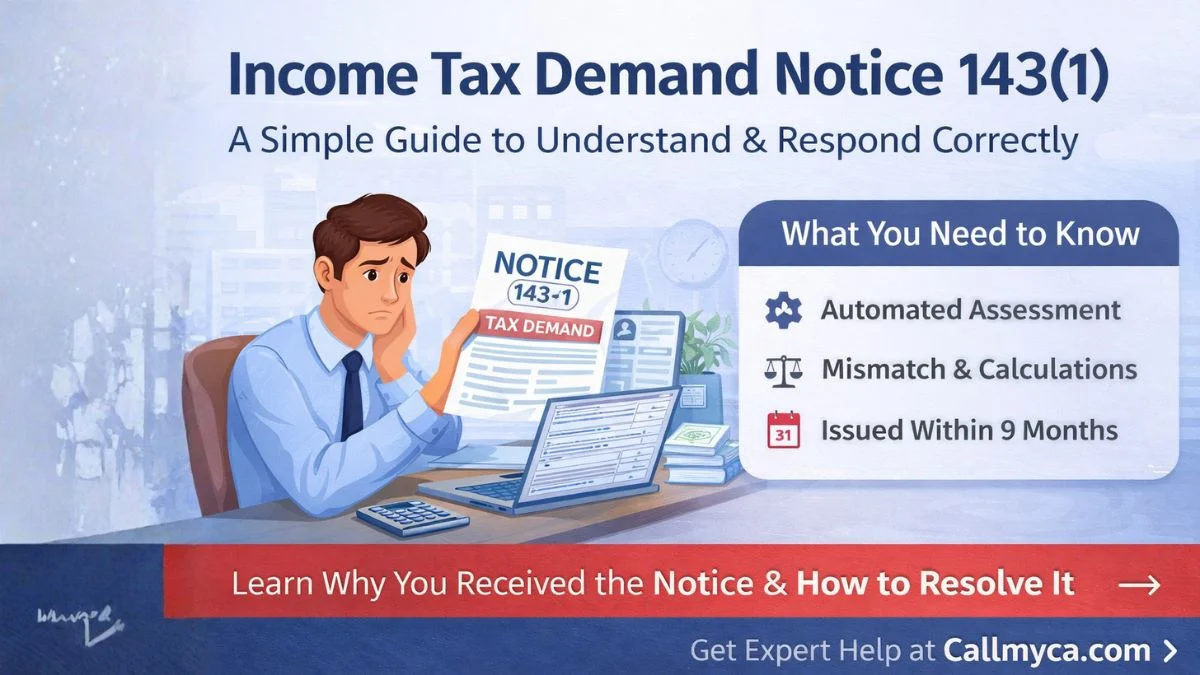

You’ve filed your income tax return on time. Maybe even got a refund. And then—out of nowhere—you receive a notice under Section 143(2) from the Income Tax Department.

No need to panic—but don’t ignore it either.

This notice doesn’t mean you're guilty of anything. It just means your return has been picked up for detailed examination. Section 143(2) is the first step in income tax scrutiny assessment, and how you respond will decide the outcome.

Here’s everything you need to know about the scrutiny notice under Section 143(2).

✅ What Is Section 143(2) of the Income Tax Act?

Section 143(2) empowers the Assessing Officer to serve a notice of scrutiny if they believe that the return filed:

