Robert Kiyosaki is again sounding the alarm about the global financial system, calling it deeply flawed and increasingly unstable. Known for his bestselling book Rich Dad Poor Dad, Kiyosaki has reiterated his belief that the “biggest crash in history” is fast approaching and that traditional savings are no longer safe.

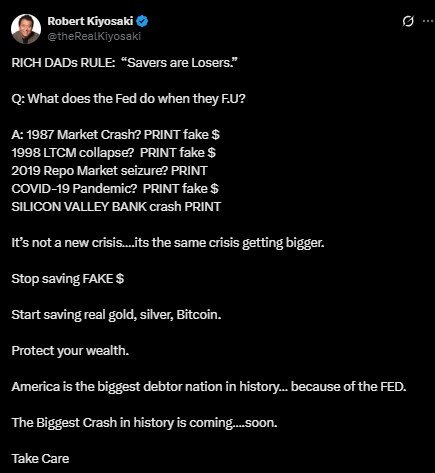

In his latest social media post, he wrote, “Stop saving FAKE Dollars,” encouraging his followers to “Start saving gold, silver, Bitcoin.” The statement echoes his long-held financial philosophy:

“Rich Dad Rule: 'Savers are losers.’”

Why Kiyosaki Says the System Is Doomed

Robert Kiyosaki is again sounding the alarm about the global financial system, citing that the U.S. Federal Reserve’s constant money printing in response to crises is destroying the long-term value of fiat currencies. He blames this monetary policy for inflating bubbles and increasing national debt.

Kiyosaki pointed to major historical crashes—the 1987 market collapse, the 1998 LTCM failure, the 2019 repo crisis, the COVID-19 meltdown, and the 2023 Silicon Valley Bank crash—as examples where the U.S. simply responded by printing more money.

“It’s not a new crisis… It’s the same crisis getting bigger,” he argued, calling America “the biggest debtor nation in history.”

Real Assets Over Paper Money

Staying true to his views, Kiyosaki urges investors to embrace gold, silver and Bitcoin. He believes these are tangible, value-holding assets that can safeguard wealth when the system fails. According to him, saving real gold, silver, Bitcoin is the only way to protect yourself from what’s coming.

He predicts silver is still “significantly undervalued” and could double in price, citing its utility and scarcity."

Why Investors Are Listening

While Kiyosaki’s views are often seen as bold and even controversial, a growing base of investors has started aligning with his message. The increasing distrust in fiat currency and the fear of inflation have made many rethink their traditional investment strategies.

With central banks continuing expansionary policies, even seasoned investors are looking at Bitcoin, gold, and silver as safer long-term bets.

Also Read: Kriti Sanon's HYPHEN: How a Celebrity Co-Founder Built a ₹400 Cr D2C Brand in Just 2 Years

Final Thoughts: Rethink Your Wealth Strategy

This latest statement from Kiyosaki reaffirms his core message—stay away from cash and paper assets and prioritise alternatives that hold intrinsic value."

So, whether you’re a conservative investor or someone just starting out, it may be time to evaluate how much of your portfolio is exposed to real assets like gold, silver, and Bitcoin—and how prepared you are for a market crash.