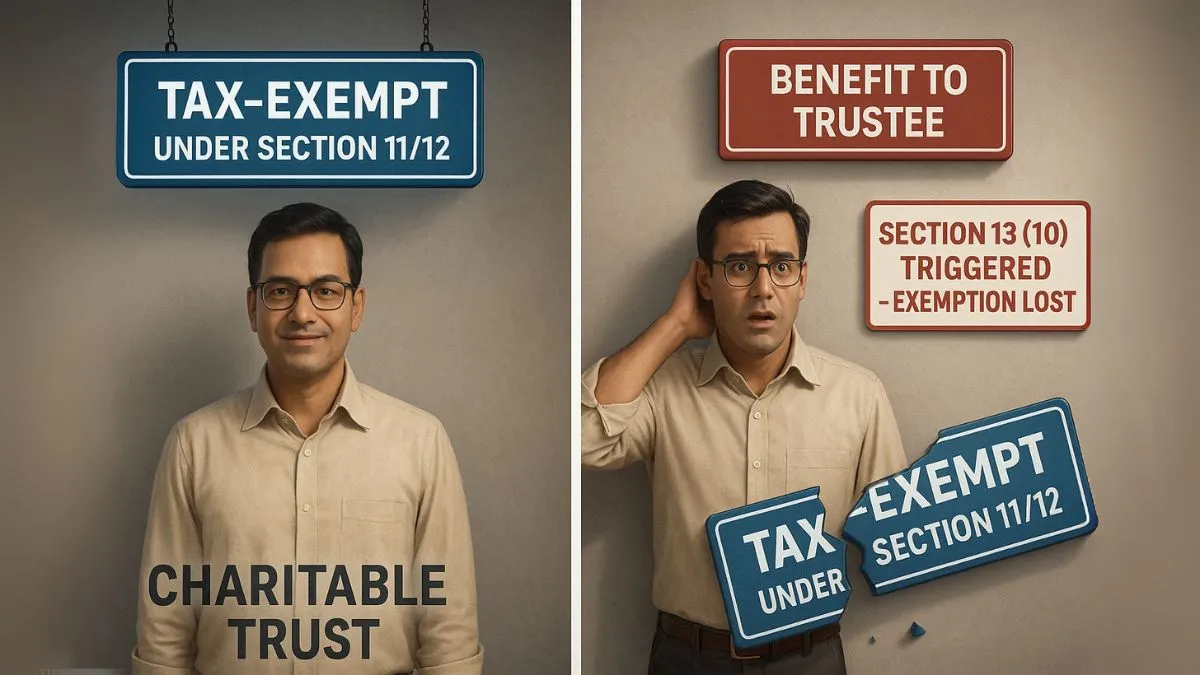

Charitable trusts & institutions in India enjoy special tax exemptions under Sections 11 & 12 of the Income Tax Act. But these exemptions come with strict conditions. If any of those conditions are violated, the consequences can be severe. That’s where Section 13(10) steps in—it’s the compliance watchdog for charitable organizations.

Whether you're managing a trust, filing returns for an NGO, or auditing such institutions, understanding Section 13(10) is crucial to preserving their tax-exempt status.

Let’s simplify this critical provision in plain English.

What is Section 13(10) of the Income Tax Act?

Section 13(10) was introduced to provide clarity on the consequences when a charitable trust or institution violates the conditions for tax exemption. When any provision of Section 13(1) is breached, the income so involved becomes taxable as per the regular tax slabs.

But Section 13(10) goes a step further. It lays out a structured mechanism for computing income, applying penalties, & revoking tax exemptions in cases of misuse.

This provision strengthens the monitoring of charitable institutions & ensures that public funds meant for noble causes aren't misused under the pretext of tax exemptions."

Where Does Section 13(10) Fit In?

To fully understand this section, let’s look at the larger context:

- Sections 11 & 12: Provide tax exemption to trusts registered under Section 12A or 12AB.

