In a business-driven economy, commissions & brokerage payments are a daily occurrence. But did you know that Section 194H of the Income Tax Act requires you to deduct TDS on such payments?

Yes, even that small commission you pay to an agent or middleman comes under tax compliance.

Let’s break it down for you—simple, clear, & complete.

📌 What is Section 194H of the Income Tax Act?

Section 194H mandates the deduction of Tax Deducted at Source (TDS) on commission & brokerage payments made to residents. Whether you're an organisation, professional, or service provider, if you’re paying commission, the Income Tax Department expects you to deduct tax before payment.

This section governs the deduction of tax at source (TDS) on commission or brokerage income, ensuring the government gets its dues at the point of transaction. “

🧾 Applicability: Who Needs to Deduct TDS Under 194H?

If you’re making payments classified as “commission” or “brokerage,” & your turnover exceeds ₹1 crore (business) or ₹50 lakhs (profession) in the previous financial year, you are required to deduct TDS.

Also, it doesn’t matter if the payment is in cash, cheque, or bank transfer—the rule applies to all modes. “

💸 What Falls Under “Commission or Brokerage”?

The term covers payments received (directly or indirectly) for:

- Services rendered (except professional services)

- Buying or selling of goods

- Transactions related to property or assets

- Referral-based earnings

- Any middleman fee in business dealings

So,o yes, Commission or Brokerage as per section 194H of the IT Act can be pretty broad.

📉 TDS Rate & Threshold Limit Under Section 194H

Section 194H requires the payer to deduct TDS at the rate of 2% on the amount paid as commission or brokerage.

📍 Threshold Limit:

No TDS is required if the total commission or brokerage paid to a person during the financial year does not exceed ₹15,000.

✅ Important: If the payee doesn’t furnish PAN, TDS may be deducted at a higher rate (20%).

📅 When Should TDS Be Deducted?

TDS must be deducted either at the time of credit to the payee’s account or at the time of actual payment, whichever is earlier.

🧾 Example:

You promise a brokerage of ₹50,000 on April 1 & make the payment on April 15. TDS must be deducted on April 1 itself (unless otherwise specified in your agreement).

📤 TDS Return and Form to Use

- Return Form: Form 26Q

- Certificate to Payee: Form 16A

- Due Dates: Quarterly filing deadlines apply (e.g., 31st July for Q1)

❗ Exemptions & Exceptions

- No TDS if paid to a banking company, insurance agent (under some conditions), or certain government entities.

- Section 194H does not apply to salary payments (covered under Section 192)

- GST component is not subject to TDS if shown separately.

✅ Conclusion

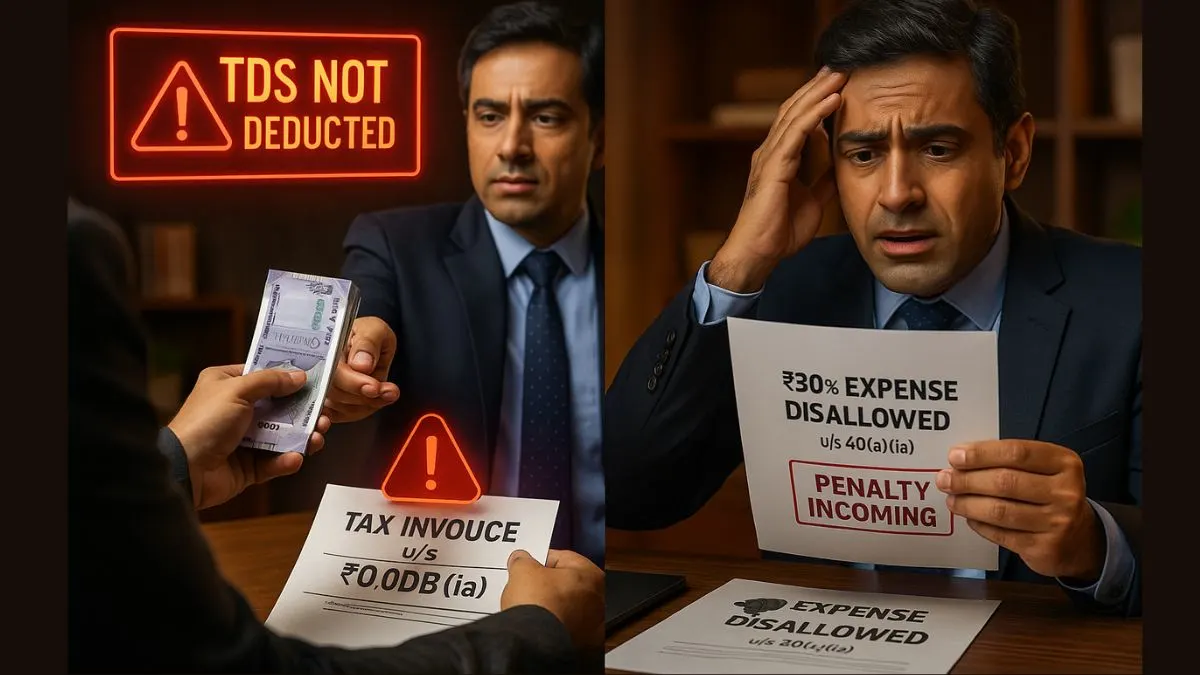

In simple terms, Section 194H addresses the deduction of tax at source (TDS) from commission or brokerage payments. Ignoring this can result in penalties, disallowance of expenses, & legal trouble. Whether you're a business owner or service provider, staying informed & compliant is the smart choice.

💡 Confused about whether TDS applies to your next brokerage payment?

Let our experts handle it while you focus on your business.

👉 Callmyca.com — Where compliance meets peace of mind.