- Has discrepancies or mismatches

- Needs further verification of income, deductions, or claims

- May have underreported or misreported items

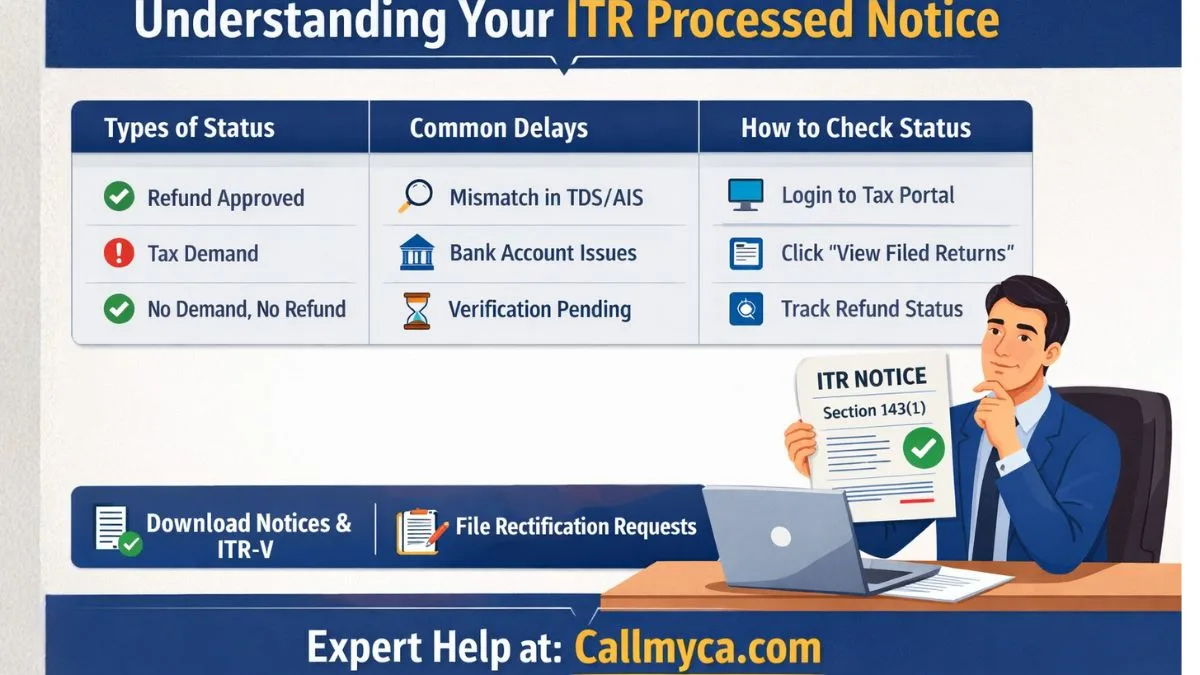

The notice is issued after the initial processing under Section 143(1) and is the beginning of a formal assessment process called a “scrutiny assessment.”

📅 Time Limit for Issuance of Notice Under 143(2)

As per the latest provisions (post-Finance Act, 2021):

- The notice must be issued within 3 months from the end of the financial year in which the return was filed.

For example:

- If you filed your return on 31st July 2024 (FY 2023–24), the 143(2) notice must be served by 30th June 2025.

Notices received after this deadline are invalid and unenforceable.

📋 Types of Scrutiny Under Section 143(2)

There are three types of scrutiny based on the scope and nature of the case:

- Limited Scrutiny

- Specific issues are flagged (e.g., mismatch in TDS, high-value transactions)

- Only those points are examined

- Complete Scrutiny

- Full assessment of all heads of income, deductions, capital gains, and exemptions

- Usually triggered by complex or high-risk returns

- Manual Scrutiny

- Selected based on risk parameters or random selection by the department

📩 What Does a 143(2) Notice Contain?

The notice typically includes:

- Assessment year and PAN details

- Specific information sought (e.g., investment proofs, capital gains reports)

- Timeline to respond (usually 15–30 days)

- Directions to submit documents online via the Income Tax Portal

- The officer’s name and contact details

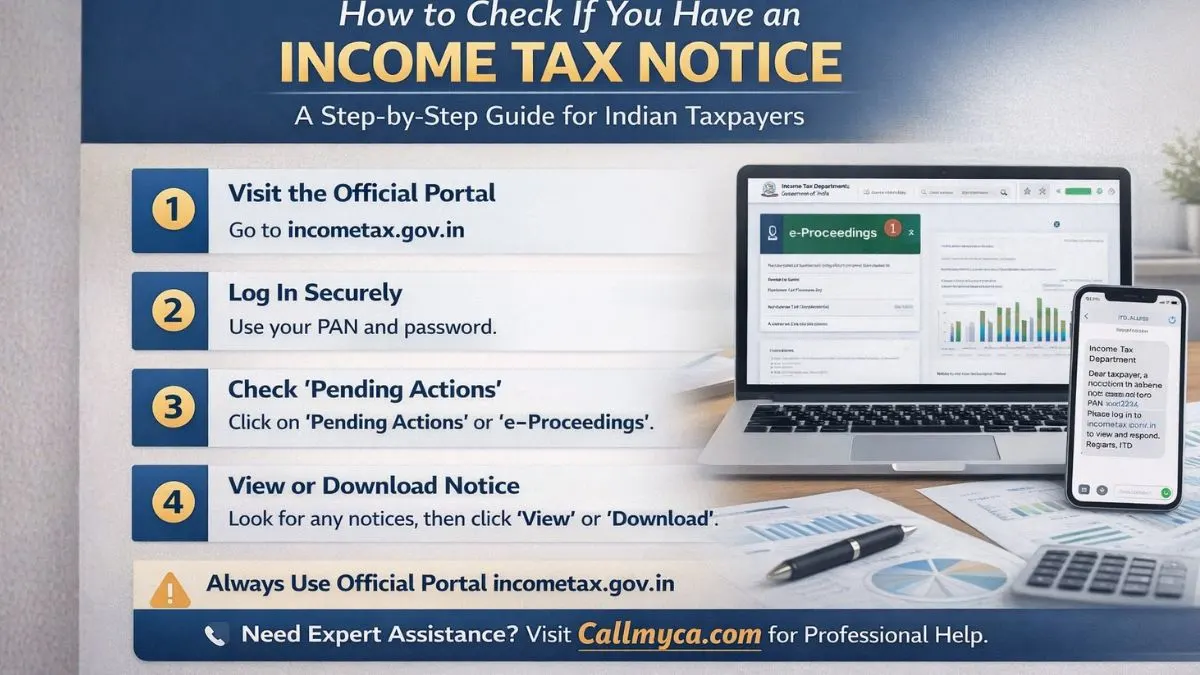

💡 All communication now happens electronically via the e-Proceedings portal at www.incometax.gov.in

🧾 Documents You May Be Asked to Submit

Depending on the nature of the scrutiny, you may need to submit:

- Salary slips and Form 16

- Bank statements

- Investment proofs (80C, 80D, etc.)