- Section 13(1): Lists conditions that, if violated, will disqualify the exemption.

- Section 13(10): Deals with how such disqualified income shall be taxed.

It’s like this:

You break a rule under Section 13(1)?

Then Section 13(10) tells the government how to tax that income.

Key Scenarios Where Section 13(10) Applies:

✅ Income or property is applied for the benefit of specific persons, like trustees, founders, etc.

✅ Trust engages in commercial activities beyond the permissible threshold.

✅ Fails to comply with registration or audit requirements.

✅ Trust applies income outside India without permission.

✅ Investments are made in prohibited modes.

How is Income Taxed Under Section 13(10)?

When a violation is detected:

- That portion of income loses the exemption under Sections 11 & 12.

- The said income is taxed as per normal income tax provisions.

- Deductions & set-offs that are generally available to businesses are not allowed on this income.

This is done to deter misuse of tax-exempt funds & bring transparency.

Why Is Section 13(10) So Important?

In India, thousands of NGOs, societies, & charitable trusts operate under the tax exemption umbrella. The government needed a clear enforcement framework for violations, & Section 13(10) does exactly that.

Here’s what it ensures:

✔ Accountability of funds.

✔ Prevention of personal gains under charitable tags.

✔ Deterrence for trustees & founders misusing exemptions.

Example to Understand Section 13(10):

Let’s say XYZ Charitable Trust uses ₹25 lakhs out of its corpus to buy a luxury vehicle for the personal use of its managing trustee.

- This is a violation under Section 13(1)(c).

- Under Section 13(10), this ₹25 lakhs will be added back to taxable income."

- The trust must pay regular income tax on this amount.

- No exemption under Section 11/12 will be granted for this portion.

What Should Trusts Do to Stay Compliant?

🔸 Maintain transparent financial records.

🔸 Avoid any related party transactions or personal benefits.

🔸 Ensure application of income strictly for charitable purposes.

🔸 File audit reports & annual returns promptly.

🔸 Invest only in prescribed modes under Section 11(5).

Penalty Provisions If Section 13(10) Is Triggered:

Once income becomes taxable:

- The trust is liable to pay income tax at the applicable rate.

- Interest & penalties may also be levied for failure to pay or report.

- Exemption status can be revoked partially or fully, depending on the nature & frequency of the violation.

Keywords Naturally Used for SEO:

- Section 13(10) of income tax act

- Disqualification of exemption under sections 11 & 12

- Violation of section 13(1)

- Charitable trust taxability

- Taxation of income applied for personal benefit

- Tax computation under section 13(10)

- Trust property misused

- Revocation of exemption under section 13(10)

Frequently Asked Questions (FAQs):

Q1. What does Section 13(10) of the Income Tax Act cover?

It covers the taxability of income when charitable trusts violate conditions mentioned in Section 13(1).

Q2. Can a trust lose its exemption partially?

Yes. Only the income portion used in violation will be taxed, not the entire income.

Q3. What kind of violations trigger Section 13(10)?

Using trust funds for personal benefit, non-approved investments, or commercial activity beyond limits.

Q4. Is prior notice given before invoking Section 13(10)?

Generally, a notice or inquiry is raised under scrutiny or assessment proceedings.

Q5. How can I ensure my trust doesn’t violate Section 13(10)?

Maintain strict financial discipline, avoid conflicts of interest, & consult a tax professional regularly."

Conclusion

Section 13(10) of the Income Tax Act is a critical safeguard in India’s taxation framework for trusts. It draws the line between genuine charitable activity & misuse of tax exemptions. For trust managers, donors, & accountants, understanding this provision is essential to ensure compliance & preserve the credibility & legal standing of the institution.

When in doubt, transparency & documentation are your best allies.

👉 Is your trust or NGO protected from compliance pitfalls under Section 13(10)? Let the experts at Callmyca.com help you stay audit-ready, exemption-safe, & 100% compliant. Book your free consultation today!