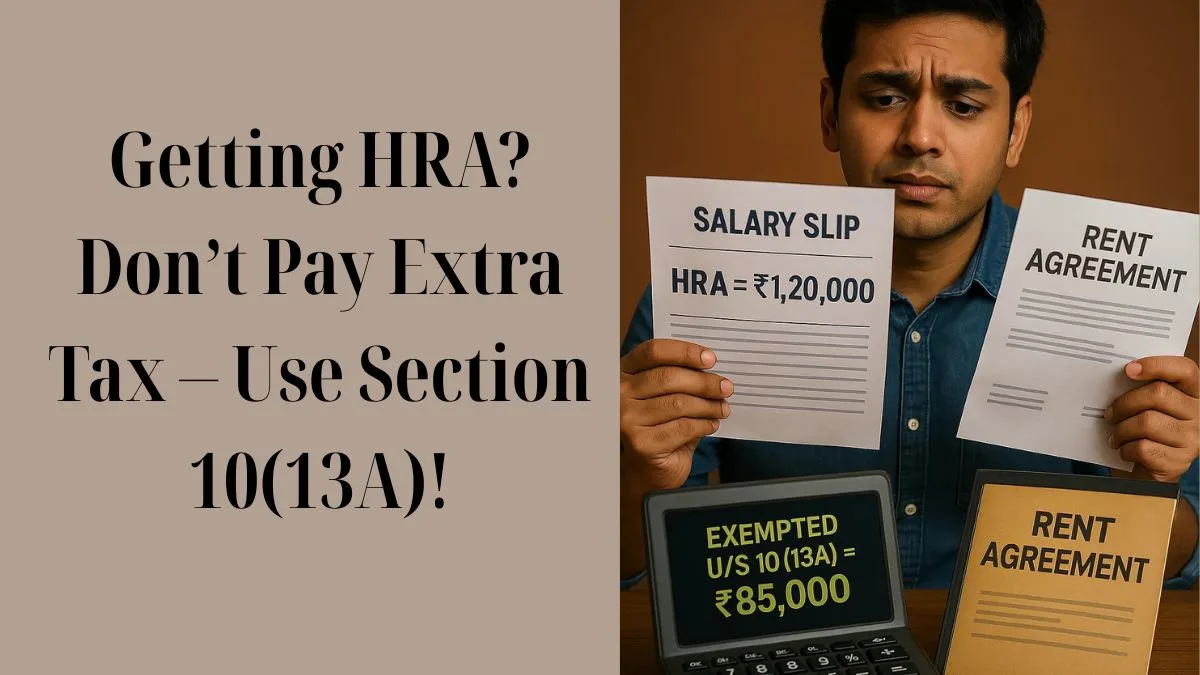

In India, rent is one of the biggest expenses for salaried employees. Thankfully, the Income Tax Act provides some relief in the form of House Rent Allowance (HRA). If you're a salaried employee receiving HRA and paying rent, you might be eligible for an income tax exemption. This benefit is governed by Section 10(13A) of the Income Tax Act.

Let’s simplify everything you need to know about claiming this deduction.

📌 What is Section 10(13A) of Income Tax Act?

Section 10(13A) of the Income Tax Act governs the rules for claiming HRA exemption. It allows salaried individuals to claim a tax exemption on HRA, reducing their taxable income. This section specifically provides for the exemption of House Rent Allowance (HRA) from income tax.

In simpler words, an employee who is in receipt of House Rent Allowance (HRA) & pays rent can claim this deduction. However, the exemption is not absolute—some limits & rules define how much can be exempted. "

🧾 Is HRA Fully Taxable?

No, HRA is not fully taxable. Only the portion that exceeds the exempt amount calculated under Section 10(13A) is taxable.

