Tax compliance can be one of the biggest challenges for small businesses, freelancers, and professionals. Maintaining detailed books of accounts, getting audits, and justifying every expense often consumes time, money, and energy. To ease this burden, the government introduced the concept of presumptive income taxation under Sections 44AD, 44ADA, and 44AE of the Income Tax Act.

Under this system, eligible taxpayers don’t need to maintain exhaustive records. Instead, they declare income at a prescribed rate of their total turnover or gross receipts. This scheme is particularly useful for shop owners, small contractors, doctors, lawyers, architects, and other professionals who prefer simplicity over paperwork.

What is Presumptive Income?

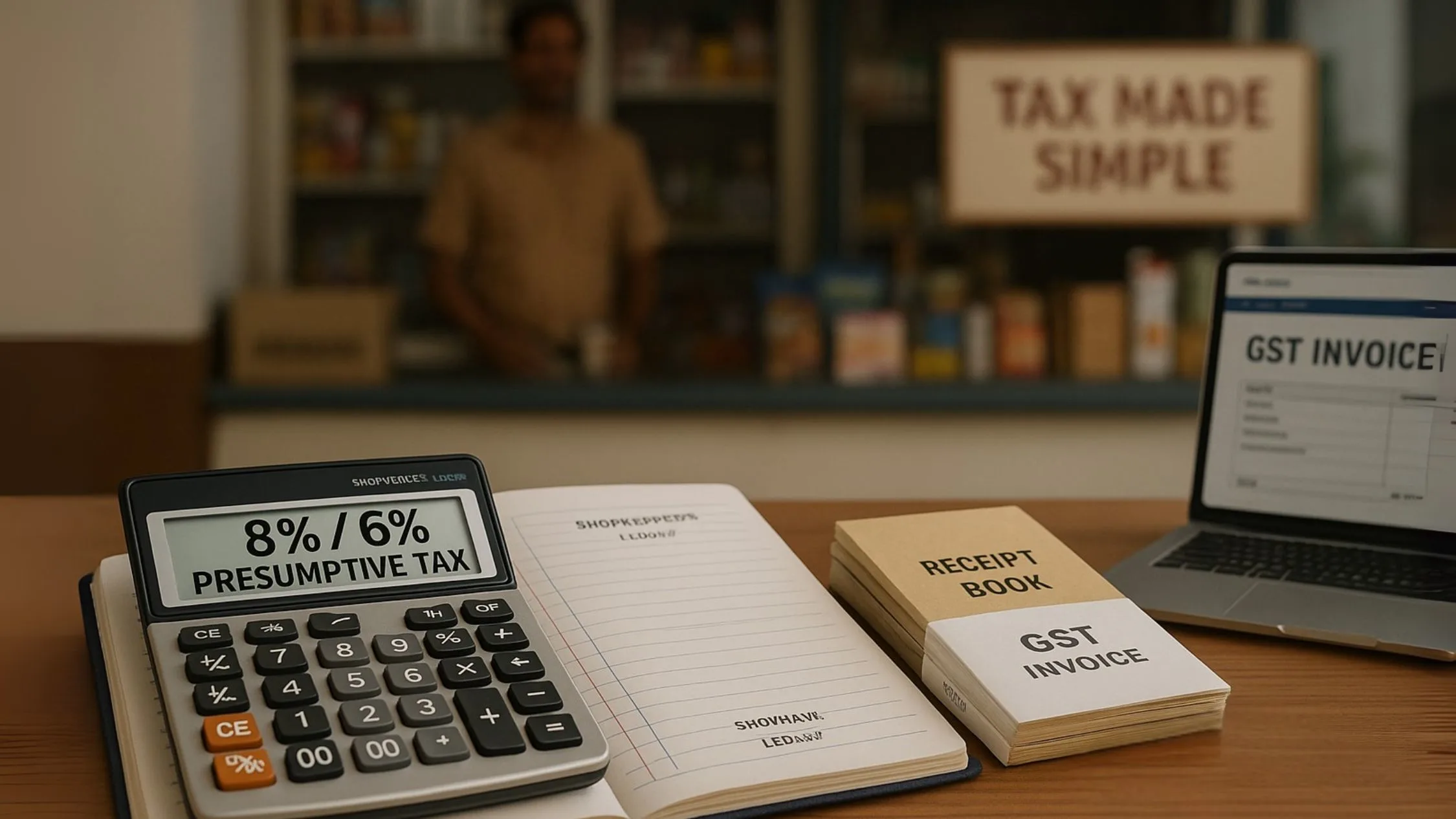

Presumptive income is a concept where taxpayers can declare their income as a percentage of their turnover, without worrying about actual expenses incurred. The law assumes that a fixed portion of the turnover is your profit.

For example:

- If your total receipts are ₹40 lakh & you choose presumptive taxation under Section 44AD, you can declare 8% (for cash) or 6% (for digital receipts) as your taxable income.

- That means your income will be ₹3.2 lakh if it is entirely cash receipts at 8%, irrespective of your actual expenses.

This way, taxation becomes hassle-free, and professionals or business owners save time & effort.

Presumptive taxation looks easy, but mistakes in turnover limits or opting out can lead to penalties. Our CA team ensures you stay fully compliant. 👉 click here

Who Can Opt for Presumptive Taxation?

- Small Businesses (Section 44AD)

- Individuals, Hindu Undivided Families (HUFs), and partnership firms (not LLPs).