- Capital gains statements from brokers

- Rent agreements for HRA

- Property sale/purchase deeds

- Business or freelance income invoices

- Foreign income disclosures (if any)

🧠 People Also Ask

❓ Is a 143(2) notice a notice of tax demand?

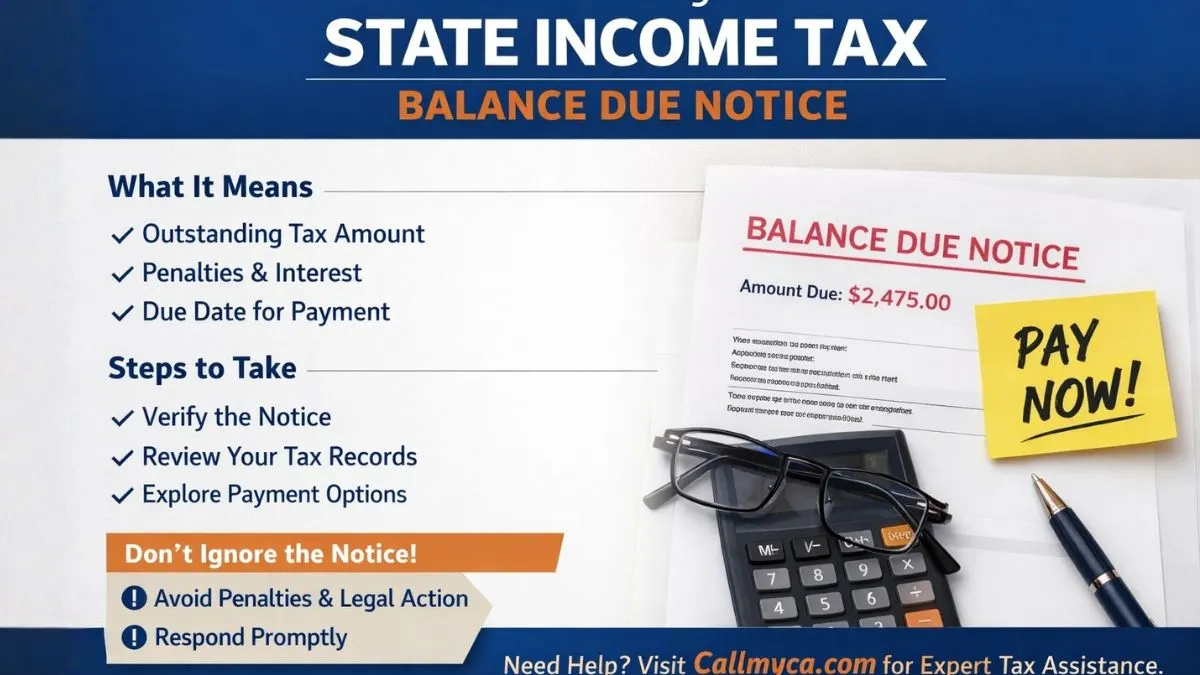

No. It is not a demand notice. It only means your return is under scrutiny. A demand may be raised only after assessment, if discrepancies are found.

❓ What happens if I ignore a 143(2) notice?

Ignoring a 143(2) notice can lead to:

- Ex parte assessment under Section 144

- Penalties

- Reopening of the case under Section 147 "

- Prosecution in severe cases

❓ Can I revise my return after getting a 143(2) notice?

No. Once the notice is issued, you cannot revise the return. You must respond with explanations or supporting documents.

❓ How do I respond to the scrutiny notice?

Log in to the Income Tax Portal, go to:

e-Proceedings → View Notices → Respond → Upload documents

All replies must be filed electronically, unless physical appearance is specifically required.

⚠️ Common Mistakes to Avoid

- Submitting incomplete or irrelevant documents

- Responding late or beyond the timeline

- Providing vague explanations without proof

- Ignoring follow-up notices

- Not consulting a professional for technical queries

🎯 Final Thoughts from a CA’s Desk

“Receiving a scrutiny notice doesn’t mean trouble—it means responsibility.”

Section 143(2) is a routine check to validate your return. Most cases close without additional tax if the data is genuine and the response is timely. But mishandling it can escalate into penalties or even litigation.

So treat it seriously, respond professionally, and let your numbers speak for themselves.

📞 Need Help Handling a 143(2) Scrutiny Notice?

At CallmyCA, we help:

- Decode the exact reason for scrutiny

- Draft structured replies and compile required proofs

- Represent your case professionally before the department

- Close the assessment with minimal or no tax liability

👉 Click here to book your scrutiny notice consultation via CallmyCA