When it comes to personal finance, filing your Income Tax Return (ITR) isn't just a routine formality—it's a legal obligation under Section 139 of the Income Tax Act. Whether you're a salaried employee, a business owner, or even a political party, understanding the implications of this section can save you from penalties and legal hassles.

What Is Section 139 of the Income Tax Act?

Section 139 mandates taxpayers to file their Income Tax Returns by the stipulated time frame. It outlines who must file returns, under what circumstances, & what exemptions or relaxations are applicable. This section is a foundational piece of the Indian tax structure.

Who Needs to File Income Tax Returns Under Section 139?

According to Section 139, the following individuals or entities are required to file returns:

- Individuals with taxable income: If your total income exceeds the basic exemption limit, you are required to file an ITR.

- Companies and firms: All companies & partnership firms must file income tax returns, regardless of their profit or loss status.

- Political parties: Yes, even political parties are not exempt. Section 139 requires political parties to file an Income Tax Return to maintain transparency in their finances.

- Trusts and institutions claiming tax exemptions.

Digital India, Digital Taxes

With the rise in technology adoption, you can e-file your income tax return on your income from salary, house, or any other source via the official Income Tax portal. It has made the process quick, paperless, and accessible for millions of Indian taxpayers. "

Why Is It Important?

Filing under Section 139 is crucial for multiple reasons:

- Avoid penalties: Not filing your ITR by the due date can result in fines and legal issues.

- Loan approvals: Banks often request ITR records as proof of income when processing home or business loans.

- Visa applications: Several embassies demand ITR records for the past few years when you apply for a visa.

- TDS refunds: If excess Tax Deducted at Source (TDS) has been collected, filing an ITR is essential to claim a refund.

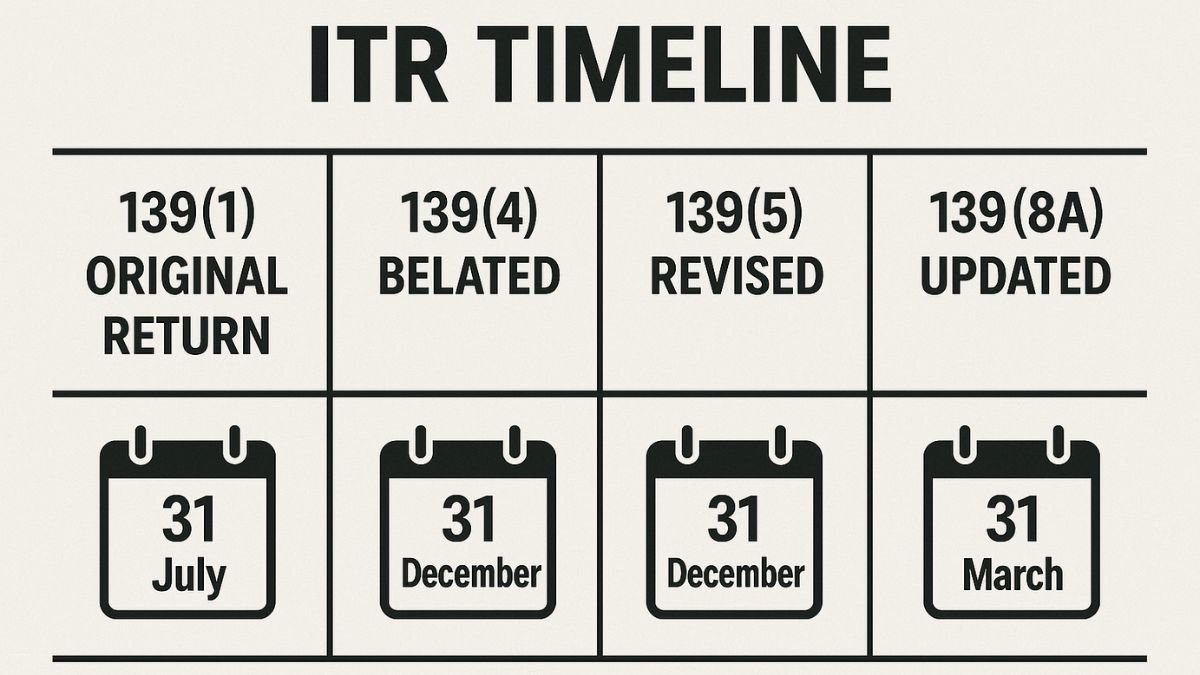

Filing Due Dates for Section 139

For most individual taxpayers, the due date to file the return is 31st July of the assessment year. However, this can vary for businesses or individuals requiring audits. If you're late, you may still file a belated return under Section 139(4) or an updated return under Section 139(8A), albeit with additional penalties. "

Special Provisions for Political Parties

Interestingly, the Income Tax Act not only focuses on salaried individuals & corporates but also holds political entities accountable. Section 139 requires political parties to file Income Tax Return to ensure financial transparency & prevent misuse of funds. Failure to comply can lead to the cancellation of tax exemptions.

How Does Section 139 Help You?

- Claim refunds: If TDS has been deducted more than required, ITR filing is the only way to get it back.

- Carry forward losses: You can carry forward losses for future tax adjustments only if you file ITR before the deadline.

- Proof of income: Your ITR acts as official proof of income for visa, loans, and other applications.

Who Benefits from This Section?

Section 139 is especially beneficial to:

- Salaried employees

- Self-employed professionals

- Freelancers

- NRIs with Indian income

- Individuals with multiple income sources

- Political entities

What Happens If You Don’t File Under Section 139?

If you fail to file your return on time:

- You may face a penalty under Section 234F, which can go up to ₹5,000 or more.

- You may lose the ability to carry forward your business or capital losses.

- Interest under Section 234A may be charged for late filing.