- Turnover up to ₹2 crore.

- Can declare income as 8% of the gross turnover or receipts for cash transactions & 6% for digital transactions.

- Professionals (Section 44ADA)

- Professionals such as doctors, lawyers, accountants, architects, engineers, and consultants.

- Gross receipts up to ₹50 lakh.

- Can declare 50% of receipts as presumptive income.

- Transporters (Section 44AE)

- Owners of up to 10 goods vehicles.

- Income calculated on a fixed amount per vehicle per month.

Also Read: Presumptive Taxation Scheme for Transporters

How Does Presumptive Taxation Work?

The beauty of presumptive taxation lies in its simplicity. Instead of maintaining detailed records, you simply apply the prescribed rate:

- 8% of the gross turnover or receipts for cash transactions.

- 6% of the gross turnover for digital payments."

- 50% of receipts for professionals under Section 44ADA.

Let’s take an example:

A small shopkeeper has a turnover of ₹50 lakh, out of which ₹30 lakh is through digital payments & ₹20 lakh in cash.

- Income from cash = ₹20 lakh × 8% = ₹1.6 lakh.

- Income from digital = ₹30 lakh × 6% = ₹1.8 lakh.

- Total presumptive income = ₹3.4 lakh.

No need to calculate actual profits, depreciation, or rent expenses separately — the scheme assumes these are included.

Advantages of Presumptive Taxation

- No Need to Maintain Detailed Books

Professionals & small businesses are free from the burden of daily accounting records. - No Audit Requirement

If you declare income at the prescribed rate, you don’t need to get your accounts audited. - Tax Simplification

The scheme allows taxpayers with business or professional income to focus more on growing their work rather than worrying about compliance. - Encouragement for Digital Transactions

By offering a lower rate (6%) on digital payments, the government promotes a cashless economy. - Certainty of Tax Liability

Since the rate is fixed, taxpayers know exactly how much income they need to declare.

Choosing presumptive taxation is simple — but once you opt in, there are hidden rules you must follow.👉 click here

Limitations of Presumptive Taxation

While the scheme is simple, it has some limitations:

- Not available to LLPs (Limited Liability Partnerships).

- Professionals with receipts above ₹50 lakh cannot opt for it.

- Businesses with turnover above ₹2 crore must follow normal accounting rules."

- Losses cannot be carried forward if income is declared under presumptive taxation.

Thus, while it benefits small taxpayers, large firms or high-earning professionals must follow regular taxation rules.

Also Read: Professional Income: Taxation for Doctors, Lawyers, Accountants, and More

Presumptive Taxation for Professionals

Section 44ADA is designed especially for professionals. Under this, doctors, lawyers, architects, accountants, and similar individuals can declare 50% of their receipts as taxable income.

Example:

A chartered accountant earns ₹40 lakh in gross receipts. Under presumptive taxation, he can declare ₹20 lakh (50% of receipts) as income. He does not need to show actual expenses like rent or staff salary.

This helps skilled professionals reduce compliance & focus on delivering services.

Presumptive Taxation vs. Regular Taxation

|

Particulars |

Presumptive Taxation |

Regular Taxation |

|

Books of Accounts |

Not required |

Mandatory |

|

Audit Requirement |

Not required if declaring prescribed income |

Required if turnover crosses thresholds |

|

Expenses Claim |

Not separately allowed (assumed in fixed % rate) |

Allowed based on actual expenses |

|

Applicability |

Small businesses (≤ ₹2 crore) & professionals (≤ ₹50 lakh) |

All businesses and professionals |

Compliance Under Presumptive Taxation

Even though the scheme is simple, taxpayers still need to:

- File ITR-4 form (for individuals, HUFs, and partnership firms opting for presumptive income)."

- Pay advance tax in one installment by 15th March if liability exceeds ₹10,000.

- Keep basic invoices & receipts for reference in case of scrutiny.

Why the Government Introduced Presumptive Taxation

The aim behind this scheme is:

- To reduce the compliance burden for small taxpayers.

- To increase voluntary tax compliance.

- To bring unorganized businesses under the tax net.

- To encourage digital transactions by offering lower presumptive rates.

Also Read: The Tax Exemption Rule for Professional Institutions

Practical Scenarios of Presumptive Income

- Small Retail Shop

- Turnover: ₹60 lakh (40 lakh digital, 20 lakh cash).

- Presumptive income = ₹20 lakh × 8% ₹40 lakh × 6% = ₹4.4 lakh.

- Doctor’s Clinic

- Receipts: ₹30 lakh.

- Income declared under Section 44ADA = ₹15 lakh (50% of receipts).

- Transport Business

- Owns 5 trucks.

- Income declared per vehicle per month as per Section 44AE, instead of calculating actual profits.

Conclusion

Presumptive income is a blessing for small taxpayers. It simplifies compliance, reduces the need for record-keeping, and ensures that taxpayers can declare their income as a percentage of their turnover instead of calculating actual profits. By opting for this scheme, businesses & professionals save time, money, and effort. Whether it’s 8% of the gross turnover or receipts for cash transactions or 50% for professionals, the scheme offers flexibility & certainty.

If you are a professional or small business owner looking for an easy way to file taxes, presumptive taxation is worth exploring.

👉 Want to know whether presumptive taxation suits your business or profession? Visit Callmyca.com — our experts will guide you with customized tax-saving strategies. Don’t miss out on simple ways to save big!