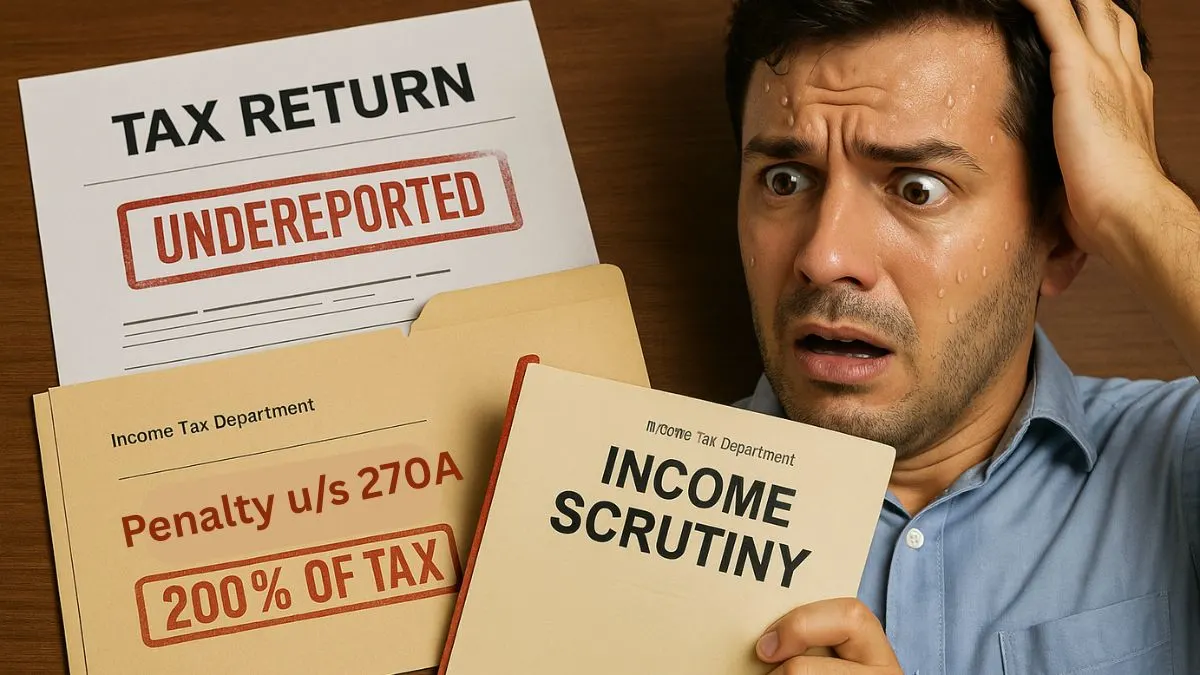

If you thought skipping a small disclosure or making an innocent “error” in your ITR was no big deal, think again. Section 270A of the Income Tax Act is here to make sure taxpayers stay honest & thorough with their declarations. This section introduces stringent penalties on under-reporting or misreporting of income, ensuring that tax evasion, in any form, is dealt with firmly.

What is Section 270A?

Section 270A of the Income Tax Act, introduced by the Finance Act 2016 & effective from Assessment Year 2017-18 onwards, deals with penalties for under-reporting & misreporting of income. The intention is clear — to shift from a voluntary disclosure system to a deterrent-based compliance framework. “

This section imposes a 50% penalty on the tax payable on under-reported income & a 200% penalty on the tax due in cases of misreporting of income. Sounds scary? It’s meant to be.

What is Under-Reporting of Income?

Under-reporting doesn’t always mean blatant tax evasion. It can arise due to:

- Miscalculation of income

- Ignoring taxable allowances or benefits

- Failing to include interest income or rental income

- Not disclosing capital gains

In such cases, if the income assessed by the tax authorities is more than what was declared in your ITR, you might be in trouble under this section.

As per Section 270A, a 50% penalty is levied on the tax due on such under-reported income. So, if your under-reporting results in ₹1 lakh extra tax, be ready to pay ₹50,000 as a penalty. “

What is Misreporting of Income?

Misreporting is graver. It includes:

- Failure to report investments

- False claims of deductions (e.g., fake 80C receipts)

- Claiming fake losses to reduce taxable income

- Hiding foreign income or assets

In such instances, the law considers it intentional. So, the penalty is harsher — 200% of the tax due on misreported income.

For example, if someone claims a fake donation of ₹2 lakh to save ₹60,000 in tax, they will have to pay ₹1.2 lakh as a penalty under misreporting provisions. Painful, right?

When is a Penalty under Section 270A Applicable?

Penalty is leviable under section 270A if:

- The taxpayer has under-reported income in return of income filed under Section 139

- A reassessment order (under Section 147 or 153A) finds more income than originally declared

- There is a failure to file a return & income is later discovered

- Incorrect reports by tax professionals or false entries have been used

If the taxpayer is said to have under-reported or misreported their income, this section automatically kicks in. No waiting for another show-cause — the penalty will be imposed along with the assessment.

Can You Avoid the Penalty?

Good news: Yes, but only in specific cases.

You can avoid a penalty if:

- You have filed the revised return voluntarily under Section 139(5) before any notice is issued.

- You can prove that the under-reporting was a genuine error & not intentional.

- The Assessing Officer accepts your explanation & feels there's no deliberate misreporting.

But if it is found to be a deliberate act, the scope of relief narrows significantly.

Penalty Calculation Example

Let’s say you declared a total income of ₹10,00,000, but during assessment, it’s found that you under-reported ₹4,00,000 more (say, rent not included).

- Tax on ₹4 lakh (under-reported income) = ₹1,00,000 (approx.)

- Penalty @ 50% for under-reporting = ₹50,000

Now, if this ₹4 lakh was from an undisclosed second property & considered misreporting:

- Penalty @ 200% = ₹2,00,000

Common Scenarios Leading to Penalty Under Section 270A

- Inflated business expenses

- Claiming HRA without paying rent

- Not reporting foreign bank accounts

- Fictitious donations under 80G

- Fake LTCG claims on penny stocks

Such red flags are easily caught by data analytics now used by the Income Tax Department.

Keywords for Quick Understanding

Let’s reiterate the critical keywords here naturally:

- Penalty for under-reporting & misreporting of income is governed under Section 270A of the Income Tax Act.

- This section imposes a 50% penalty on tax due for under-reported income.

- If the act qualifies as misreporting, then a 200% penalty is applicable.

- A penalty is leviable if an assessee is said to have under-reported or mis-reported income.

- It offers penalties for misreporting income, intending to deter wrong declarations.

Final Words — Avoid the Trap

In the world of taxation, being “smart” can cost you more than being honest. With Section 270A in place, the cost of non-compliance is steep & swift. Whether you’re a salaried individual, a business owner, or a professional, make sure your return is clean, accurate, & full-proof.

💡 Need help filing your taxes accurately & avoiding penalties under Section 270A? Our team at Callmyca.com can help you stay compliant and stress-free. Book your tax advisory now!