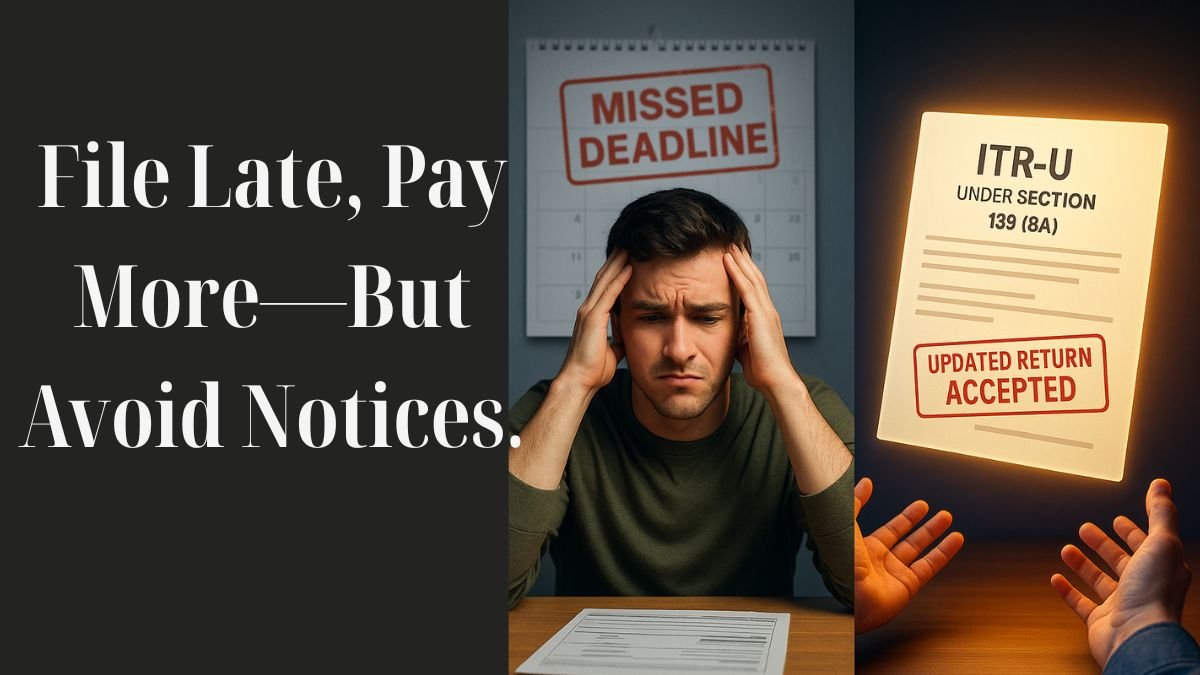

Mistakes happen. Sometimes, you miss reporting an income. At other times, you realise post-deadline that you’ve claimed the wrong deduction or need to revise your Income Tax Return (ITR). Earlier, this could lead to heavy scrutiny or penalties. But now, Section 139(8a) of the Income Tax Act gives you a golden opportunity.

The Government of India has introduced this section to provide taxpayers the opportunity to furnish an updated return for a specific assessment year, even if they missed the original deadline. Let’s understand what this section is all about and how it can benefit you.

✅ What is Section 139(8a) of Income Tax Act?

Section 139(8a) allows taxpayers to file an Updated Return (ITR-U) if they have made mistakes, missed disclosing certain incomes, or failed to file their return altogether.

Introduced via the Finance Act 2022, this section is a taxpayer-friendly provision meant to boost compliance and reduce litigation. It provides a second chance to those who may have missed reporting certain income in their previous filings.

Unlike revised returns, this section even allows updates if you haven’t filed any return earlier for that assessment year. "

📌 Who Can File Under Section 139(8a)?

You can file an updated return if:

- You missed filing your ITR originally.

- You filed your ITR but missed declaring some income.

- You wish to rectify errors voluntarily.

However, you cannot file an updated return if:

- It results in a refund or increases your already claimed refund.

- It leads to a decrease in your total tax liability.

- You are under scrutiny, search, or survey proceedings.

- It involves prosecution under tax-related or other financial crimes. "

⏳ Time Limit for Filing Updated Return

The beauty of Section 139(8a) lies in its generous window. It allows you a chance to update your ITR within two years from the end of the relevant assessment year.

For example:

If you missed declaring income for FY 2022–23 (AY 2023–24), you can file an updated return by 31st March 2026.

💸 Additional Tax and Interest Payable

As generous as this second chance is, it comes at a cost. To discourage misuse, the government has added a penalty-like structure:

- If filed within 12 months, an additional tax of 25% on the extra tax is payable.

- If filed after 12 but within 24 months, an additional tax of 50% on the extra tax is payable.

Plus, the assessee shall be liable to pay simple interest at fifteen per cent per annum under sections 234B & 234C on the unpaid taxes.

🧾 How to File an Updated Return Under Section 139(8a)

- Log in to the Income Tax portal https://www.incometax.gov.in

- Go to ‘File Income Tax Return’ → Choose 'ITR-U' (Updated Return).

- Select the relevant AY and mention the reasons for filing (e.g., missed income).

- Pay tax, interest, and additional tax using Challan 280.

- Submit the ITR-U with Form 139(8a).

Note: No attachments are required with ITR-U.

✋ Proviso to Section 139(8a): Situations Where You Cannot File

As per the proviso to section 139(8a) of the Income Tax Act, an updated return cannot be filed:

- If the return is a nil return.

- If there is a reduction in total income or an increase in refund.

- If there’s a search or seizure conducted against the taxpayer.

- If the updated return would lead to loss adjustments.

✅ Benefits of Section 139(8a)

- Avoid penalties and prosecution later.

- Peace of mind by staying compliant.

- Legal relief – avoids scrutiny notices in many cases.

- Easy online process – can be done from home.

⚠️ Penalty for Misuse

Misuse of this provision—like underreporting or hiding information—may attract a penalty under section 270A and prosecution under section 276CC. Hence, it should be used with genuine intent.

✍️ Final Thoughts

The introduction of section 139(8a) of the Income Tax Act 1961 reflects the government’s intent to support honest taxpayers. If you realise you’ve made a mistake in your return or missed declaring income, don’t panic. Use this provision wisely.

This updated return option is a compliance booster and a lifeline for many.