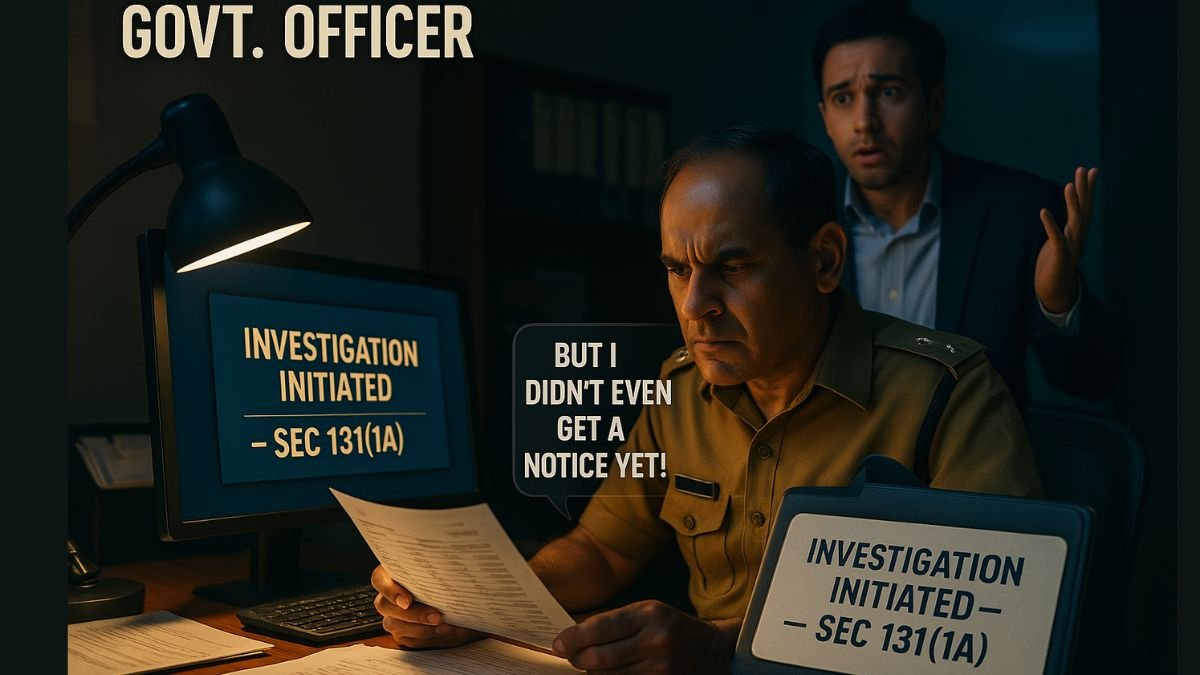

If you’ve ever received a notice from the Income Tax Department out of the blue, especially when you haven’t even filed your return yet, chances are—it may have been under Section 131(1A) of the Income Tax Act.

This section serves as a magnifying glass for the tax department, enabling it to keep a close eye on those who might be trying to hide income or manipulate financial data before officially declaring it.

What Is Section 131(1A) of the Income Tax Act?

In simple terms, Section 131(1A) authorises the issuance of notices and summonses to individuals, businesses, or entities suspected of concealing income. It gives the tax authority the power to collect information even before the return is filed.

Unlike regular notices issued during assessment, this one comes before any formal assessment begins, because the department believes something fishy is going on.

When Can It Be Used?

This section empowers assessing officers to issue notices seeking information from taxpayers, but not randomly. There needs to be a reason to suspect that:

- A person is hiding income, or

- Will likely hide income when filing the return.

So, even if your ITR isn’t filed yet, if your activities raise a red flag—transactions, foreign remittances, unexplained cash deposits—you can be pulled into an inquiry under Section 131(1A).

Who Has the Power?

The power under Section 131(1A) lies with:

- Assessing Officer (AO)

- Joint Commissioner (JC)

- Commissioner (CIT)

- Director General of Income Tax

- Director of Investigation

These officers are granted additional powers to issue notices & gather evidence that can later be used during full assessment proceedings. "

What Can the AO Do Under 131(1A)?

Here’s what the assessing officer can do under this section:

- Summon an individual to appear personally.

- Demand books of accounts, bills, vouchers, or digital records.

- Examine witnesses.

- Inspect premises, especially during search or seizure proceedings (when supported by a higher authority).

This section is almost equivalent to the powers of a civil court in matters of inquiry, & the goal is to stop tax evasion before it starts.

Why Is It So Important?

Section 131(1A) plays a key role in preventing tax evasion at a preliminary stage. It equips tax authorities with a proactive tool, rather than a reactive one.

Let’s say you haven’t filed your ITR yet but deposited a suspicious ₹50 lakh in cash—this section allows the officer to step in immediately, gather documents, & issue a summons if necessary, even before assessment begins.

What If You Ignore the Notice?

Don’t.

A notice under this section carries the same weight as a court order. Failure to comply can lead to prosecution, penalty, & even search or seizure proceedings under other sections like 132.

Real-Life Examples Where 131(1A) Was Invoked

- A business showed zero income on TDS returns but had lakhs of rupees in supplier payments.

- Someone bought property worth crores but didn’t file any income tax return.

- Transactions through shell companies raised alarms with the investigation wing.

In all such cases, Section 131(1A) was used to kick-start inquiry proceedings well before formal scrutiny. "

Is There a Time Limit?

There is no fixed time limit under Section 131(1A) as such—it’s mostly used before or during the early stages of investigation. However, once a notice is issued, you’ll typically get 7–15 days to respond, depending on the complexity.

Summing It Up

Section 131(1A) of the Income Tax Act isn’t meant to harass you—it’s a preventive power, used to plug leaks before they flood the system. If you’re clean, transparent, & cooperative, you’ve got nothing to fear.

But if you’re hiding income? Well, now you know why that notice just landed in your inbox.

To file your ITR, contact our experts at Callmyca.com.