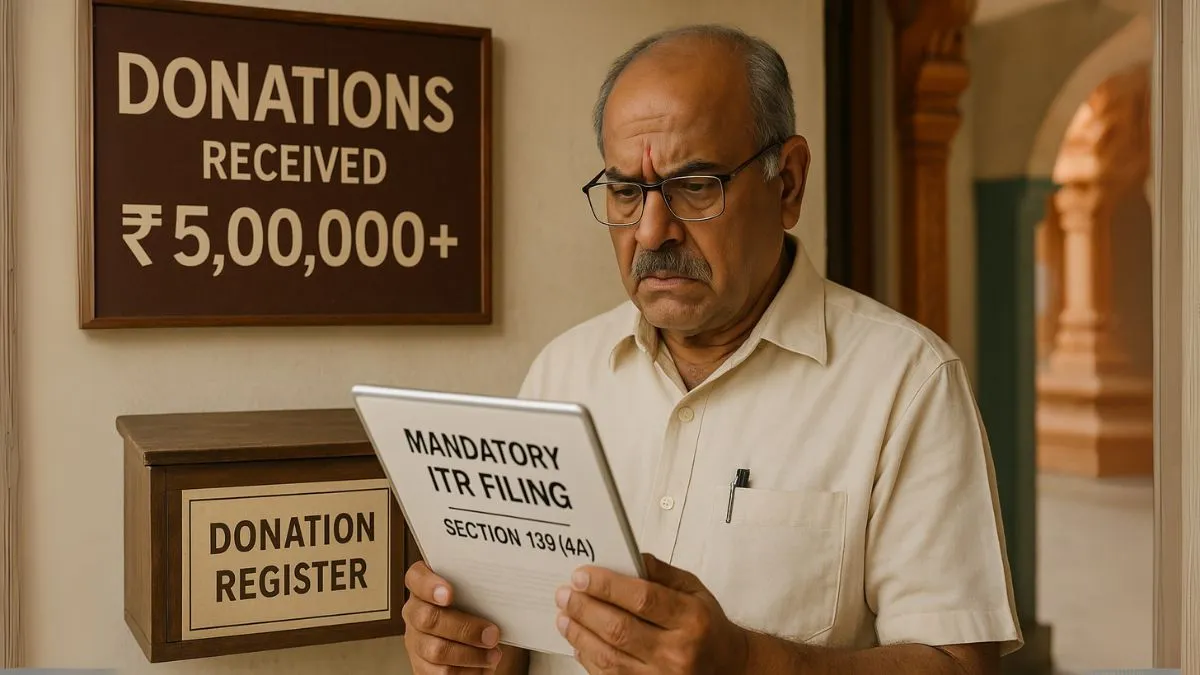

When we think of income tax return filing, charitable or religious institutions are not typically the first entities that come to mind, largely because they are presumed to be tax-exempt. However, Section 139(4A) of the Income Tax Act mandates that such institutions must file income tax returns under specific conditions, regardless of whether they generate business income in the conventional sense.

This provision serves a vital role in ensuring that donations and public contributions received by these organisations are properly disclosed and subjected to regulatory oversight. After all, when funds are driven by public trust, transparency & accountability become non-negotiable.

Who Needs to File Under Section 139(4a)?

According to this section, any trust or institution claiming exemption under Section 11 or Section 12 must file a return if its total income exceeds the basic exemption limit before applying the exemption. That means, even if your income gets fully exempt after claiming deductions under sections 11 & 12, you still need to file a return if the gross income crosses the basic threshold.

This includes:

- Religious trusts

- Charitable institutions

- Educational & medical institutions

- Registered NGOs

If your institution falls under any of these & receives income (donations, voluntary contributions, grants, etc.) exceeding the threshold, then yes—you’re required to file the ITR."

Why Is This Important?

Filing under Section 139(4a) is not just a formality. It proves that the institution is operating transparently & as per tax regulations. Non-filing could lead to cancellation of registration under Section 12A or 12AB, which will disqualify the entity from claiming exemptions in the future.

So, even though these trusts are not-for-profit organisations, they are still under the scanner of the Income Tax Department.

What Income Is Covered?

This section covers income like:

- Voluntary donations

- Grants from the government or foreign sources

- Rental income from property held under trust

- Income from investments or securities

- Miscellaneous receipts for services offered

If the total income from these sources (before claiming exemption) is more than the applicable basic exemption limit (₹2.5 lakh currently for individuals below 60), you must file the return.

What Is the Due Date?

If the trust or institution is required to get its accounts audited, the due date for filing is 31st October of the assessment year. For others, it’s 31st July.

Late filing can lead to interest under Section 234A & penalties under Section 271F. In the worst cases, the trust may lose its exemption status, which could have serious financial implications.

How Is It Different from Other Return Filing Sections?

Most sections related to return filing—like 139(1), 139(4), 139(5)—talk about individuals, companies or businesses. But Section 139(4a) is specifically designed for charitable & religious trusts, making it unique in its approach.

It considers both the intent of the income (used for charitable purposes) & the origin (voluntary contributions, grants, etc.). This dual approach ensures that no misuse of public funds or donations goes unnoticed."

Common Mistakes to Avoid

- Not filing the return just because income is exempt: Always calculate gross income before exemption to determine liability.

- Filing under the wrong section: Many institutions mistakenly file under 139(1) or 139(4), which isn’t appropriate for trusts.

- Missing audit requirement: If income exceeds ₹2 crore or other audit conditions apply, the audit under Section 44AB must be completed.

- Failure to renew registration: Trusts registered under 12A/12AB must also ensure that their registration is valid for that assessment year.

What If You Miss Filing?

Missed the deadline? You may still file a belated return under Section 139(4). But this could invite interest & penalty. Moreover, repeated non-compliance may lead to cancellation of exemption status, defeating the very purpose of being a trust.

Why Compliance Matters for Charitable Entities

Whether you run a school for underprivileged children or a temple managing donations, the government requires you to maintain accountability. Section 139(4a) is a tool to ensure that charitable intentions are backed by financial responsibility.

By filing the return on time, you not only protect your registration status but also build credibility with donors, government authorities & foreign funding bodies.

Final Words

Section 139(4a) is not about complicating the lives of charitable institutions—it’s about ensuring that the faith people place in them is well guarded. With increasing digital scrutiny & compliance mandates, being updated about your responsibilities under this section isn’t optional—it’s essential.

So if your institution is receiving income in any form, don’t assume exemption protects you from filing. Understand your obligations & file your ITR with care.

📌 Want expert help in filing returns for your trust or NGO?

Visit Callmyca.com to connect with trusted professionals who simplify complex compliance, so you can focus on your mission, not just the paperwork.