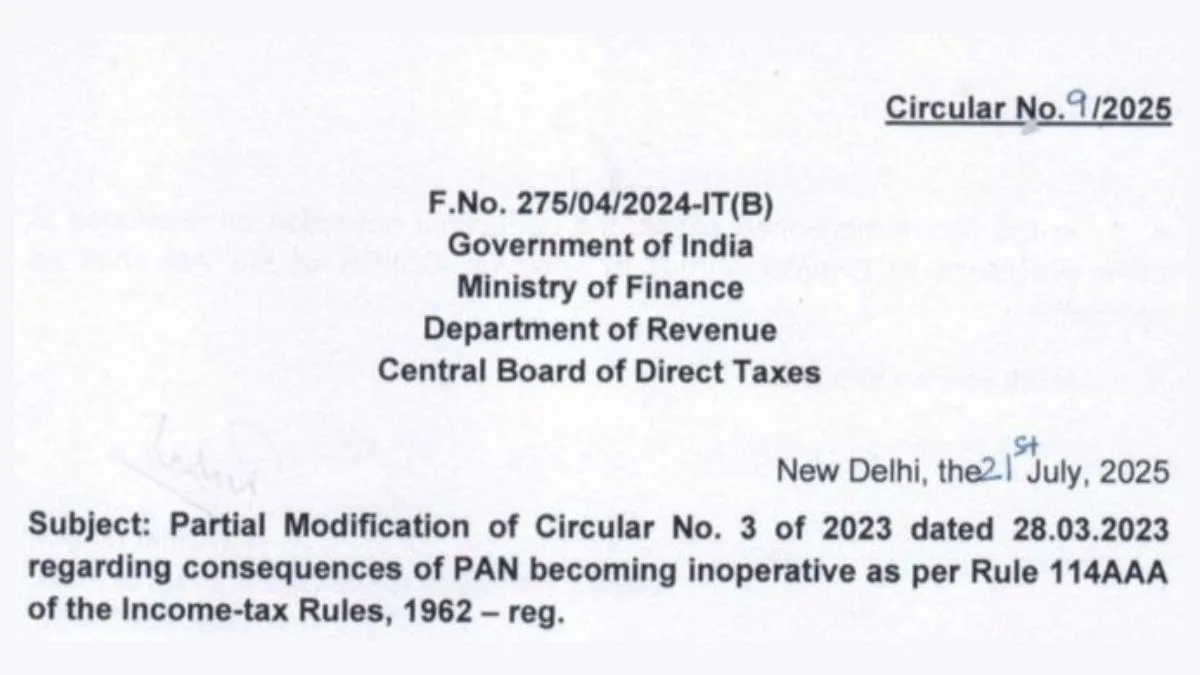

In a much-needed move, the Income Tax Department has issued Circular No. 09/2025, offering major relief to taxpayers and deductors dealing with inoperative PAN issues due to non-linking with Aadhaar.

This update is especially relevant for individuals and businesses struggling to manage TDS/TCS compliances under higher rates due to a delayed PAN-Aadhaar linkage. Now, you have another opportunity to link your PAN with Aadhaar without facing harsh consequences.

Let’s break down what this circular means & how it impacts you.

What’s the Relief About?

According to the circular, higher TDS/TCS rates will not apply if certain conditions are met during specific timeframes:

Scenario 1: Transactions Between 01.04.2024 and 31.07.2025

- If your PAN was inoperative during this time due to non-linkage with Aadhaar,

- But you linked your PAN on or before 30th September 2025,

➡️ You’ll be exempted from higher TDS/TCS rates.

Scenario 2: Transactions On or After 01.08.2025

- If the payment/credit happens after August 1, 2025,

- And you link your PAN within 2 months from the end of that month,

➡️ You’ll still be eligible for rolling relief, avoiding punitive higher rates."

This provision essentially creates a 2-month compliance window, allowing deductors & collectors to act without facing interest penalties or higher tax rates due to administrative delays.

Who Benefits from the Circular?

The circular gives relief to taxpayers & deductors, especially those:

- Facing PAN inoperative status, but taking steps to link Aadhaar soon

- Worried about TDS or TCS being deducted at 20% or more in the absence of linkage

- Collectors/deductors managing large volume payments and remittances

It’s particularly impactful for salaried individuals, freelancers, vendors, & anyone who missed the earlier PAN-Aadhaar linking deadline.

Also Read: ITR Filing FY 2024–25: 5 Hidden Home Loan Tax Benefits Every Taxpayer Should Know

Quick Snapshot of Key Circulars

|

Circular |

Transaction Period |

Relief Granted |

|

06/2024 |

Up to 31.03.2024 |

Relief from the higher rate if PAN becomes operative |

|

09/2025 |

01.04.2024 to 31.07.2025 |

Exemption from higher TDS/TCS rates if PAN is linked by 30.09.2025 |

|

09/2025 |

On or after 01.08.2025 |

Rolling relief continues based on timely PAN-Aadhaar linkage |

Final Takeaway: Avoid Penalties, Ensure Compliance

This circular is a welcome step toward enabling ease of compliance without penalising genuine delays. If your PAN is still inoperative, this is your chance to get it corrected & avoid higher TDS or TCS deductions."

✔️ Check your PAN-Aadhaar linkage status now

✔️ Advise your deductors/collectors about this 2-month relief window

✔️ Link PAN with Aadhaar before the new timelines end

Stay ahead of compliance issues and help others in your network stay informed.

Need help checking your PAN-Aadhaar status or resolving TDS/TCS issues? Our experts at Callmyca.com can handle it all before you miss the deadline again.