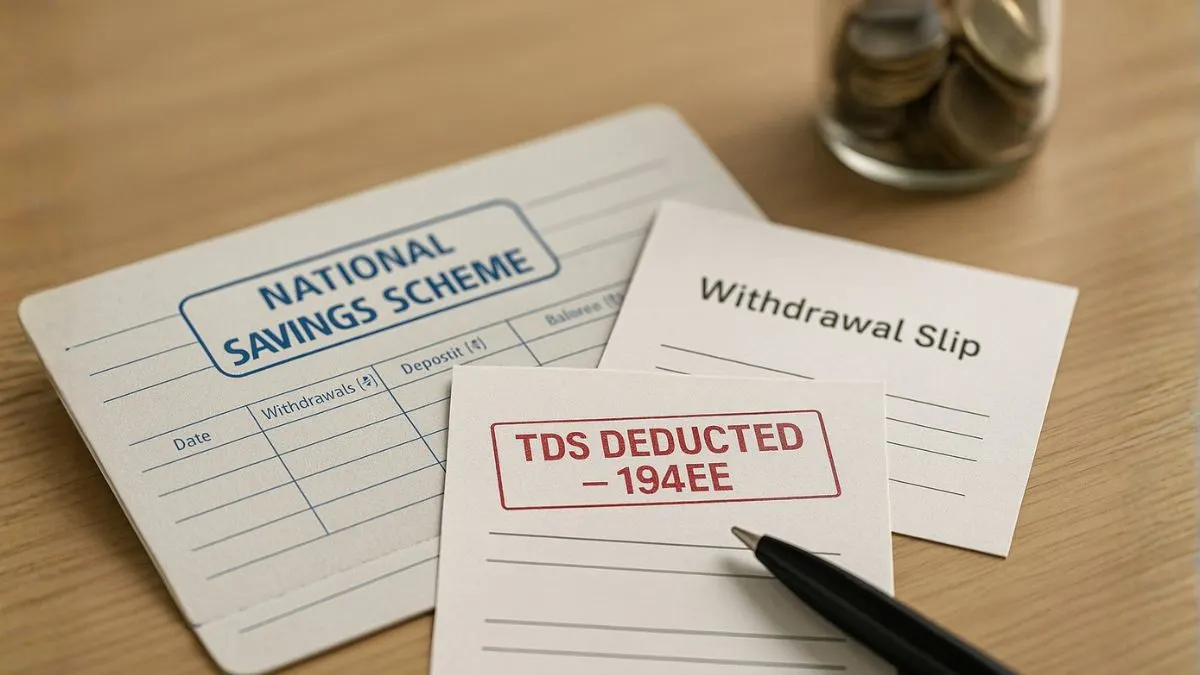

You can calculate your HRA exemption based on the least of the following three:

- Actual HRA received

- 50% of salary if living in a metro city (Delhi, Mumbai, Kolkata, Chennai); 40% otherwise

- Actual rent paid minus 10% of salary

✅ Example: If your salary is ₹40,000/month and you live in Delhi, paying ₹15,000 rent, your HRA exemption will be calculated using the above criteria. The lowest of the three will be the exempt portion. "

💼 Who Can Claim HRA Under Section 10(13A)?

The exemption is allowed under Section 10(13A) only to salaried individuals who live in a rented house and receive HRA as part of their salary. It is not available to self-employed individuals.

📌 Remember: Even if your salary includes HRA, you must submit rent receipts and a rent agreement to your employer or claim while filing your ITR.

🏠 What If You Live with Parents?

You can still claim an HRA exemption if you're paying rent to your parents. However, a valid rent agreement is required, & your parents should report the rent received as income on their tax return.

❌ What If You Don’t Pay Rent?

If you stay in your own house or do not pay rent, then you are not eligible for exemption under this section.

🗓️ Documentation Required for Claiming HRA

To claim the exemption under Section 10(13A), ensure:

- You receive HRA from your employer.

- You pay rent.

- You maintain rent receipts.

- A PAN of the landlord is mandatory if the annual rent exceeds ₹1 lakh.

📅 Applicability and Limitations

The exemption applies only to salaried individuals residing in rented accommodation. Also, you can only claim this for the months you paid rent.

The maximum limit of HRA exemption will depend on your salary structure and rent paid. Section 10(13A) of the Income Tax Act 1961 clearly defines these rules & their implementation.

✅ Key Takeaways

- Exemption is allowed under Section 10(13A) for salaried employees receiving HRA.

- HRA received is not fully taxable.

- You can claim a tax exemption on your HRA under Section 10(13A).

- Maintain proper documentation like rent agreement, rent receipts, and the landlord’s PAN.

- Section 10 13a of the Income Tax Act is your reference point for understanding the exemption.

Whether you're new to filing taxes or just want to optimise your deductions, understanding Section 10(13A) is essential. Don’t leave money on the table—if you’re paying rent and receiving HRA, make sure you claim this benefit properly.

If you still have questions about how to calculate your HRA exemption or file your return correctly, feel free to consult a tax expert or use our HRA calculator tool.