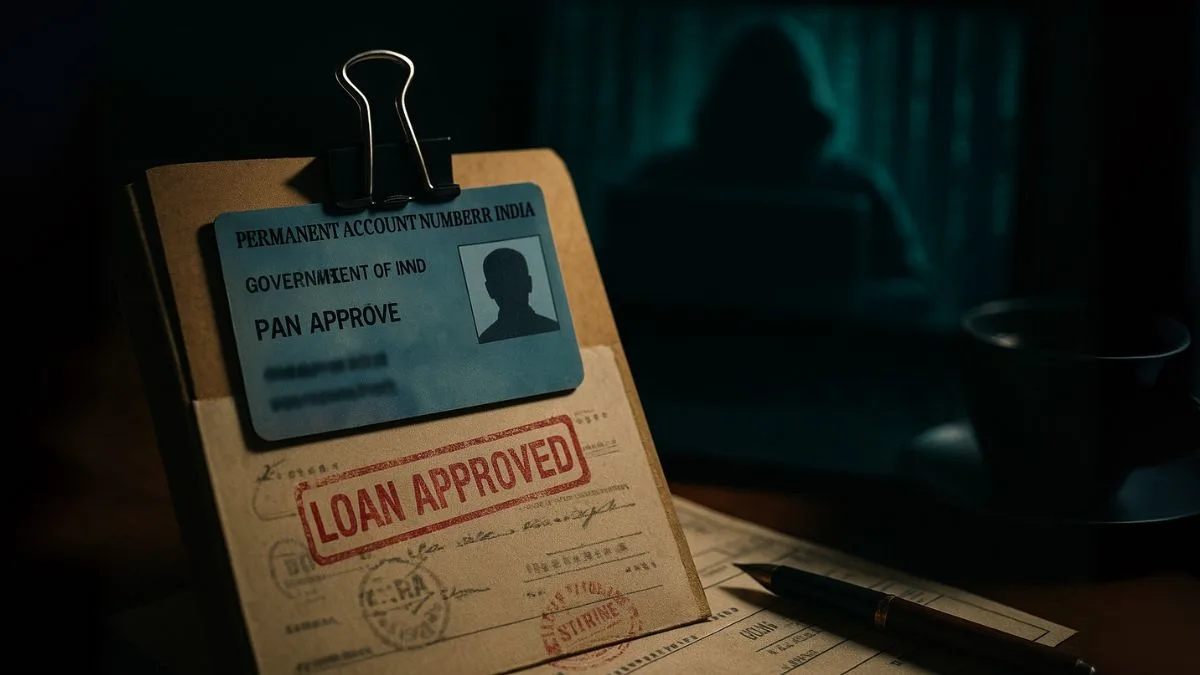

In today’s digital age, identity theft is no longer a far-fetched threat—it’s real, growing, and shockingly common. One of the most dangerous forms of this fraud is the PAN card scam, where cybercriminals use your PAN details to take a loan in your name without your knowledge.

Imagine waking up one day and discovering you're being chased by a bank for a loan you never applied for. Terrifying, right? The good news is—there are smart ways to detect & prevent it before it ruins your credit history.

Let’s explore how to identify if someone is misusing your PAN card, how to check your CIBIL report, and the steps to take if you've been scammed.

What is a PAN Card Scam?

A PAN card scam happens when fraudsters obtain your Permanent Account Number (PAN)—a unique 10-digit alphanumeric identifier issued by the Income Tax Department—and use it to:

- Apply for instant personal loans

- Create fake bank accounts

- Conduct high-value transactions

- Commit tax fraud or money laundering

Since your PAN is linked to all major financial & tax-related activities, its misuse can wreck your credit score, financial credibility, and peace of mind.

Warning Signs: How to Know If a Loan Is Taken in Your Name

- You get calls for EMI default on a loan you never took

- Banks or NBFCs deny you new credit citing poor credit score

- Unexpected drop in your CIBIL score

- You receive SMS alerts or emails about loan approvals or rejections

- Unknown loan accounts appear when you view your credit report

Even one of these should ring alarm bells.

