When we think of Tax Deducted at Source (TDS), we often associate it with businesses and organisations. But did you know that even individuals & Hindu Undivided Families (HUFs) might be required to deduct TDS in certain cases?

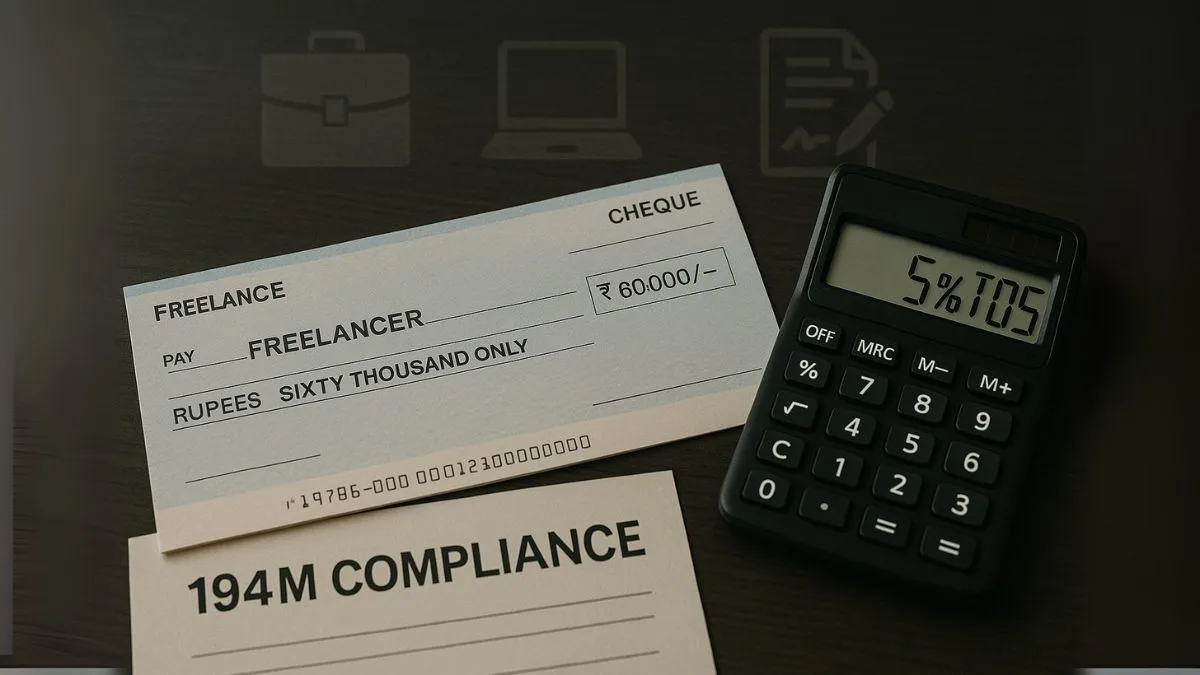

Yes, that’s where Section 194M of the Income Tax Act steps in. It was introduced to plug a major loophole where high-value payments were escaping the TDS net just because the payer wasn’t engaged in business or didn’t require a tax audit. So let’s decode this section in a simple, practical way.

What is Section 194M of the Income Tax Act?

Section 194M provides for tax deduction at source on certain high-value payments made by individuals or HUFs who are not required to deduct TDS under any other provisions like 194C, 194H, or 194J.

This means if you're not running a business but you're paying someone a substantial amount for work, TDS might still apply."

Who Needs to Deduct TDS Under 194M?

Section 194M applies when:

- An individual or HUF is making a payment to a resident contractor or professional.

- The aggregate payment exceeds ₹50 lakh in a financial year.

- The individual/HUF is not required to deduct TDS under other sections like 194C or 194J (i.e., not liable to tax audit).

In such cases, TDS at the rate of 5% must be deducted.

Let’s take an example:

Suppose you hire a wedding planner and pay ₹55 lakh for the services. You’re just a salaried individual, not running any business. In that case, even though you’re not liable for tax audit, Section 194M kicks in, & you must deduct 5% TDS on the ₹55 lakh.

Threshold Limit and Key Features

- Section 194M has a threshold limit of ₹50 lakh. That means TDS is deducted only when such sum, or aggregate of such sums, exceeds fifty lakh rupees in a year.

- TDS on payments made to resident individuals must be deducted at 5%.

- Section 194M applies to both lump sum & instalment payments, which means splitting the amount into parts doesn’t help you escape TDS.

- It specifies TDS requirements for payments made by individuals or HUFs, even when they are not running a business.

Types of Payments Covered

Section 194M covers payments made to a resident contractor or professional for services rendered or work done. This includes:

- Wedding planning

- Home renovation

- Architectural work

- Legal services

- Consultancy

- Photography/videography

- Freelance designing

And the list goes on…

What About the Due Date for Depositing TDS?

Interestingly, no due date has been prescribed separately for depositing the tax deducted under Section 194M. However, the general TDS rules apply. That is:

- If tax is deducted in March, deposit it by April 30.

- For other months, deposit within 7 days from the end of the month in which TDS was deducted.

Also, Form 26QD must be filed within 30 days from the end of the month in which TDS was deducted."

PAN of Payee is Mandatory

If the person receiving the payment does not furnish their PAN, TDS will be deducted at 20% instead of 5%. So, make sure you collect the PAN before making high-value payments.

Exemptions Under Section 194M

- Payments made for personal purposes below ₹50 lakh are not subject to TDS.

- TDS under Section 194M does not apply if TDS has already been deducted under Sections 194C, 194J, etc.

So if you’re a business owner and have already deducted TDS under another section, you don’t need to deduct again under 194M.

Compliance Made Easy

The good part? The government has simplified the process for individuals:

- No need to obtain a TAN (Tax Deduction & Collection Account Number)

- TDS is deposited using PAN through Form 26QD

- TDS certificate can be issued using Form 16D

Why Was Section 194M Introduced?

Before 194M, many high-value transactions were escaping TDS simply because the payer was not a business entity. This led to revenue leakage. The introduction of this section ensures that even personal payments above ₹50 lakh are brought into the tax net, making the system fairer and more inclusive.

Final Word

If you’re an individual making large payments for personal or professional services, Section 194M is something you can’t afford to ignore. It's better to comply than to face penalties later.

Need help with TDS filing or understanding your obligations under Section 194M?

👉 Book your service now at Callmyca.com – we make tax compliance effortless for you!