read: Relief from Penalties in Genuine Cases

Penalty Under Section 271A — The Real Impact

Yes, the penalty amount is fixed at ₹25,000. But the impact goes beyond numbers.

When an Assessing Officer invokes Section 271A, it indirectly questions your reliability as a taxpayer. It’s like telling the department, “I can’t show proof for what I’ve reported.” That can trigger further notices or detailed assessments.

This penalty is also separate from Section 271B, which applies when books exist but aren’t audited.

In short:

- Section 271A = You didn’t keep proper books.

- Section 271B = You kept them but didn’t get them audited.

And yes, you can be penalized under both if both apply.

Failure to Keep or Maintain — What It Really Means

The word “failure” in this context isn’t limited to absence of records. Even if your books exist but are incomplete, unreliable, or poorly retained, you could still fall under this section. For instance:

- You didn’t preserve your ledgers for the required six years.

- Your vouchers or bills are missing for major expenses.

- You didn’t maintain digital or manual backup.

All of these are treated as partial non-compliance. And under Section 271A, partial compliance is as good as non-compliance.

A Real-World Example

Imagine this: Meena runs a boutique design firm in Jaipur. Her turnover last year was ₹32 lakh. Everything seemed smooth until she received a notice for a routine inquiry. The officer asked for her expense ledgers & receipts. Meena confidently shared her bank statements but had no invoices or proper ledgers.

She assumed digital payments were enough proof. Unfortunately, they weren’t.

The officer invoked Section 271A, levied a penalty of ₹25,000, & even questioned her expense claims. Meena didn’t evade tax, but her lack of recordkeeping told another story — one of negligence.

That’s why I often tell clients: keeping proper books isn’t a luxury; it’s a safety net.

Can This Penalty Be Avoided or Waived?

Yes, and thankfully, the law allows room for genuine hardship.

Under Section 273B, if you can prove that your failure to maintain books happened due to a reasonable cause, the penalty may be waived.

For instance:

- Your records were lost in a flood, fire, or theft.

- You changed accountants or software, & data was accidentally deleted.

- You were genuinely unaware of a compliance obligation as a first-time small entrepreneur.

However, the burden of proof is on you. In my experience, if you can show that there was no deliberate intention to hide information, most officers are fair in granting relief.

Also Read: Penalty for Under-Reporting and Misreporting of Income

Common Mistakes That Lead to Section 271A Penalties

- Relying solely on bank statements or UPI screenshots.

They show transactions, not purpose. - Not maintaining supporting vouchers or invoices.

If the expense can’t be matched with a bill, it’s invalid. - Using multiple personal and business accounts.

This confuses both auditors & the tax department. - Forgetting digital retention.

If you delete old data, you lose your defence. - Ignoring professional help.

A CA’s basic record review can prevent months of trouble.

These may sound minor, but every small omission gives the department a reason to doubt.

Difference Between Section 271A and 271B

|

Particulars |

Section 271A |

Section 271B |

|

Applicability |

Failure to maintain or retain books of account |

Failure to get existing books audited |

|

Penalty |

₹25,000 (fixed) |

0.5% of turnover, up to ₹1.5 lakh |

|

Stage |

Before audit stage |

After audit becomes applicable |

|

Relief under 273B |

Available |

Available |

Understanding this distinction is vital. I’ve seen many small firms panic over audit notices when the real issue was non-maintenance, not non-audit.

How to Stay Compliant and Avoid Penalties

Here’s my go-to checklist for clients:

- Maintain digital ledgers — use accounting tools like Tally, Zoho, or even Excel.

- Keep soft copies of invoices & bills; paper fades, but PDFs don’t."

- Reconcile bank accounts monthly.

- Hire a CA for quarterly reviews instead of waiting for year-end panic.

- Store everything — physical or digital — for at least six years.

In short, treat bookkeeping like insurance. You hope you’ll never need it — but when the notice comes, you’ll be grateful you have it.

Also Read: When TDS Defaults Turn Into Criminal Offences

Final Thoughts

Section 271A isn’t just a compliance clause — it’s a reminder that every transaction tells a story, and those stories must be recorded. Maintaining proper books isn’t about fearing the tax department. It’s about protecting your business from misinterpretation, over-assessment, or unnecessary stress later.

If you’re unsure whether your records are up to date, or if you’ve already received a notice & don’t know what to do next — don’t wait.

👉 Our experts at CallMyCA.com can review your books, fix compliance gaps, and help you stay audit-ready before the taxman does.

A quick consultation today could save you far more than ₹25,000 — it could save your peace of mind.