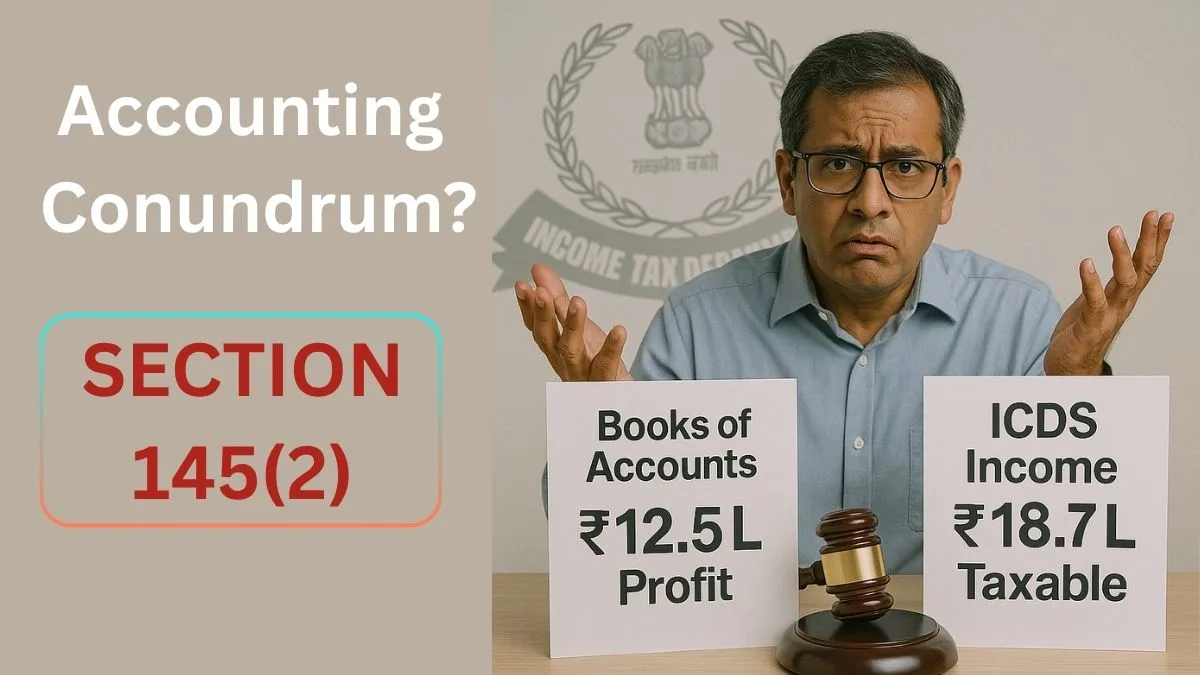

Tax compliance isn’t just about how much income you earn—it’s also about how you compute & report that income. This is where Section 145(2) of the Income Tax Act, 1961 comes into the picture. It gives power to the Central Government to notify Income Computation & Disclosure Standards (ICDS) that every taxpayer must follow while calculating taxable income.

But what does this mean for you in practice? Let’s decode it in plain English.

What is Section 145(2) of the Income Tax Act?

Section 145(2) provides the legal framework for the method of accounting that taxpayers must follow for income tax purposes. While Section 145(1) allows income to be computed under the cash or mercantile system of accounting, Section 145(2) goes one step further. It empowers the Central Government to notify accounting standards, known as ICDS, which override general accounting practices when computing income under the heads “Profits & Gains from Business or Profession” and “Income from Other Sources.”

These standards are binding, & taxpayers have to follow them even if they differ from regular accounting standards used for financial reporting.

What Are ICDS?

The Income Computation & Disclosure Standards (ICDS) are a set of ten standards notified by the government. These cover different aspects of income recognition, such as construction contracts, borrowing costs, foreign exchange differences, & provisions.

Think of ICDS as a rulebook for how to compute income for tax purposes, not how to maintain your books of accounts.

Why Was Section 145(2) Introduced?

The objective of introducing this section was to bring uniformity & clarity in income computation. Earlier, taxpayers used various accounting practices & interpretations, leading to disputes and inconsistencies in tax assessments.

With ICDS in force under Section 145(2), there’s now a standardised framework for income calculation that applies across industries & sectors."

Key Features of Section 145(2)

- Applies only to income under “Profits and Gains from Business or Profession” & “Income from Other Sources”

- Overrides other accounting standards like AS or Ind AS when it comes to income tax computation

- Gives the Central Government authority to notify or amend standards as needed

- Applies to all taxpayers (companies, firms, individuals, etc.) who follow mercantile accounting

How Does This Impact Charitable Trusts or Specified Persons?

Even though Section 145(2) is largely associated with businesses & professionals, its effect can indirectly impact transactions by charitable trusts with specified persons. This happens when trusts earn income from business activities or rental income, which must be calculated in line with ICDS. If such income involves defined specified persons (as in related party transactions), authorities may scrutinise the method of computation.

For example, if a charitable trust gives property on rent to a specified person, the income must be calculated per Section 145(2) & applicable ICDS. Any deviation may attract disallowance or reassessment under other provisions like Section 13 or 263."

Common ICDS That Apply Under Section 145(2)

Here are a few ICDS examples that can impact your tax calculation:

- ICDS I – Accounting Policies

Income to be recognised on an accrual basis unless otherwise stated. - ICDS II – Valuation of Inventories

Inventories to be valued at cost or net realisable value, whichever is lower. - ICDS IV – Revenue Recognition

Revenue is recognised when there is reasonable certainty of ultimate collection. - ICDS VII – Effects of Changes in Foreign Exchange Rates

Treatment of gains/losses from foreign exchange transactions.

These standards are mandatory while computing taxable income, even if your regular financial books follow a different principle.

Practical Example

Suppose a firm enters into a long-term construction contract. As per ICDS, revenue recognition may need to be based on the percentage completion method, whereas the company’s books may follow a different policy. This discrepancy must be adjusted during tax filing. Failure to do so may attract penalties.

Applicability and Non-Applicability

- Applicable to all taxpayers (including companies, LLPs, & individuals) maintaining accounts on the mercantile system.

- Not applicable to those following the cash basis of accounting.

- Not applicable to calculation under Minimum Alternate Tax (MAT) under Section 115JB or Alternate Minimum Tax (AMT) under Section 115JC.

Final Thoughts

Section 145(2) may seem technical, but it holds great significance in tax computations. Ignoring it can result in serious mismatches during scrutiny or assessments. Whether you’re running a business, managing a trust, or dealing with specified persons, understanding this section ensures you’re not caught off guard by differing income tax norms & accounting practices.

👉 Want to ensure your income is computed correctly as per ICDS & avoid costly errors during assessment? Reach out to Callmyca.com—your trusted CA partner for accurate, compliant, & stress-free tax filings!