How Does the Fraud Happen?

Here are common ways your PAN details may be compromised:

- Sharing PAN copies during KYC without watermark or masking

- Uploading PAN on unsecured websites or apps

- Misuse by agents, HR departments, or cyber cafes

- Data leaks from loan apps or social media accounts

- Stolen documents, phishing emails, or fake eKYC links

How to Check If Someone Is Using Your PAN to Take a Loan

One of the most effective ways to detect misuse is by checking your CIBIL report regularly. Your CIBIL report (or any credit report from Equifax, Experian, CRIF) shows all loans, credit cards, and credit inquiries made using your PAN.

You can check if someone is using your PAN card by checking your CIBIL score or credit score."

Here’s how to do it:

✅ Step 1: Visit CIBIL or any credit bureau's official site

✅ Step 2: Log in or sign up using your PAN & mobile number

✅ Step 3: Verify with OTP and view your credit report

✅ Step 4: Look for:

- Any loans or accounts you don’t recognize

- Sudden drop in credit score

- Multiple loan inquiries in a short period

🛑 Checking your CIBIL report at least once every 3 months is a healthy financial habit.

Also Read: Trump’s 25% Tariff: Impact on India’s Economy & Your Portfolio

Other Ways to Stay Alert

- Check SMS and email alerts from banks/NBFCs regularly

- Register with credit monitoring tools that send alerts on changes in your report

- Use MyCAMS or Karvy to track mutual fund KYC linked to PAN

- File an income tax login & check Form 26AS for suspicious transactions

What to Do If You Find a Loan You Didn't Take

If you find a loan or credit card in your name that you didn’t apply for, take these immediate steps:

- Raise a Dispute with the Credit Bureau

- Go to CIBIL/Experian/CRIF website

- Select the disputed loan account

- Explain that the account does not belong to you

- Attach supporting documents (ID proof, complaint letter)

- Report to the Bank or NBFC

- Contact the lender listed in your CIBIL report

- Share your PAN & proof that the loan is fake

- Request closure or investigation into the fraudulent loan

- File a Police Complaint

- Visit the local cyber crime police station

- Submit a written complaint stating PAN misuse

- Keep a copy of the FIR or acknowledgement

- Notify the Income Tax Department

- If high-value transactions are seen under your PAN, write to TIN-NSDL or Income Tax department with supporting documents

- Update UIDAI or PAN Database if Required

- If you suspect a PAN card has been duplicated or cloned, apply for re-issuance or correction

Preventive Measures: How to Protect Your PAN from Misuse

- Always write “For KYC purpose only” and date on photocopies of your PAN

- Don’t upload PAN publicly on LinkedIn, job portals, or unsecured apps

- Mask or blur the middle part (e.g., ALPXXXXX9Q) when sharing

- Enable SMS/email alerts for all bank activities

- Use official apps and government-authorized loan platforms only

- Do not trust instant loan offers via WhatsApp or SMS

Remember: once your PAN is compromised, reversing the damage takes time & legal effort. Prevention is better (and cheaper) than cure."

Real-Life Example

Rohit, a 32-year-old IT professional, applied for a home loan and was shocked to be rejected due to an existing unpaid personal loan. He had never taken one.

On viewing his credit report, he discovered a ₹1.5 lakh loan taken six months ago from a digital NBFC. After filing a complaint with CIBIL and the police, & following up for 3 months, the loan was finally removed from his report.

The scam had started when he uploaded his PAN on a job search site without watermarking it.

Also Read: Stock Market Profits, No Tax? The 87A Trick Most Investors Miss

Final Thoughts

A stolen PAN can be the gateway to financial fraud that silently ruins your creditworthiness. If you suspect misuse, checking your CIBIL report is your first line of defense. Staying alert, watching your credit score, and taking immediate action can protect you from deep financial and legal trouble.

So, next time you share your PAN—pause & think: Is it really safe?